A few days back, I watched a commercial by LIC promoting its children’s plan. The two plans promoted were LIC Jeevan Tarun and LIC New Children’s Money Back Plan.

I had reviewed LIC Jeevan Tarun in an earlier post and found it to be an utterly stupid product. Though I do not expect LIC New Children’s Money Back plan to be any different, I will still review this product to complete the review set.

Please note I have nothing against LIC. Even private insurers come out with equally bad products. However, since LIC is more popular and better trusted, it is easier to get the message across. You must be equally apprehensive of such products from private insurers.

You are advised to go through reviews of LIC New Jeevan Anand, LIC Jeevan Tarun and LIC New Money Back Plan-25 years. These reviews will give you an idea about inherent issues in traditional life insurance plans.

Review: LIC New Children’s Money Back Plan

New Children Money Back plan is a participating non-linked money back plan.

Like all money-back plans, you get guaranteed payback (percentage of Sum Assured) from the insurer during the premium payment term. At maturity, you get the unpaid Sum Assured along with vested bonuses.

You can find policy wordings for the plan on LIC website.

Bonus is a much misused keyword when it comes to traditional life insurance plans.

Under this plan, Simple Reversionary Bonus in announced every year by LIC. It is expressed as per thousand of Sum Assured. Do note even though the bonus is announced every year, it is paid only at the time of policy maturity. So, LIC may have announced a bonus of Rs 40,000 for your plan. You wouldn’t Rs 40,000 right. You get the amount only at the time of maturity. And therein lies the trick.

Go through the post on LIC New Money Back Plan to understand how this bonus feature is smartly used during sales pitches.

There is no compounding.

Getting Rs 40,000 today is not same as receiving Rs 40,000 20 years later.

Though Final Additional Bonus (FAB) is announced every year, it is applicable for your plan only in the year of maturity or death. If LIC does not announce anything in the year of maturity (or death of the policy holder), you don’t get anything.

Salient Features: LIC New Children’s Money Back Plan

- Life cover is on the life of the child

- Entry Age: 0 to 12 years

- Policy Term: 13 to 25 years

- Policy matures when the policy holder turns 25 (policy anniversary immediately following 25th birthday)

- Premium waiver rider is available in the event of death of parent/proposer. I ignore this rider. Will focus only on the base plan.

Survival Benefits under LIC New Children Money Back Plan

Your child gets 20% of Sum Assured on policy anniversary immediately following 18th, 20th and 22nd birthday.

At maturity (after 25th birthday), the child will get remaining 40% of the Sum Assured, along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

Death Benefit under LIC New Children’s Money Back Plan

As frivolous as it may sound, life insurance is on the life of the child.

This is a good enough reason for you to discard this plan.

Who takes a bet on his/her child’s life?

So, if something were to happen to you, your family won’t get anything. In that case, essentially, it becomes an investment plan. And traditional life insurance plans provide guaranteed poor returns.

You purchase insurance so that your family’s finances are taken care off in case you are not around.

Although this aspect is meaningless, even the cover on the life of the child does not commence from day 1. The life cover commences once your child turns (first policy anniversary after the child turns 8) and two years from the date of purchase of policy, whichever is earlier.

In the event of death (of child) before commencement of risk (life cover), you will get back total premiums paid till date excluding taxes and rider premium.

In the event of death (of child) after commencement of risk (life cover), you will get:

Sum Assured + Vested Simple Reversionary Bonuses + Final Additional Bonus, if any

Illustration

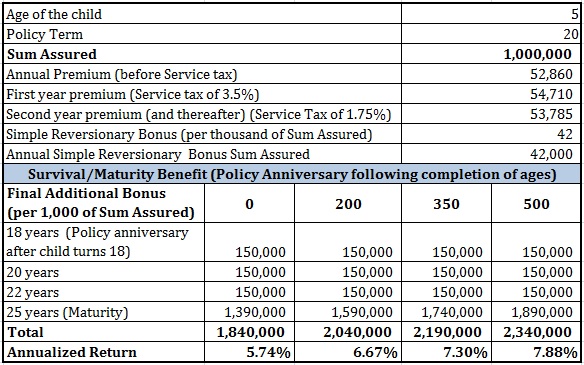

Suppose you purchase LIC New Children Money Back plan for your daughter aged 5 years. The policy term is 20 years and the policy matures after your daughter turns 25.

You chose Sum Assured of Rs 10 lacs.

The annual premium for the plan is Rs 54,710 in the first year and Rs 53,785 in the subsequent years.

New Children Money Back plan is a new plan. Hence, bonus for only last year is available. In 2015, the Simple reversionary bonus for policy term of 20 years was Rs 42 per thousand of Sum Assured.

That makes it an annual bonus of Rs 42,000 (42 * Rs 10 lacs / 1000). I have assumed the bonus will remain same during the course of the plan.

Final Additional Bonus (FAB) is tricky since it is applicable in the year of maturity/death. Hence, I will consider for various values of FAB

You can see the return for a very optimistic FAB is 7.88% p.a. only.

Even the safest PPF gives a return 8.1% at the moment. You may argue returns in PPF are not guaranteed and may change next year. However, bonuses on LIC plans are not guaranteed either. LIC may not declare any bonus or may declare a lower bonus.

Had you invested the same amount in PPF account for your daughter, your daughter will have Rs 26.9 lacs in her PPF account when she turns 25.

I ignore Death benefit under the plan because the life insurance is of the life of your daughter. By doing so, the return under the plan has increased a bit (as the mortality charges will be lower for a child). However, life insurance component of the plan serves little purpose.

Must Read: Which is the best term life insurance plan for you?

PersonalFinancePlan Take

Traditional Life insurance plans are opaque, provide low life coverage and guaranteed poor returns. LIC New Children Money Back plan is no different.

Regular payout after completion of 18, 20 and 22 years are meant to fund your children’s education. Your child will receive maturity amount after turning 25. You may plan to use the money for children’s education and marriage.

However, the returns, as we have seen, are low. Even PPF is expected to beat the returns easily.

Moreover, there is little flexibility if you want to exit/surrender the plan and take out your money. There is heavy surrender penalty.

But the clincher is the life cover. Life cover is on the life of the child. Such cover is meaningless. In such a case, you are purchasing the product only for investment purpose. And you know investment returns are bad in such plans. Good enough reason to avoid the plan.

Verdict: Stay away from LIC New Children Money Back Plan