Many of us invest in aggressive hybrid funds (balanced funds) to earn good returns with lower volatility. We believe that the equity portion will provide the upside and the debt portion will cushion the downside. Over the long term, this may result in better absolute returns than even a pure equity fund (or at least better risk-adjusted returns).

Has your hybrid fund delivered this value to your portfolio?

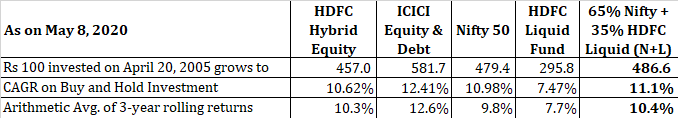

In this post, I pick two popular hybrid funds (HDFC Hybrid Equity and ICICI Equity & Debt) and compare the performance against Nifty 50 index and a simple combination of a Nifty index fund and a liquid fund (N+L). The comparison against N+L is important because this portfolio is easy to replicate for any investor and at a much lower cost (expense ratio). The expense ratio of a cheap Nifty index fund and a liquid fund will range between 5 to 20 bps. Actively managed hybrid cost around 1%.

If the hybrid funds struggle to beat this simple combination, then the value they are adding is not worth the cost.

Let’s find out.

Why I picked HDFC Hybrid Equity and ICICI Equity& Debt Funds?

I have invested in these funds at some point and am still invested in one of these funds but have reduced the position quite a bit. I have also recommended these funds to my clients over the past 5 years.

I could have considered other hybrid funds too or the entire balanced (aggressive hybrid) fund category but my scripting skills are a bit challenged. Hence, I picked up the two funds I was interested in. You can do a similar exercise for the fund you own.

ICICI Equity & Debt Fund started in November 1999. HDFC Liquid fund was launched in November 2000. HDFC Hybrid Equity Fund was launched in April 2005. Hence, April 2005 is the starting point for this exercise. This gives us a good 15 years to assess performance.

Since a balanced fund is a mix of equity and debt, it is useful to compare the performance of any balanced fund with a combination of an equity index fund and a simple debt product (say bank fixed deposit or a liquid fund). I consider a mix of Nifty+ HDFC Liquid Fund in the ratio 65:35 rebalanced annually. I use 65:35 ratio because the balanced funds must own at least 65% domestic equity to quality for equity taxation (even though most aggressive hybrid funds usually own more than 65% equity).

- HDFC Hybrid Equity Fund-Regular plan

- ICICI Equity & Debt Fund-Regular plan

- HDFC Liquid Fund-Regular plan

- Nifty 50 (Price index)

- 65% Nifty 50 + 35% HDFC Liquid Fund-Regular plan, rebalanced annually (N+L). For the ease of calculation, I have considered this as a wrapper product that starts on April 20, 2005, with 65:35 allocation and gets rebalanced every year on January 1.

Performance Comparison

I copy the Buy and Hold and 3-year rolling returns data for mutual funds, Nifty 50, and N+L combination.

ICICI Equity & Debt has been the best performer. A simple combination of Nifty+Liquid fund (N+L, 11.1% CAGR) has beaten a popular hybrid fund (HDFC Hybrid Fund, 10.62% p.a.) over 15 years if you just bought and held the units. Not just that, the N+L has beaten both Nifty 50 (10.98% p.a.) and HDFC Liquid fund (7.47% p.a.), its underlying constituents.

Read: CAGR vs IRR

You may argue that we cannot just look at the 15-year point-to-point returns and make our judgement. And that’s right too. You wouldn’t just make investment in April 2005 and hold the fund forever. You will perhaps make multiple investments at different points in time. You might invest way by way of SIPs. Thus, we look at 3-year rolling returns for all the funds, Nifty price index and the N+L combination.

The first data point in the rolling returns chart is the annualized return between April 20, 2005, and April 19, 2008. The second point is the annualized return between April 21, 2005, and April 20, 2008. And so on. The rolling returns paint a more accurate performance picture for the investor as compared to point-to-point returns. For more on rolling returns, refer to this article on Investopedia.

As happens with volatile investments and active management, nothing wins all the time. Both HDFC Hybrid and ICICI Equity & Debt had their days, even though ICICI Equity & Debt looks like a better performer. To figure out the winner, we average the rolling returns. ICICI Equity & Debt has given the best returns (12.41% p.a.), followed by N+L (10.4% p.a.), HDFC Hybrid Equity (10.3% p.a.) and Nifty (10.98% p.a.). A simple N+L combination has again given a good fight to HDFC Hybrid Equity.

Returns are important but what about volatility? Too much volatility can affect judgement and compromise investment discipline. You may not be able to stay the course with a very volatile product and this is more applicable to an actively managed product. Ideally, you would want a product with higher returns and lower volatility.

The above graph (along with rolling returns graph) shows that a simple Nifty+ Liquid fund combination has done remarkably well both in terms of returns and controlling risk. Compared to HDFC Hybrid Equity Fund, it has given higher returns at lower volatility. ICICI Equity & Debt again does very well. Please note my knowledge of statistics is limited. I hope my conclusion is correct.

Next, you might invest by way of SIP. Here is the data for various funds, Nifty, and Nifty+Liquid combination. I have calculated rolling returns for 3-year SIPs (it is an overkill). Simple rolling returns give a very fair idea. I have considered SIP on 1st of every month only (hence, not the complete picture). The way SIPs work, a more volatile product can throw up better returns because of rupee cost averaging. For instance, for the same set of data, HDFC Hybrid Equity Fund (10.3%) had better average SIP rolling returns than N+L combination (9.82%). That is one way how rupee-cost averaging can help with volatile investments. ICICI Equity & Debt is the clear winner with 12.05% p.a. Nifty gets you 9.24% p.a.

Read: The Credit Risk in Hybrid Mutual Funds

What this means?

For me, there are two important observations here.

Firstly, Nifty has given 10.98% p.a. (CAGR) over the period. HDFC Liquid Fund has delivered 7.47% p.a. during the period. However, an annually rebalanced mix of Nifty and liquid fund (65% Nifty + 35% liquid) has delivered 11.09% during the period, higher than both Nifty and liquid funds returns. That’s the power of portfolio rebalancing for you. And not just that, the higher returns have come at lower volatility. The combination (10.4%) beats the Nifty (9.8%) handily on rolling returns too.

Secondly, you can generate your own hybrid fund experience by owning a Nifty index fund and a liquid fund (or a good debt mutual fund) at a much lower cost. Secondly, since the equity portion is passively managed, you need not worry about the confusion that accompanies actively managed funds. Given what we have seen above, this combination can be difficult to beat for a balanced fund (aggressive hybrid fund). I concede I do not have enough data to prove that.

Not to forget the two hybrid funds, ICICI Equity & Debt has been a better performer than HDFC Hybrid Equity Fund. The ICICI fund has delivered higher returns than the HDFC fund at a lower volatility.

Remember, the ICICI Fund has not been the better fund throughout. The HDFC Fund had its days too but the ICICI Fund has delivered better performance overall. At the same time, depending on the timing of your investment and exit, it is possible that the HDFC fund would have given you a much better returns experience.

Should I move out of HDFC Hybrid equity and move to ICICI Equity & Debt?

For the period under consideration, ICICI Equity & Debt is a clear winner.

Do I think ICICI Equity & Debt will come out ahead in the future too?

I don’t know. Toss a coin. That’s the problem with active management.

But yes, if I had to pick up a fund between HDFC Hybrid Equity and ICICI Equity & Debt for a fresh investment, I will be more comfortable going with the ICICI fund.

By the way, HDFC Hybrid equity has not been a bad performer (even though this post gives the impression). If nothing else, it has beaten Nifty on rolling returns basis over 15 years. But we must see if this performance is worth the cost charged.

Points to Note

I have considered Nifty Price Index instead of Nifty Total Returns index (Nifty TRI). Nifty TRI considers dividend re-invested and hence offers higher returns than the price index. In my opinion, using the price index is apt since this will cover the expenses and the tracking error of an index fund.

I could have added other indices such as Nifty Next 50 or the midcap index or assets such as gold or international equity funds and seen different results. Remember the equity portfolio of hybrid funds usually resembles a multicap fund. I could have also added consistency scores, risk ratios etc. That’s for later though.

I have used a liquid fund for the debt portfolio of the N+L combination. Over the last 15 years, HDFC Liquid fund has given 7.47% p.a. PPF has been over 8% for much of the last 15 years. If we have replaced the liquid fund with say PPF, the returns would have been even better for the combination. I understand PPF has investment and liquidity constraints. However, we could have used, let’s say, 15% liquid fund and 20% PPF for the debt component.

I have considered regular plans of mutual fund schemes. Direct plans came into existence only in January 2013. In this exercise, direct plans would have improved the results for balanced funds.

Mutual funds are wrap products. The transactions by the fund manager do not attract any tax liability in your hands. On the other hand, annual rebalancing between Nifty and the liquid fund would have generated capital gains tax liability. I have not considered the impact of such capital gains tax in this exercise. Equity mutual funds have enjoyed a favourable tax treatment as compared to debt mutual funds. For instance, since the beginning of the exercise until the end of FY2018, the long-term capital gains from the sale of equity funds were exempt from tax.

I have used certain approximations in this exercise that I think do not affect the conclusion. With better spreadsheet and scripting skills, I could have done without these adjustments.

Has your balanced fund delivered value?