The Govt. of India announced 7.75% Savings (Taxable Bonds), 2018 in the year 2018.

Let’s understand the salient features of these bonds and whether you should consider investing in these bonds.

The Current Context (May 7, 2020)

Interest rates on bank fixed deposits have been going down for some time now. Interest rates for Small Savings held strong during these times providing some relief. However, in March 2020, the Government of India cut interest rates on small savings schemes too. While products such as PPF and SSY still remain attractive in comparison, there are liquidity constraints with these products and hence may not be good for investors looking for income immediately.

If you are looking for regular income, you can look at options such as bank FDs, SCSS or SWP from debt mutual funds. However, FD and SCSS interest rates are down. Many investors are not comfortable with risk in debt mutual funds after Franklin debt MF mess. With such a backdrop, RBI Savings Bonds 7.75% can make sense for a certain set of investors.

Now, coming back to RBI Savings Bonds. Firstly, these are not new bonds. The Govt. withdrew 8% taxable bonds (2003) in 2018 and introduced these new 7.75% taxable bonds, 2018 in its place. The earlier bonds had a maturity of 6 years. The new bonds mature in 7 years.

Do note 7.75% is very high given 10-year Govt. bond yields and even small savings scheme rates. Therefore, it is quite possible that the Government may withdraw the bonds in its current avatar and relaunch new bonds with a lower rate of interest. Hence, if you are keen on buying these bonds, you should move fast.

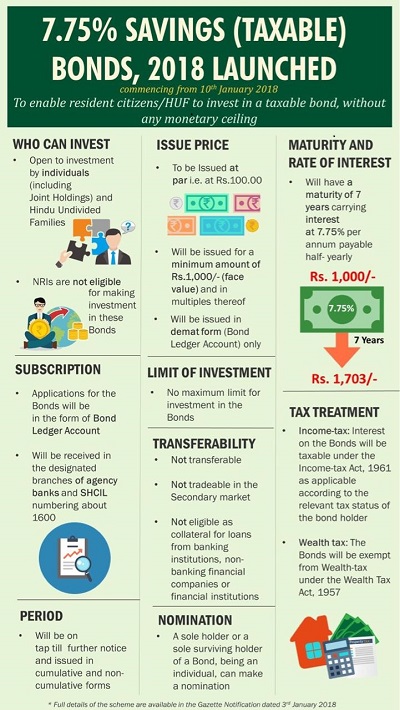

Here is an infographic released by Ministry of Finance about these bonds.

Almost, all the information about the bonds is available in the above infographic. There are still a few points that I should mention.

Government of India 7.75% Savings (Taxable) Bonds, 2018: Points to Note

- Maturity: These Government of India Bonds will mature in 7 years.

- Rate of Interest: The rate of interest of 7.75%, payable semi-annually.

- The bonds are available in both cumulative and non-cumulative mode.

- Who can invest? Individuals and Hindu Undivided Family (HUF) can invest in such bonds.

- NRIs cannot invest in these bonds.

- Maximum Investment: There is no maximum limit on investment in these bonds.

- Taxability of Interest Income: The interest income from such bonds will be taxed at your income tax slab rate.

- Tax Benefit on Investment: You do not get any tax benefit for investing in these bonds.

- The Bonds are exempt from Wealth Tax.

- Pre-mature exit before maturity: You will not be able to exit these bonds before maturity. There is no option of exit in the secondary market either. Therefore, if you foresee the need for such funds in the next few years, don’t invest in these bonds.

- These bonds are not eligible as collateral for loans from banks or NBFCs either.

- No credit risk (unless you believe the Government of India can default on rupee-denominated debt.

- How to Invest: You can invest through select bank branches or through websites of leading brokers.

These bonds are available on tap until further notice i.e. you can invest whenever you want to.

If you invest Rs 1 lac in Government of India 7.75% Savings (Taxable) Bonds, 2018

Under non-cumulative mode, you will get Rs 3,875 every six months for 7 years. At the time of maturity, you will get your principal back.

Under cumulative mode, you will not get anything till maturity. At the time of maturity (7 years), you will get Rs 1.7 lacs back. Effective pre-tax yield is 7.9% p.a.

Please understand I have not considered the impact of taxes while calculating the above numbers i.e. these are pre-tax numbers.

Should you invest in Government of India 7.75% Savings (Taxable) Bonds, 2018?

Since the interest is taxable, there is no need to invest in such bonds unless you are looking for regular income.

Under non-cumulative mode, for an investor in the 30% tax bracket, the post-tax yield falls to about 5.5% p.a.

Therefore, if you are young, have many years before retirement, do not need a regular income and already have taxable income, the guaranteed post-tax return of 5.5%-7% p.a. is not very good for medium-term investment.

Now, we need to see if these bonds make good sense for retirees or senior citizens. For this, we need to compare against some of the other income options for retirement.

Pradhan Mantri Vandana Vyaya Yojana (PMVVY) gives you 8% (taxable) for 10 years. Fresh subscriptions to PMVVY have been stopped.

Senior Citizens Savings Scheme (SCSS) is currently offering 8.3% p.a. (as on January 5, 2018) 7.4% p.a. (as on May 7, 2020) for 5 years.

Bank Fixed deposits are delivering nowhere close to 7.75% p.a. either.

Clearly, 7.75% Savings Bonds do not fare well in terms of returns.

Therefore, at present, the 7.75% savings bonds are offering a very attractive risk-free pre-tax return.

Additionally, there are limits on how much you can invest under PMVVY (Rs 7.5 lacs) and SCSS (Rs 15 lacs). There is no such limit for Govt. of India 7.75% Savings Bonds. You can invest as much as you want. This is one good thing about these bonds.

You can invest unlimited amounts in bank fixed deposits too. As a senior citizen, you may be eligible for better rates too. However, 7.75% looks very difficult on bank FDs even for senior citizens. There are other ways to generate income during retirement too. For instance, good credit quality corporate FDs/NCDs may offer good rates (although that comes at a higher risk of default). There is also an option to go for Systematic Withdrawal Plans from the right kind of debt funds for tax-efficient returns. However, no matter how hard you try, the debt mutual funds will always carry an element of risk.

Therefore, in the current context (May 7, 2020), if you are looking for a risk-free income-generating investment, RBI Savings Bonds 7.75% is a very fine choice. Note this opinion may change with time (depends on the alternatives).

Do note, by investing in these bonds, you are locking in the interest rate only for the next 7 years (not for your entire life). If you are looking to lock-in the interest rate for life, you can look at annuity plans. However, annuity plans are slightly complicated. You must buy the right variant of an annuity plan at the right age. Staggering annuity purchases is also an option.

Another point to note is that there is no way you can exit these bonds before maturity (7 years). You can’t access these your investment even in case of an emergency. Other income options have some way out, albeit at a penalty. This is a big drawback.

What will you do? Do you plan to invest in Govt. of India savings bonds?

Would love to hear your views in the comments section.

Additional Points to Note

- TDS at 10% is applicable on interest payments. If eligible, you can submit Form 15G/Form 15H to avoid TDS deduction.

- Even though the bonds are issued in demat form, you do not need to own a demat account to hold these bonds. The bonds will be credited to Bond Ledger Account (BLA) opened in your name. You will receive a certificate of holding. For more on Bond Ledger Account, refer to this link on RBI website.

- The interest and the principal at maturity will be credited directly to your bank account.

- The interest will be for the first time on Feb 1 or August 1, as the case may be. Thereafter, the interest will be paid every 6 months.

- You can apply for these bonds in the branches of all nationalized banks and a few private sectors. You can also apply on websites of SHCIL and a few brokerage firms. For the sample forms and the list of forms, refer to Annexure 2 and Annexure 3 of this document.

- Premature encashment is allowed for senior citizens with a minimum lock-in period of 4-6 years, depending on your age. However, you will have to incur a penalty (50% of the last 6 months interest) in case of premature withdrawal.

The post was first published in January 2018 and has been updated since.