The Govt. of India announced 7.75% Savings (Taxable Bonds), 2018 in the year 2018.

Let’s understand the salient features of these bonds and whether you should consider investing in these bonds.

The Current Context (May 7, 2020)

Interest rates on bank fixed deposits have been going down for some time now. Interest rates for Small Savings held strong during these times providing some relief. However, in March 2020, the Government of India cut interest rates on small savings schemes too. While products such as PPF and SSY still remain attractive in comparison, there are liquidity constraints with these products and hence may not be good for investors looking for income immediately.

If you are looking for regular income, you can look at options such as bank FDs, SCSS or SWP from debt mutual funds. However, FD and SCSS interest rates are down. Many investors are not comfortable with risk in debt mutual funds after Franklin debt MF mess. With such a backdrop, RBI Savings Bonds 7.75% can make sense for a certain set of investors.

Now, coming back to RBI Savings Bonds. Firstly, these are not new bonds. The Govt. withdrew 8% taxable bonds (2003) in 2018 and introduced these new 7.75% taxable bonds, 2018 in its place. The earlier bonds had a maturity of 6 years. The new bonds mature in 7 years.

Do note 7.75% is very high given 10-year Govt. bond yields and even small savings scheme rates. Therefore, it is quite possible that the Government may withdraw the bonds in its current avatar and relaunch new bonds with a lower rate of interest. Hence, if you are keen on buying these bonds, you should move fast.

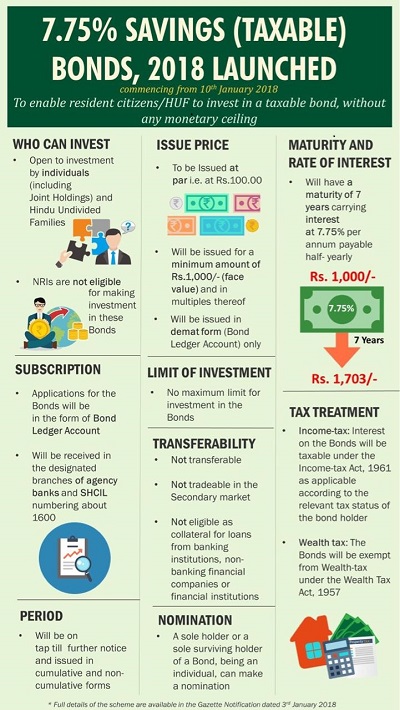

Here is an infographic released by Ministry of Finance about these bonds.

Almost, all the information about the bonds is available in the above infographic. There are still a few points that I should mention.

Government of India 7.75% Savings (Taxable) Bonds, 2018: Points to Note

- Maturity: These Government of India Bonds will mature in 7 years.

- Rate of Interest: The rate of interest of 7.75%, payable semi-annually.

- The bonds are available in both cumulative and non-cumulative mode.

- Who can invest? Individuals and Hindu Undivided Family (HUF) can invest in such bonds.

- NRIs cannot invest in these bonds.

- Maximum Investment: There is no maximum limit on investment in these bonds.

- Taxability of Interest Income: The interest income from such bonds will be taxed at your income tax slab rate.

- Tax Benefit on Investment: You do not get any tax benefit for investing in these bonds.

- The Bonds are exempt from Wealth Tax.

- Pre-mature exit before maturity: You will not be able to exit these bonds before maturity. There is no option of exit in the secondary market either. Therefore, if you foresee the need for such funds in the next few years, don’t invest in these bonds.

- These bonds are not eligible as collateral for loans from banks or NBFCs either.

- No credit risk (unless you believe the Government of India can default on rupee-denominated debt.

- How to Invest: You can invest through select bank branches or through websites of leading brokers.

These bonds are available on tap until further notice i.e. you can invest whenever you want to.

If you invest Rs 1 lac in Government of India 7.75% Savings (Taxable) Bonds, 2018

Under non-cumulative mode, you will get Rs 3,875 every six months for 7 years. At the time of maturity, you will get your principal back.

Under cumulative mode, you will not get anything till maturity. At the time of maturity (7 years), you will get Rs 1.7 lacs back. Effective pre-tax yield is 7.9% p.a.

Please understand I have not considered the impact of taxes while calculating the above numbers i.e. these are pre-tax numbers.

Should you invest in Government of India 7.75% Savings (Taxable) Bonds, 2018?

Since the interest is taxable, there is no need to invest in such bonds unless you are looking for regular income.

Under non-cumulative mode, for an investor in the 30% tax bracket, the post-tax yield falls to about 5.5% p.a.

Therefore, if you are young, have many years before retirement, do not need a regular income and already have taxable income, the guaranteed post-tax return of 5.5%-7% p.a. is not very good for medium-term investment.

Now, we need to see if these bonds make good sense for retirees or senior citizens. For this, we need to compare against some of the other income options for retirement.

Pradhan Mantri Vandana Vyaya Yojana (PMVVY) gives you 8% (taxable) for 10 years. Fresh subscriptions to PMVVY have been stopped.

Senior Citizens Savings Scheme (SCSS) is currently offering 8.3% p.a. (as on January 5, 2018) 7.4% p.a. (as on May 7, 2020) for 5 years.

Bank Fixed deposits are delivering nowhere close to 7.75% p.a. either.

Clearly, 7.75% Savings Bonds do not fare well in terms of returns.

Therefore, at present, the 7.75% savings bonds are offering a very attractive risk-free pre-tax return.

Additionally, there are limits on how much you can invest under PMVVY (Rs 7.5 lacs) and SCSS (Rs 15 lacs). There is no such limit for Govt. of India 7.75% Savings Bonds. You can invest as much as you want. This is one good thing about these bonds.

You can invest unlimited amounts in bank fixed deposits too. As a senior citizen, you may be eligible for better rates too. However, 7.75% looks very difficult on bank FDs even for senior citizens. There are other ways to generate income during retirement too. For instance, good credit quality corporate FDs/NCDs may offer good rates (although that comes at a higher risk of default). There is also an option to go for Systematic Withdrawal Plans from the right kind of debt funds for tax-efficient returns. However, no matter how hard you try, the debt mutual funds will always carry an element of risk.

Therefore, in the current context (May 7, 2020), if you are looking for a risk-free income-generating investment, RBI Savings Bonds 7.75% is a very fine choice. Note this opinion may change with time (depends on the alternatives).

Do note, by investing in these bonds, you are locking in the interest rate only for the next 7 years (not for your entire life). If you are looking to lock-in the interest rate for life, you can look at annuity plans. However, annuity plans are slightly complicated. You must buy the right variant of an annuity plan at the right age. Staggering annuity purchases is also an option.

Another point to note is that there is no way you can exit these bonds before maturity (7 years). You can’t access these your investment even in case of an emergency. Other income options have some way out, albeit at a penalty. This is a big drawback.

What will you do? Do you plan to invest in Govt. of India savings bonds?

Would love to hear your views in the comments section.

Additional Points to Note

- TDS at 10% is applicable on interest payments. If eligible, you can submit Form 15G/Form 15H to avoid TDS deduction.

- Even though the bonds are issued in demat form, you do not need to own a demat account to hold these bonds. The bonds will be credited to Bond Ledger Account (BLA) opened in your name. You will receive a certificate of holding. For more on Bond Ledger Account, refer to this link on RBI website.

- The interest and the principal at maturity will be credited directly to your bank account.

- The interest will be for the first time on Feb 1 or August 1, as the case may be. Thereafter, the interest will be paid every 6 months.

- You can apply for these bonds in the branches of all nationalized banks and a few private sectors. You can also apply on websites of SHCIL and a few brokerage firms. For the sample forms and the list of forms, refer to Annexure 2 and Annexure 3 of this document.

- Premature encashment is allowed for senior citizens with a minimum lock-in period of 4-6 years, depending on your age. However, you will have to incur a penalty (50% of the last 6 months interest) in case of premature withdrawal.

The post was first published in January 2018 and has been updated since.

48 thoughts on “13 Things to know about Govt. of India 7.75% Savings (Taxable) Bonds, 2018”

I am an senior citizen, retired recently. Yes, I do agree that these bonds are not a good source for investment considering the tax levied. There are better investments like dividend paying companies which are non taxable, provided we are prepared to take a calculated risk.

Thanks Sir for your inputs.

Hello sir, I want to ask I invested in RBI 2003 savings (taxable) Bonds! last year to keep yearly interest just below ₹10000/- so as to avoid 15 G form!……. Now if again i am investing in newly launched 2018 (taxable) 7.75% bonds will there be ₹10000 limit for me or Not? …….. or they will combine both Intrests together ?Thanks

Hi Vaibhav,

I am not too sure of this.

In my opinion, the limits will be combined.

Thanks

Thanks

How can we do investment in these bonds?

Banks like ICICI ,

HDFC are accepting these deposits.

If you have a Demat a/c with ICICI Bank, these bonds can be purchased on- line also.

you can invest from your bank branch. Several broker website also offer this serive.

Won’t brokers charge a commission?

Will one have to pay tax every year on the interest generated for the year (like for bank FDs) or is tax paid on the cumulative interest in the 7th year?

Thanks.

The commission is in-built. You don’t have to pay anything.

Depends on how you report income. You can file every year or in the year of receipt.

If you file in the year of maturity, it might increase the marginal tax rate.

Please explain why short term Gilt fund of any Mutual Fund fare better(More CAGR) than Gilt Long term fund

Both have portfolio of sovereign bonds

Hi Pradip,

That’s not the case always.

In a rising interest rate regime, you can expect short-term gilt to perform better.

In a falling interest rate regime, long-term gilt funds are likely to do better.

Thanks Deepesh for the clear explanantion

You are welcome, Paatch.

Hi,

I wish to know if I invest 20 lac in GOzi bond and my income from other sources is zero then if Ideposit 15 G form every year then will I still be charged for tax!

No

Sir,

I am retiree.I have invested. in 8%/7.75% taxable GOI Bonds Cumulative scheme.Since I am reporting bank interest on accrual basis I requested HDFC Bank for TDS certificate for accrued interest on GOI Bonds.The bank stated that TDS certificate will be issued on maturity and no interest certificate can be issued for yearly interest.

Should I have to calculate yearly interest on my own and report in ITR ?

Further on maturity interest for 6/7 years will be reflected in 26 AS and I will be reporting only interest for 6th/7th year since I follow accrual system.Will it lead to some problem ?

Thanks & Regds;

Sir,

Further to my above query I would like to state that it was given to understand that interest on Cumulative GOI Bonds does not accrue in Bank or RBI records till maturity.No interest is paid/credited/provided till maturity.

In view of above every year interest income should be reported in ITR or total interest to be reported on maturity which may result in very heavy tax on maturity.

Thanks & Regds

Dear Sir,

I understand your concern,

However, I do not have a concrete answer to your question. Talked to a few people. No one seems completely sure.

There is a bit of confusion about how to report such income in income tax returns.

Suggest you talk to a CA about it.

I am facing similar problem as Mr Bharat. Since nothing is uploaded till the year of maturity to 26AS (TRACES), you do not get the tax credit.Further on consultation CA(two different) say that the SBI bank has to upload it year-wise but they are surely not doing it for cumulative.

Presently at least one has no option than to report the income only at maturity as then only it will be possible to get the tax credit from 26AS as CA is also not able to resolve the confusion in clear cut manner. Further we all should prevail upon RBI to spell out correctly these things in their document for these bonds that heir is no accrual of interest and the complete maturity amount will reflect as income in that year under 26AS. Then it will be investors choice depending on his tax slab as to whether or not to invest in this instrument.

In case of non-commulative bonds when will they issue TDS certificate.

sir i want to invest 10 lakh rupees i want to know the interest is credited in non cumulative mode was going to credit in every 6 month but when that six month calculated by the date of deposit or any fixed date in a year

Hi Arpit,

For the first payment, the payment will be credited on January 31/July 31 (irrespective of the date of investment).

Thereafter, the payment will be made on 6-month intervals on January 31/July 31.

Hi ,

We read your interesting write-up.

I wanted to know as to what percentage of interest will be deducted as TDS in this GOI bond of 2018 for the year. Though the RBI brochure talks of TDS, what the %ge rate will be, is not given.

Should we presume it will be the usual 10%?

Is there any RBI or FMy. circular which says so?

Thanks for your reply.

Sudha Sundar Rajan

Dear Sir,

TDS will be deducted at 10%

https://www.incometaxindia.gov.in/Pages/Deposit_TDS_TCS.aspx

HELLO SIR VERY IMPORTANT QUESTION REGARDING RBI BONDS IF I INVEST 20 LAC IN CUMULATIVE OPTION TDS DEDUCT AT MATURITY –

1) CAN I SHOW INTEREST ON MY BOOKS YEARLY (MERCANTILE BASIS)

2) SHOW ALL INTEREST INCOME ON MATURITY .

NOW QUESTION IS THAT IF I SHOW YEARLY BASIS (CALCULATE MY SELF BECAUSE NO INTEREST CERTIFICATE ISSUE BY RBI) THAN BIG MISMATCH IN 26AS AFTER 7 YEAR (20 LAC BECOME 34 LAC).

THEES MISMATCH ATTRACT INCOME TAX DEPARTMENT AND IF I SHOW ALL THE INCOME IN MATURITY I A GONE IN 30% INCOME BRACKET

PLEASE ADVICE

Deepesh :

Like many readers have pointed out, I am keen on Cumulative option of 7.75% bond but looking at an option of taking care of considering yearly interests on accrual mode as part of my yearly IT return. In which case, there should be a mechanism to ensure that RBI does not deduct tax portion during final payment. How to ensure the same ? Kindly clarify.

I request other informed readers also to respond pl. Thanks.

Hi Jeyaram,

I understand your concern. However, I am not aware of the workaround.

Ok. Thank you. Pl let us know if you get to know any further inputs in this regard.

DEAR DEEPESH JI WE ARE WAITING FOR YOUR REPLY

BEST REGARDS.

STILL WAITING

…………………………………

REGARDS

in case of cummulative option on these 7.75% RBI bonds,

how will tds be deducted.

or tds will not be applicable in cummulative option.

pls clarify

GOI conditions. 14. Tax Deduction at Source

(i) Tax will be deducted at source while making payment of interest on the NonCumulative Bonds from time to time and credited to Government Account.

(ii) Tax on the interest portion of the maturity value will be deducted at source at the

time of payment of the maturity proceeds on the Cumulative Bonds and credited

to Government Account.

Provided that tax will not be deducted while making payment of interest/

maturity proceeds, as the case may be, to individual/s who have made a

declaration in the application form that they have obtained exemption from tax

under the relevant provisions of the Income Tax Act, 1961 and have submitted a

true copy of the certificate obtained from Income Tax Authorities.

your explanation for the above.TDS at 10% is applicable on interest payments. If eligible, you can submit Form 15G/Form 15H to avoid TDS deduction..Kindly consult an Auditor and give your advise.

With kind regards,

M.S.Natarajan

Hello, just a clarification needed, Does they provide any physical certificate from RBI or the concerned bank from where we have subscribed will be providing any acknowledgment from their end ?

You will get a physical certificate.

HELLO SIR

ONES AGAIN MY QUERY IS STILL PENDING:

VERY IMPORTANT QUESTION REGARDING RBI BONDS IF I INVEST 20 LAC IN CUMULATIVE OPTION TDS DEDUCT AT MATURITY –

1) CAN I SHOW INTEREST ON MY BOOKS YEARLY (MERCANTILE BASIS)

2) SHOW ALL INTEREST INCOME ON MATURITY .

NOW QUESTION IS THAT IF I SHOW YEARLY BASIS (CALCULATE MY SELF BECAUSE NO INTEREST CERTIFICATE ISSUE BY RBI) THAN BIG MISMATCH IN 26AS AFTER 7 YEAR (20 LAC BECOME 34 LAC).

THEES MISMATCH ATTRACT INCOME TAX DEPARTMENT AND IF I SHOW ALL THE INCOME IN MATURITY I A GONE IN 30% INCOME BRACKET

PLEASE ADVICE

Reply

Dear Rajat ji,

I get your concern about cumulative option.

However, I don’t have a very clear answer about this.

A Chartered accountant is a better person to answer this question.

Perhaps, you can report interest every year and clarify to the assessing officer if your case comes up for scrutiny due to TDS and return mismatch in the year of maturity.

Thanx sir

charter accounttant also confuesd .

प्रिय दीपेश जी , पाठको की GOI CUMULATIVE BONDS के सन्दर्भ जो दुविधा बनी है उसका सही तर्कसंगत उत्तर अगर आप नही देंगे तो कौन देगा लोगो ने जो निवेश कर दिया है उसे वापिस तो मंगाया नही जा सकता ! C A भी असमर्थ है कृपया विषय की गंभीरता को दिखते हुये कुछ तो स्पष्टीकरण दे ?

आपके उत्तर की प्रतीक्षा मे

संजय कुमार

Hi ,

As many readers have asked , what is the best way of treating Cumulative interest on GOI 7.75% bonds .

Should the accrued interest be shown every year at the time of filing returns or all on maturity receipts.

Please Advise.

Very important question GOI cumulative bond interest income show yearly or all income show on maturity. Please guide

I have invested in taxable RBI bonds 8% p.a with cumulative option i.e interest payable on maturity. Should the interest amount be added to my income every year or will it be added to my income in the year when it matures i..e. 2023. Please let me know.

Faceing Same above problem.

Sir,

I am retiree.I have invested. in 7.75% taxable GOI Bonds Cumulative scheme.Since I am reporting bank interest on accrual basis I requested HDFC Bank for TDS certificate for accrued interest on GOI Bonds.The bank stated that TDS certificate will be issued on maturity and no interest certificate can be issued for yearly interest.

Should I have to calculate yearly interest on my own and report in ITR ?

Further on maturity interest for 7 years will be reflected in 26 AS and I will be reporting only interest for 7th year since I follow accrual system.Will it lead to some problem ?

Kindly help I do not have taxable income…if the TDS otherwise is done on maturity my whole savings would be eroded. Kindly help.

Thanks & Regds;

1)yes its problem.Better you show 7 th year and 7th year u pay tax(safest way)

2)if u adopt show interest yearly may be u face littel problem mismatch in 26as and in your annual return in 7th year.than ready for correspondence with IT dept. but if your investment is low than dont worry go ahead for show annual int

dono mai hi dikkat hai

deepesh bhai to kuch batate nahi?