The Government (EPFO) has offered a choice to select eligible EPF/EPS subscribers to opt for higher pension under EPS (Employees’ pension scheme).

An option to earn a higher pension during retirement.

Who would say “No” to such an offer?

Well, there is no free lunch in this world. While there is an option to earn higher pension, it comes at a cost.

The question: Should you opt for higher pension under EPS?

In this post, let’s look at the following aspects in detail.

- How much pension do you get under EPS? When does the pension start and how long do you get it?

- How do you contribute to EPF and EPS?

- What is this entire issue about higher pension? And why does this arise?

- Who is eligible?

- What do you get if you opt for higher pension? What do you lose?

- If you opt for higher pension, what portion of your EPF corpus will be moved to EPS?

- What are the problems/drawbacks of EPS? These drawbacks might impact your decision.

- Should you opt for higher pension under EPS? Or should you stick with the status quo?

Discussed this topic in a Twitter thread too.

How much pension do you get under EPS?

Monthly Pension = (Pensionable salary X Pensionable service)/70

Pensionable salary = Average of last 60 months of base salary (earlier it used to be last 12 months salary). The pensionable salary is now capped at Rs 15,000. However, there is a way for old employees (who joined workforce before September 1, 2014) to get around this cap and earn pension on actual base salary. And this is the source of the entire dispute that we will discuss in this post.

Pensionable service = No. of years of contribution to EPS

I have read in many places that the pensionable service is capped at 35 years for the purpose of pension calculation. However, I could not find the supporting clause in the EPS Act. If such a cap is indeed there, it may flow from another set of rules/regulations.

The pension starts at the age of 58. If you exit EPS at the age of 58 and have rendered more than 20 years of pensionable service, 2 years will be added to the pensionable service for calculation of pension.

You have an option to start pension early (but not before the age of 50). The pension will be reduced by 4% for every year of early exit. Can also defer but not beyond the age of 60.

Let’s understand this with the help of an illustration.

Your last 60 months’ average base salary is Rs 1 lac. And you were contributing as per actual salary (not as per wage cap of Rs 15,000)

You have rendered 33 years of pensionable service. Since you have worked for over 20 years and are exiting at the age of 58, your pensionable service will be 35 years.

Monthly pension = Rs 1 lac X 35/70 = Rs 50,000

- You will earn this pension of Rs 50,000 per month for life.

- Demise of pensioner with Surviving spouse: After you, your spouse will earn 25,000 (50%) until he/she is alive (or gets remarried). In addition, your children will get 6,250 (12.5%) per month until they turn 25. Max 2 children. That makes it a maximum of 75% (50% to spouse+ 12.5% each to 2 kids) pension to the family.

- Subsequent demise of spouse (pensioner had passed away earlier): If the spouse passes away subsequently, the pension to the children (maximum 2) will increase to 37.5% each. Until the age of 25. That’s again a maximum of 75%.

- Demise of pensioner without surviving spouse: If there is no surviving spouse, the children (maximum 2) get orphan pension (37.5% each) until the age of 25. Maximum of 75% of member’s pension to the family.

- There are a few other provisions taking care of corner cases. You will have to check the EPS Act to see how pension provisions will apply in such cases.

Note: If you were contributing with a wage ceiling, you will get pension of only Rs 15,000 X 35/70 = Rs 7,500.

When you see such a formula for calculating pension in a defined benefit scheme, you can sense this can be gamed. Such a formula may have had some relevance in the years gone by but not now. Good that the Government has plugged the loophole, at least for the new members.

By the way, how is the pension from EPS funded? It works through your (your employer’s) contribution to EPS.

How does contribution to EPS and EPF work?

You contribute 12% of your base salary (Basic + DA) to EPF every month.

Your employer makes a matching contribution of 12%. However, this 12% is invested in a different manner.

Of this 8.33% goes towards EPS (Employee pension scheme). And the remainder (3.67%) goes to EPF.

However, the salary on which EPS is calculated is capped at Rs 15,000 per month.

Let us consider an example. Let us say your base salary is Rs 50,000.

Your contribution to EPF = 12% * 50000 = Rs 6,000.

You don’t contribute to EPS.

Your employer also contributes Rs 6,000 to your EPS+EPF.

What is the breakup?

Employer contribution to EPS = 8.33% X Rs 15,000 = Rs 1,250 (since the ceiling wage of Rs 15,000 gets triggered).

Employer contribution to EPF = Rs 6,000 – Rs 1,250 = Rs 4,750

The Government also contributes 1.16% of your base salary to EPS subject to a wage cap of Rs 15,000 per month.

This sounds all right. Where is the problem?

Where is the problem?

The wage ceiling has kept changing. Before the amendment in the EPS scheme in 2014, the ceiling was Rs 6,500.

Well, that’s also fine. I don’t see any problem there.

Had the above wage ceilings concrete, everything would have been fine.

However, the EPS rules allowed employees to contribute over and above the wage ceiling cap. (Btw, the amendment in EPS scheme in 2014 plugged this loophole and the employees joining the workforce after September 1, 2014 can’t contribute above the ceiling cap of Rs 15,000).

But this does not prevent employees who were member of EPS scheme before September 1, 2014 (and still are OR retired after September 1, 2014) from contributing above the wage ceiling (Rs 5,000/Rs 6,500/ Rs 15,000). And earn a HIGHER PENSION.

And this has led to all the confusion.

Note that EPS is a defined benefit scheme (unlike NPS which is a defined contribution)

How does this lead to confusion?

There are multiple pathways.

Case 1

In some cases, your employer caps contribution to EPF to wage ceiling of Rs 15,000 (wage ceiling has kept changing. It was Rs 5,000 earlier. Then to Rs 6,500 and now to Rs 15,000).

Hence, even if your basic salary is Rs 50,000, you will contribute only Rs 1,800 (12% of Rs 15,000). Your employer will contribute 1,250 (8.33% of Rs 15,000) to EPS. And Rs 550 to EPF.

If you belong here, you are not eligible for HIGHER PENSION. Why? Because you have been contributing only as per the wage cap.

Case 2

Your employer does not cap contribution. You contribute on actual salary (and not based on salary cap). Actual base salary of Rs 50,000.

Your contribution to EPF = 12% X Rs 50,000 = Rs 6,000.

Your contribution to EPS is NIL.

Employer contribution to EPS = 8.33% X 50,000 = Rs 4,165

Employer contribution to EPF = 3.67% X 50,000 = Rs 1,835

You are eligible for higher pension.

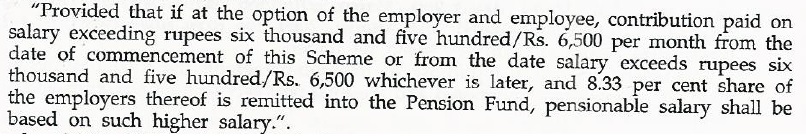

However, there was a technical rule here where the employee and employer had to convey this decision to EPFO within certain timelines. Provision to Para 11(3) of the scheme before amendment in 2014. I reproduce the provision below.

Hence, there were instances where people had contributed more to EPS without explicitly stating this choice.

When they reached out to EPFO for higher pension, EPFO rejected their claim for higher pension (and gave pension as per the ceiling cap) since those employees didn’t specify this option explicitly with stated timelines. And refunded excess contribution in the EPS to the EPF accounts of the employees with interest.

Such employees challenged EPFO in the courts and won. The Supreme Court found those timelines arbitrary and ruled in favour of such employees. Eligible for higher pension. You can read about this case about Mr. Praveen Kohli here.

Case 3

Your employer does not cap contribution. You contribute on actual salary (and not based on salary cap). Actual base salary of Rs 50,000.

Your contribution to EPF = 12% X Rs 50,000 = Rs 6,000.

Your contribution to EPS is NIL.

Employer contribution to EPS = 8.33% X 15,000 = Rs 1,250 (while the employer does not cap contribution to EPF, it caps the EPS contribution)

Employer contribution to EPF = 6,000 – Rs 1,250 = Rs 4,750

Since the EPS contribution has been made as per the wage cap of Rs 15,000, you would get pension only as per the wage cap. Not higher pension.

If you belong here, this recent EPFO circular dated Feb 20, 2023 will interest you.

Why?

Because you have an option to fill up a form and confirm that you want a higher pension now. Since there is free lunch, EPFO will transfer a portion of money (deficit contribution to EPS along with interest from EPF to EPS). For your future contributions also, you (your employer) will have to contribute more to EPS.

So, higher pension but a lower EPF corpus. In the latter part of the post, we will see how to evaluate these choices.

Who is eligible for higher pension under EPS?

I reproduce an extract from EPFO circular dated February 20, 2023.

The circular refers to eligibility for exercising this new option for higher pension by filling up a form.

- You must have been a member of EPS as on September 1, 2014. Therefore, if you started working after September 1, 2014, you are NOT eligible. OR if you retired before September 1, 2014, you are NOT eligible for higher pension.

- Your (and your employer’s) contribution to EPF (as on September 1, 2014) was on the salary that exceeded the wage ceiling cap of Rs 5,000 or Rs 6,500. Let’s say your base salary was 25,000 and you were contributing on the actual salary of Rs 25,000 (and not as per wage cap of Rs 15,000). You are ELIGIBLE even if your EPS contribution was capped but your EPF contribution was on actual salary.

How to apply for Higher Pension under EPS?

The EPFO circular lays down the method.

You must make a joint application along with your employer to EPF. As things stand today, you must apply before March 3, 2023 (4 months from the Supreme court judgement).

Given the confusion surrounding this matter, I hope the deadline is extended.

Suggest you reach out to the accounts team of your employer for the operational details.

Should you opt for Higher pension under EPS?

If you opt for Higher pension, you will get higher pension. Risk-free. Guaranteed for life. And that is the biggest advantage.

How high a pension will you get?

Well, that depends on your average base salary in the final five years of your work life (and years of pensionable service).

Now, you cannot answer this question accurately, especially if you are in the private sector where salaries can fluctuate drastically. If you are working with a PSU and are closer to retirement, you may have a firmer grip on the answer.

Still, take educated guesses. How much increment you have been receiving the last few years? And with those assumptions, you can arrive at the final pension number.

And you compare that against the alternatives? Don’t you?

Firstly, the higher pension comes at a cost. Your EPF corpus will go down as a significant portion of your EPF corpus will be shifted to EPS scheme. Your future contribution to EPF will also fall since you will now contribute more to EPF.

After retirement, you would get this corpus and you can invest this money in bank fixed deposits, Government Bonds, SCSS, PMVVY or even annuity plans to generate regular retirement income.

So, you must see, how much EPF corpus are you foregoing? And how easy or difficult it is for you to generate a similar level of income using this corpus? If you can do that easily, then maintain the status quo. If you cannot (the rate of return will be quite high), then opt for a higher pension.

If you opt for Higher pension, what portion of EPF will be shifted to EPS?

In the aforementioned EPFO circular dated Feb 20, 2023, EPFO has mentioned, “The method of deposit and that of computation of pension will follow through subsequent circular”.

Deposit means deposit from EPF to EPS. To be honest, it is unfair to expect employees to make a choice until EPF comes out with these calculations. Remember, the Supreme court passed its judgement on November 3, 2022, and gave 4 months (until March 3, 2023) to members (employees) to make their choice. And EPFO says on Feb 20, 2023, that they will issue a subsequent circular for calculations.

EPFO, in its circular dated May 11, 2023, came out with the calculation methodology for how much amount shall be shifted from EPF to EPS If you choose to apply for higher pension.

For this, you have calculate 2 amounts.

A = Amount that should have gone to EPS (if you had exercised higher pension option at the very beginning)

B = Actual Amount that has gone to EPS

To calculate A

- We should first calculate the EPS contribution for each month on actual salary (and not capped salary)

- Up to August 31, 2014: At the rate of 8.33% out of 12% employer contribution on higher pay (from November 16, 1995 or from the date the pay exceeds the wage ceiling, whichever is later).

- From September 1, 2014: 8.33% of the 12% employer contribution up to basic pay of Rs 15,000. 9.49% of the 12% employer contribution exceeding Rs 15,000

- For each month, deduct the amount that was originally transferred to the EPS in that month. This is the deficit amount that needs to be transferred to EPS.

- Not just the deficit amount, the interest earned on such deficit amounts must also be transferred to EPS.

If you can work out this math, you have the answer.

Let’s do some crude calculations and see how much will be moved out of your EPS corpus.

Let’s say you started working in the year 2001.

Your base salary at the beginning was Rs 20,000 and grew at 5% per annum. I have assumed that EPF returned 8.5% p.a. throughout the tenure.

The wage cap was Rs 6,500 until September 2014 and Rs 15,000 thereafter.

While you were contributing to EPF on actual salary, the contribution to EPS was only as per cap.

In the first year, Base salary =20,000

Employee EPF contribution = 20,000 * 12% = Rs 2,400

Employer EPS contribution = 8.33% * 6,500 = Rs 542 (if this were on actual salary, employer would have invested Rs 1,667)

Employer EPF contribution = Rs 2,400 – Rs 542 = Rs 1,858 (if EPS contribution were on actual salary, this would have been Rs 2,400 – Rs 1,667 = Rs 733)

The deficit contribution to EPS = Rs 1,667 – Rs 542 = Rs 1,125

Now, this deficit contribution to EPS (that went to EPF) will have to be shifted back to the EPS scheme. And the interest on this deficit contribution too. And this must be done for your entire past service.

How much will this amount be?

This will depend on the trajectory of your salary growth. The higher your salary, the higher the deficit contribution. And the more (in percentage terms) you will have to transfer from EPF to EPS.

Percentage of transfer= Total deficit contribution to EPS/Total Contribution to EPF

In this example, total contribution to EPF (includes both employer and employee) = Rs 21.63 lacs

Total deficit contribution to EPS = Rs 6.06 lacs

Percentage of EPF to be transferred to EPS = Rs 6.06/21.63 lacs = 28%

You can also compare the EPF corpus. Current vs the EPF corpus you would have without EPS contribution being capped. You would get the same answer.

I did very crude EPF calculations (not exact). Current corpus = ~51.66 lacs

EPF corpus after removing EPS cap = Rs 37.14 lacs. A difference of 28%.

Note this difference would be higher for a higher base salary.

In this example, if we change the starting base salary from Rs 20,000 to Rs 50,000, the transfer percentage rises to 32%.

If starting base salary drops to Rs 10,000, the transfer percentage falls to 19.8%.

What is this 8.33% and 9.49%?

We know about employer contribution of 8.33% of your basic pay to EPS account. Well, that’s not enough to fund your EPS pension. The Government contributes an additional 1.16% to your EPS account to fund the pension.

The Government is fine with contributing 1.16% up to the wage ceiling limit of Rs 15,000. Beyond that, not so much. That’s why in the EPS pension rules in 2014, EPFO has clearly mentioned that if you opt for higher pension, this 1.16% has to come from the subscriber (you).

The Honorable Supreme Court had put this on hold. For more on this, refer to page 7 of this document. However, the Government of India clarified this through a Gazette notification dated May 3, 2023.

Going forward, you (your employer on your behalf) will contribute 8.33% on basic salary up to 15,000 and 9.49% on the portion exceeding Rs. 15,000.

Your future EPF contributions will fall

If you opt for higher pension, your employer’s future contribution to EPS will rise and to EPF will fall. That will also slow down the growth of EPF corpus.

As mentioned in the previous section, your employer will now contribute 8.33% of your basic salary to your EPS account. And for the portion of basic salary exceeding Rs 15,000, the employer contribution will be even higher at 9.49%. As more money goes to EPS, less money goes to EPF.

Extending the example to pending 10 years of service, if you opt for higher pension, you would end with Rs 1.04 crores of EPF corpus after 10 years.

Had you stuck with lower pension, you would have Rs 1.46 crores.

What will be the pension?

Average base salary in the last 5 years = Rs 86,645

Monthly pension = 86,645 X 35/70 = Rs 45,798

Even if you stuck with lower pension option (status quo), you would get pension of Rs 7,500 (Rs 15,000 X 35/70).

Difference of Rs 41.68 lacs in EPF corpus.

Difference in EPS pension = Rs 45,798 – Rs 7,500 = Rs 38,298

Now, for this Rs 41.68 lacs to generate income of Rs 38,298 per month, it needs to generate a return of 11% p.a. That’s not easy.

Looking at such an analysis, opting for higher pension looks like a better choice.

But EPS has its own set of problems.

What are the problems with pension under EPS?

Firstly, you get the full pension until you are alive. After you (the primary pensioner passes away) your spouse gets the pension but only 50% of the original amount. And after the spouse passes away, a maximum of 2 kids gets 25% each until they are 25.

I am imagining a morbid scenario, but the family does not get as much if you (the primary pensioner) pass away too soon after retirement.

Had you stuck with a lower pension, you would have gotten a much bigger EPF corpus at retirement. Now, this EPF corpus belongs to you. And after you, it belongs to your family. So, this excess EPF corpus may not be able to generate as high income as EPS but this EPF corpus belongs to you and your family.

Secondly, the pension depends on the last 5 years (60 months) of base salary. So, if you decide to take a step off the accelerator once you cross 50 and pick up a job that pays less, your average income during the final five years of your working life may fall. And hence the pension will be lower.

For instance, let us assume your average base salary between the age of 48 and 53 was Rs 2 lacs. And the average base salary between 53 and 58 years was 1 lac. The pension would be calculated for the average salary in the last 5 years i.e. Rs 1 lac. That you are earning more before that does not matter.

Thirdly, if you want to retire early, then your pensionable years of service will be less, and the pension will accordingly be lower. Plus, the pension amount does not start before the age of 50. Let us consider an example. You started working at the age of 25 and worked until the age of 45. 20 years of service. Let’s further assume that your average salary in the last 5 years was Rs 1 lac. Hence, your monthly pension would be Rs 1 lac X 20/ 35 = Rs 57,142.

However, if you want this full pension, you will have to wait until the age of 58. But you retired at the age of 45. There is an option to start drawing earlier but not before you turn 50. The early withdrawal comes at a cost. You get 4% less for each year of early withdrawal. So, if you start at 50, you will get 8 X 4% = 32% less. Rs 38,857 instead of Rs 57,142.

Lastly (and I am not sure about this), the option for a higher pension is a joint option exercised by you and your employer. You are in a private job and have opted for a higher pension (and your existing employer is ok with this). You switch your job after a few years and the new employer has a different policy about contributions. Caps the contribution as per wage ceiling. You can ask them to make an exception for you, but this is a headache. This possibility would make me extremely uncomfortable.

What is the final verdict?

There is no one-size-fits-all solution.

Going by numbers (and as we have seen above), opting for the higher pension will indeed give you a very high pension. It would be difficult to replicate the same level of risk-free income from your EPF corpus.

However, the higher pension comes with many ifs and buts. Many caveats. You lose flexibility.

You must weigh the higher pension against these problems in EPS.

I get extremely uncomfortable if you take away flexibility from my investments. Hence, please appreciate my biases in my final comments.

If you are closer to retirement and are ok with all the caveats (as mentioned in the previous section), you will likely be better off by signing up for Higher pension. But check the calculations before taking a final call.

If you are younger (35-40), attach greater weight to problems/caveats/lack of flexibility in EPS.

Disclaimer: While I have tried my best to understand and explain the topic in detail, there may be shortcomings in my analysis or my understanding of the EPS scheme and the EPFO circular.