I have reviewed many traditional plans in this blog. The conclusion was same in all the cases that the plans were strictly avoidable.

In this post, I will review LIC New Endowment Plan (814) and see how it fares against a simple combination of term plan and Public Provident Fund (PPF).

LIC New Endowment Plan (Plan no. 814) is a traditional participating non-linked life insurance plan.

Must Read: Say No to Traditional Life Insurance Plans

LIC New Endowment Plan: Key Features

- Minimum Sum Assured: Rs 1 lacs, No maximum limit

- Policy Term: 12 to 35 years

- Premium payment term is same as policy term.

- Minimum Entry Age: 8 years, Maximum Entry Age: 55 years

- Maximum Age at Maturity: 75 years

How LIC New Endowment Plan works?

You pay an annual premium for the duration of the policy.

If you survive the policy term, you get Sum Assured + Vested Simple Reversionary Bonus + Final Additional Bonus, if any.

Let’s try to understand this with the help of an example.

Every year, LIC announces a simple reversionary bonus. This bonus is awarded as per thousand of Sum Assured. So, if the Sum Assured (life cover) under the plan is Rs 10 lacs and LIC announces a reversionary bonus of Rs 40 per thousand of Sum Assured, your bonus for the year will be Rs 40,000 (40*10 lacs/1,000).

Do note the simple reversionary bonus merely gets vested. You do not get anything in hand. You get this amount only the time of maturity. And you don’t earn any return on the bonus amount. There is no element of compounding of returns.

It is not difficult to see Rs 40,000 today is not same as Rs 40,000 20 years hence. Inflation will eat into the value.

Assuming the plan is 20 years and reversionary bonus stays at Rs 40 per thousand of Sum Assured, you will earn Rs 8 lacs (20 X 40,000 per year).

In addition, you also get Final Additional Bonus (FAB). Even though FAB is announced every year, it is applicable to your policy only in the year of maturity/demise. So, if LIC does not announce any FAB in the year of maturity of your plan or demise, you (your nominee) do not get any Final Additional Bonus. FAB also depends on Sum Assured and policy term.

Let’s not get so harsh. Let’s assume in the above example, LIC announces a FAB of Rs 200 per thousand of Sum Assured. Your FAB will be Rs 2 lacs (200 X Rs 10 lacs/1,000).

Maturity Value = Sum Assured + Vested Simple Reversionary Bonus + FAB = Rs 10 lacs + Rs 8 lacs + Rs 2 lacs = Rs 20 lacs.

Death Benefit (if the policy holder dies during the policy term)

In the event of death of the policy holder during the policy term, the policy holder gets the sum of Sum Assured, vested Simple Reversionary Bonus and Final Additional Bonus, if any.

You can read policy wordings here.

Benefit Illustration: LIC New Endowment Plan

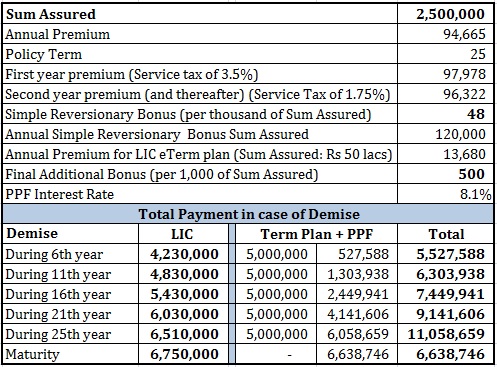

I have considered premium for a 35 year old for Sum Assured of Rs 10 lacs. Policy term is 25 years. You can find out the premium for the plan here.

Let’s consider various scenarios if the policy holder survives the term.

As for the values of Simple Reversionary Bonus, LIC has announced bonus of Rs 48 per Rs. 1,000 of Sum Assured for the last two years (for LIC New Endowment plan with policy term of over 20 years). So, Rs 48 is a fair assumption.

For Final Additional Bonus, I have considered various values of FAB and tried to assess the impact.

You can see the returns are extremely poor. The safest PPF gives 8.1% at present (August 25, 2016). You can argue PPF interest rate is subject to change every quarter. However, so is LIC bonus. You cannot expect LIC to announce the same bonus if the PPF interest rate goes down to 6% p.a.

Comparison with combination of Term Plan and PPF

You may argue that PPF is a pure investment product while LIC New Endowment plan has an insurance element too.

I agree. To make a fair comparison, I will add term insurance too. I take a term plan of Rs 50 lacs (Age: 35 years, Term: 25 years). Since many of us have distrust towards private insurers, I have picked up eTerm plan from LIC itself. The annual premium for eTerm plan is Rs 13,680.

To compare, I reduce the annual premium of term plan from annual premium for LIC New Endowment plan. The remaining gets invested in PPF.

You can see a simple combination of term plan from LIC and PPF easily outperforms money back plan in every scenario except when the policy holder survives the term.

You can argue LIC New Endowment plan better in case the policy holder survives the policy term.

However, you must note, I have taken a very generous value of Final Additional Bonus (Rs 500 per thousand of Sum Assured). At a lower value of Final Additional Bonus, you will end up lower than PPF + Term plan combination.

Additionally, I have considered term plan from LIC. Plans from private players are cheaper.

For a term of 25 years, you could also have taken exposure to equity mutual funds, which would have given you better returns. At 10% return, you could have ended up with a corpus of ~90 lacs.

In any case, if maturity corpus was your concern (and not life cover), you could have skipped term cover and invested the entire amount in PPF. You would have got higher corpus (~Rs 77 lacs) in PPF.

Read: Which is the best Term Insurance Plan for you?

Issues with LIC New Endowment Plan?

- Insurance and investment are mixed. If you opt for such products, your premium payment ability will determine your life cover. This shouldn’t be your approach. With this approach, you are likely to remain underinsured. For instance, in this LIC plan, you need to pay ~Rs 98,000 to get a life cover of Rs 25 lacs. Many of us may not be in a position to spend so much. What can this lead to? You will settle for life cover which you can afford. If you can pay premium of Rs 50,000, you will settle for cover of say Rs 12 lacs. Not the right approach.

- The correct approach is to assess your life insurance requirement. Purchase term life cover for the amount. Invest what is left after purchasing the life cover.

- You are getting guaranteed poor returns and low life cover.

- You cannot exit without incurring a heavy penalty. Surrender charges are very high.

PersonalFinancePlan Take

You are better off staying away from LIC New Endowment Plan. Keep things simple. Keep your insurance and investment needs separate. Purchase a pure term life cover and invest the surplus.

By the way, I have nothing against LIC. All private insurers sell such plans. You are advised to avoid such plans from private insurers too.

59 thoughts on “What’s wrong with LIC New Endowment Plan?”

Sir, pl give us detail benefit illustration of sbi hum suffer policy

Dear Sagar,

You can avoid SBI Humsafar plan.

It is traditional joint life insurance plan.

You can find details and benefit illustration at this link.

http://www.sbilife.co.in/sbilife/content/9_8951

Hi, Currently, I am of 23.This year I did a New Endowment Plan(814) policy for a period of 35 years with an Assured Sum 5 lakhs.I pay premium of 13k/year. I was told that the maturity amount would be somewhere aroung 25 lacs. How true is that? I could not relate your above calculations with what I see in different sites calculating the maturity amount to be around 24-25 lacs. Are calculations just the prediction or its guaranteed return?

Hi Sumit,

My calculations are for a different age and policy tenor.

Hence, maturity will be quite different.

Nothing is guaranteed (except for Sum Assured). The maturity amount depends on the annual bonuses announced.

Hence, all the calculations (mine or others) are based on assumptions.

If the assumptions don’t hold true, maturity amount will also be different.

Hope this answers your query.

Thankyou Deepesh. So would it be good to continue with the Endowment Plan or should I switch to a term insurance plan?

Sumit,

How many premiums have you paid?

Decision to purchase term plan should be irrespective of your decision to continue or surrender the plan.

Endowment plan is unlikely to be be enough to meet your insurance requirement.

http://www.personalfinanceplan.in/insurance/life-insurance-calculator/

In that case, you must purchase a term life plan.

http://www.personalfinanceplan.in/insurance/which-is-the-best-term-insurance-plan-for-you/

Have paid premium for one year only

You can surrender the plan then. Do note tax benefits, if taken under Section 80C for this investment, will be clawed back.

Hi..I am one of the employees of lic..the return after maturity will be approximately 2577000 as per the current bonus rate of 53 rps per 1000 sum assured. The final additional bonus nd diamond jubilee bonus will also be included.it was properly guided by lic person..stick to this plan ..it provides better return in case of long term.and don’t surrender the policy because surrendering a policy incurs a huge loss in terms of policyholder’s side.thank u.

Hi Namrata,

Thanks for your input.

Shall I take a eterm and new endowment plus _ plan 825 of LIC.

I AM 35 years old and capable of paying 30000 annual premium. Please suggest

Dear Padma,

I have not seen the plan.

However, don’t expect the plan to be any different from other plans from LIC stable.

My father has taken LIC New Endowment Plan(814) on 03/march/2016 , On dec 18th 2016 he died and he forgot to pay 2016 march premium, shall we get any lic accidental benifit for this ,please give any info

My father has taken LIC New Endowment Plan(814) on 03/march/2015 , On dec 18th 2016 he died and he forgot to pay 2016 march premium, shall we get any lic accidental benifit for this ,please give any info

Dear Venkat,

I am sorry for your loss.

As I understand, the policy would have lapsed due to non-payment of premium. Since the premium was paid for just one year, the policy would have lapsed due to non-payment of premium.

Which is the best endowment plan in LIC currently?

Should i go for money back instead?

Sorry, I don’t have an answer.

I write the post about what’s wrong with endowment plans. And you ask to provide you the best endowment plan. 🙂

Hi , i need to invest for my child future who is currently 9 month old. Pls suggest.

Hi Ajay,

Not easy to comment since I don’t know much about you.

Suggest you seek services of an advisor.

If I were to give generic advice, since your kid is only 9 months, if you are saving for his higher education, you can consider taking some exposure to equity mutual funds. And yes, do open PPF account for him/her and keep making minimum contributions.

Good luck!!!

I need a financial advisor like you. You have explained it quite well. I just submitted the documents for the endowment plan. Guess, I am going to cancel the check after all! Thanks so much.

You are welcome, Lovely!!!

Will appreciate if you could share the post with your friends too.

Hi sir I am 32 want to invest in plants you get life insurance and wealth generation within a duration of 15 years. Please suggest some good plan

Hi Supreet,

Purchase a pure term plan and invest the remaining amount in PPF, mutual funds etc.

I am 46 years old i don’t have any insurance or saving plans. Now I want to take new endowment plan 814. And jeevan labh 836 please suggest me. Can I go ahead or any other good plan s please suggest….chandan

Dear Chandan,

Suggest you work with a local advisor.

I can only offer generic advice.

If you need to purchase insurance, suggest you purchase a term life insurance plan.

You can invest the money in PPF, fixed deposits, EPF, a bit in equity funds etc.

Hello Mr. Deepesh,

Firstly, congratulations for an excellent blog on various investment and insurance plans. Now, my question is regarding a so called LIC retire and enjoy plan. Basically its a sum of 17 LIC endowment policies which was bundled as 1 policy and sold to me back in 2009. I was 26 years old than. Currently, I am paying 92488 INR/annum as premium. My first policy shall mature in 2042. Now, obviously I haven’t taken right decision here, have I? But going forward what can be done to undo this mistake. What are my options and what would you suggest.

Thank you

D Gupta

Dear Mr. Gupta,

Appreciate your kind words.

I know about retire and enjoy.

Is the annual premium a burden on your pocket?

I mean, is the premium crowding out other investments?

Investing in such a product structure was a bad idea in the first place.

However, since you have paid the premium for so many years, you can consider continuing the plan unless the annual premium forms a significant portion of your annual investments.

Btw, you also have an option to surrender select policies.

Please understand I have not worked out any numbers.

If you want a mathematical solution, you will have to compare scenarios in a spreadsheet.

Thank you for your time Mr. Deepesh. I keep looking for friendly as well as professional advise when it comes to financial matters. But usually, the professional advice is biased ( Bank HR manager, or Agents etc). I am not saying they are wrong, but its is equally important to have a non-biased advice. Currently, there are a no. of things I am looking into including shares and mutual funds. I dont know much about you or your company, but I liked your blog above and the way you have explained things in layman’s terms and not as an financial expert form IIM. So if you do this professionally, than I would like to have your advice on my financial matters in near future. Kindly let me know how can I get in touch with you, so that I can know more about you and your company.

Thanks

D Gupta

Dear Mr. Gupta.

Thanks for your kind words.

Please drop an e-mail at support e-mail id (given on the top right).

We can take this ahead from there.

Hi Sir,

I have taken New Endowment Plan (814) in Nov,2015. However, now I realize that it’s not meaningful for me. Can I convert in Paid-up value? If not now, in near future can I do?

Thanks,

Brijendra.

Hi Brijendra,

You can make the policy paid up after paying 3 premiums.

Guess you would have paid the 3rd premium in November.

Surrender is also an option though.

Hello

I would like to share my master plan of new जीवन anand policy

My age is 30

I have purchased 7 policies of 1 lac sum assured and each maturity year term 26 to 32

I purchased in 2017

Along with I have purchased 3 policies of same jivananad of 11lac each

Maturity year term 33,34,35

Now what will I have to pay is rs, 130000 premium per year means 370rs per day

At age of 55 in year 2047

I will start getting return, of, 3lac maturity per year till 2054

For 7policies of i lac I buyed for safety of paying next 10 years premium of 130000

As year by year my liability goes on decreasing and at the age of 62 to 65 I get my major part of maturity amount around 16000000 one crore sixty lac

Along with 4000000 sum assured continued for rest of life

So from above example it is true that you can make money to make money for you

You can enjoy a large sum by just paying 370 per day and you will feel you have earned 19000000/35 years=1500 per day

And assume if I die after 5years then in this case also my spouse will get 7500000 as death claim against 650000 paid premium

Whats bad in this

A asset is getting created for you

It is a property of 2 crores which you are buying for 35 year installment

If you make fd of 2000000 Lacs against this policy u will get 135000 interest per year to pay for 35 years

If u buy a flat for 20 lack in 2017 there is no scope of valuation of Flat will be 2 crores

But as I described you are creating a class asset for your beloved easily just investing 10500 per year for 35 years

And too buy a term of 50 Lacs with it

And rest you earn deposit in ppf

Keep in mind if you will survive then only ppf will create corpus for you but in lic your family is insured to a higher extent till 1 crore with term including

And its sufficient if you are earning 100000per Month no problem for investing of 10% in New जीवन anand with rest 90% you go with ppf, mutual funds, equity, gold, lottery, real estate any thing but keep 10%for new jeewan anand it’s a class if you understand it properly and after all if you rely only on term there are more chances of rejecting claims as one thing is sure cheap things just come under warranty but lic brand is guaranteed because in case of demise if your nominee doesn’t get claim then your all hardwork is going to be waste so think and invest take long term and bigger sum assured for least premium

You can assign your policy for taking flat or property it is a legal asset of you

But term never.

I am only hsc passed

But still I have fixed my goals of making 5crores estate by just investing 10000 per month in lic and 10000 per month in ppf for 35 years

I

Thanks for your inputs, Kailas!!!

Always invest in all fields 10%in lic10%in ppf 20%in equity30%inproperty5%in fd5%in gold and 20% cash liquidity for daily need

A huge estate you can create in 35years

Only if u survive

Thanks for inputs, Kailas!!!

Sir,

Could you please give your views on LIC’s new Jana Raksha Plan – 91.

I have been paying since last 12 years and it still needs to be paid for another 8 years.

Thanks,

Chintan

Chintan,

Think the plan has been withdrawn now. So, dont have details.

However, since you have already paid for 12 years, suggest you continue for remaining years.

I want to invest 4000 RS per month for minimum 15 years. Can someone suggest some high returns plans, I am looking for wealth and Medium risk plans. Please suggest some plans

Can’t give exact recommendations.

Since the investment horizon is long term, do consider equity mutual funds too.

Please work with a SEBI RIA.

I am planning to take LIC New Endowment plan 814.

My age is 26, Sum Assured is Rs 2,500,000, term 34 years. It’s showing maturity of Ra 11,705,000. Should I go for it?

Hi Deepesh

Very well put article! I am in a great dilemma. Wish you could help me here.

I have purchased New Endowment 814 plan in 2016 with SA 11,00,000 for 21 years and yearly premium of 50352. I have made payment for two premiums and my 3rd premium is due in June’18.

I am in process of purchasing a 1Cr Aegon iterm Term insurance plan too.

Questions here is, should I also continue with the LIC plan which I have bought or just forgot about it and start investing the same amount somewhere else like PPF/MF/ELSS.

I wish,I could come across this article two years earlier. Decision would have been much simpler then. 🙁

Thanks Amit!!!

Mathematical answer is surrender.

Please understand such questions are always complex. Investors go through articles like these and make up their mind to surrender traditional plans.

At the same time, they have no plans about purchasing term insurance (at least you have) and or about how they will make other investments.

Therefore, it becomes difficult for me to make broad-based statements.

Hi Deepesh I’m 28years old..I have iProtect plan of ICICI with life coverage of 80 lakh till the age 70 with yearly premium 13k.. Recently in 2018 March I purchased retire and Enjoy New endorsement plan 814 as my dad forced me to get retiremental plan which is combination of 8 plans with each one expires after 28yrs to 35yrs…I pay 38k/yr with returns from age 56-63…From 56-62yrs 3lakh and at 63yrs 30lakh with life coverage starting from 12lakh increasing to 36lakh till 56age then decrease to 12lakh….So is it worth to continue or I should stop paying from 2nd year ?..I’m looking for long period investment with stable risk free returns…

Ravikiran,

First, LIC Retire and Enjoy is not a product by LIC.

LIC retire and enjoy is nothing but bundling of multiple endowment plans from LIC.

LIC Agents do this at their level.

Bundling does not improve underlying product any bit.

Since you have paid just one premium, suggest you surrender the plan and forget about the money. Tax benefits, if taken, will be reversed too.

Sir, I have opted for the Endowment Plan 814 for a period of 35years and quarterly premium 13275/-

If i am surrendering the policy after 3 years, will i get the bonus accrued.? F

Dear Aswin,

You will not the entire bonus accrued.

The policy document will have surrender table. You can check there.

Or simply ask your agent or visit LIC branch to find out surrender value.

Is there any guarantee that the interest rate of PPF is going to be same in next 25 years? I am just curious to know because it has been come down to 7.6%.

There is no guarantee.

Then why u giving your stupid suggestions

my premium amount for half yearly 19889 and yearly 39778 and the sum assured is 450000, i have paid 9 * 19889 = 179001. Can you please help, i want to withdraw it now, please confirm me the total amount i get as on today. is any penalty or deductions happen? I could not get the exact amount by using the calulator

Hi Meena,

Please check the exact surrender amount with your agent. He will give you an accurate answer.

Hi Deepesh,

I am 55 yr old. i have taken LIC’s New Endowment Plan (814) in march 2016 for a period of 23 years with an Assured Sum 5 lakhs.I pay premium of 82000/-per year. I was told that the maturity amount would be somewhere around 33 lacs.but now i m not able to pay the monthly installment which is 7200/- so what i can i do now??

The Query related to New endowment Plan 814 – Meena

Hi Deepesh,

I am 55 yr old. i have taken LIC’s New Endowment Plan (814) in march 2016 for a period of 23 years with an Assured Sum 5 lakhs.I pay premium of 82000/-per year. I was told that the maturity amount would be somewhere around 33 lacs.but now i m not able to pay the monthly installment which is 7200/- so what i can i do now??

LIC Endowment plan is the best plan with the highest returns and can give protection for a long term of 35 years. Even an PPF cannot give at least 40% returns compared to LIC Endowment plan.

I request you to check once and twice before commenting or suggesting about an insurance plan. You have only half knowledge. I think, you don’t know current market conditions and future predictions. First know yourself and then comment….

Its True. I also with you sir. Without any total knowledge, pls dont gave any suggestions, it turns a path of investor, who goes with LIC. If you campare with PPF, it also better for investment. But if proposer will not survive or got death at mid term, LIC give him a total S.A. nor in PPF. Also at time of any claim any of the advisor help to complete formality process, but about PPF its goes very hard to take claim. So LIC is better than PPF. Personally my suggestion is every person who want to invest in LIC, first they calculate their actual remaining income, which you want to invest in LIC for Premium, excluding after all expences from net worth monthly income. If planning is better, then your thoughts also been positive and you cant think about surrender.

Sir,

I have enrolled in Lic endowment plan on 2014 and the the agent told me to pay premium for 5 years only. I have not paid premium of Rs.49,000 for the last 2 years. They have asked to renew the policy with Rs.1,04,000. I have so far made payment of Rs.2,50,000 and if I discontinue now, will get Rs.1,90,000.

I don’t need life cover as I am house wife and have interest income on Gifted money from father.

My husband got sufficient life cover.

Please suggest, if I should continue for 11 installment of Rs.49000 or withdraw the amount of Rs.1,90,000 and discontinue the policy.

Sir

I have brought 5 separate endowment plan ,sum assured of all 5 plans together is 10 lacs.Of late I realised that the premium of some of these plans will hv to b paid by me even after retirement…for another 11 years .,which I feel might b difficult. This breakage into 5 separate plan was not my idea but was done by my agent. Pls clarify and suggest

1. Can I merge all the plans into one and pay premium….so that I dont hv to pay premium after my retirement and I get benefit of maturity by the tym I retire.

2 .Or should I surrender the policy

I will retire by 2030 and premium payment of 3 policies is extending up to 2031,34 and 2041.

Pls guide

Sir,

I have enrolled in Lic endowment plan on 2014 and the the agent told me to pay premium for 5 years only. I have not paid premium of Rs.49,000 for the last 2 years. They have asked to renew the policy with Rs.1,04,000. I have so far made payment of Rs.2,50,000 and if I discontinue now, will get Rs.1,90,000.

I don’t need life cover as I am house wife and have interest income on Gifted money from father.

My husband got sufficient life cover.

Please suggest, if I should continue for 11 installment of Rs.49000 or withdraw the amount of Rs.1,90,000 and discontinue the policy.