Affordable housing is one of the major focus areas of the present Government. Pradhan Mantri Awas Yojana (PMAY) was launched in 2015 to promote affordable housing.

Under PMAY, the Government launched Credit Linked Subsidy scheme (CLSS) to provide relief to such buyers who take loan to purchase or construct a house .

Under the scheme, the Government, through its nodal agencies HUDCO and National Housing Bank, will credit the interest subsidy directly to the loan account of beneficiaries.

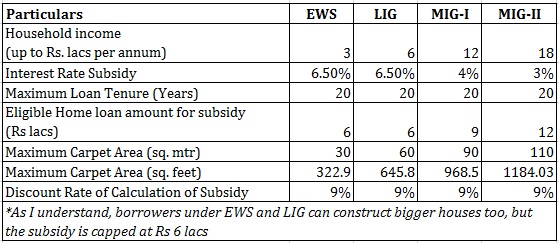

You need to meet eligibility criteria before you get subsidy benefit. The interest subsidy will depend on your income segment.

Let’s look at the fine points of the scheme.

What are the various Income Classifications?

Economically Weaker Section (EWS): Household income up to Rs 3 lacs per annum.

Low Income Group (LIG): Household income above Rs 3 lacs and up to Rs 6 lacs per annum

Middle Income Group-I (MIG-I): Household income above Rs 6 lacs and up to Rs 12 lacs per annum

Middle Income Group-II (MIG-II): Household income above Rs 12 lacs and up to Rs 18 lacs per annum

What constitutes a Household?

As I understand, the household comprises self, spouse and unmarried children.

The adult earning member (irrespective of marital status) can be considered a separate household.

Eligibility criteria

- The applicant must not own a pucca house anywhere in India.

- In case of a married couple, either of the spouse or both together in joint ownership will be eligible for a single house. Therefore, if you are married, then you can’t get subsidy for two houses.

- The applicant must meet the income eligibility criterion too for the household (as mentioned above).

- The applicant (family) must not have availed of central assistance under any housing scheme from Government of India.

- The house should have basic civic infrastructure such as water, sanitation, sewerage, road, electricity.

How is subsidy calculated?

This is slightly complicated. The eligible loan amount is not reduced from the actual loan amount.

Before we move on to exact calculations, here are a few points you must know.

- Your loan amount can be much larger, but the eligible loan amount for calculation of subsidy shall be Rs 6 lacs (EWS or LIG), Rs 9 lacs (for MIG-I) and Rs 12 lacs (MIG-II).

- If the tenure of the loan is greater than 20 years, the subsidy is calculated using tenure of 20 years. Tenure for subsidy calculation shall be Rs lower of (Actual Tenure, 20 years).

Illustration

Suppose you fall in MIG-II bracket with income of Rs 15 lacs per annum. You take a home loan of Rs 35 lacs at rate of 10% p.a. for 25 years. Your home loan EMI will be Rs 33,775.

- Since you fall in MIG-II, loan amount eligible for subsidy will be Rs 12 lacs. This will vary depending upon income segment you fall in. It does not matter if your actual loan amount is much higher at Rs 35 lacs.

- Tenure will be 20 years i.e. lower of (actual tenure, 20 years)

- Interest rate used shall be 3% p.a. (interest subsidy for MIG-II). Again, will vary depending upon income segment.

- Calculate EMI using the aforementioned parameters. EMI can be calculated using PMT formula in MS Excel. EMI comes out to Rs 6,655.

- Calculate interest paid (effectively interest saving) in each month.

- Discount the interest paid every month at 9% p.a.

- Add the discounted amount to arrive at total subsidy amount. This amount will be credited upfront to your loan account.

How did you benefit?

As you can see, the interest subsidy to be credited to loan account is Rs 2.3 lacs, which is a significant amount.

In absence of such subsidy, the loan EMI would have been Rs 33,775 per month.

After adjusting the loan amount for subsidy, the EMI will be Rs 31,554 per month.

That is a neat saving of Rs 2,221 per month. Over the loan tenure, your total savings due to subsidy will be Rs 5.33 lacs (Rs 2,221 X 240)

Do note the saving will change if you move across income groups.

If you were in MIG-I group (income between Rs 6 lacs and Rs 12 lacs), the loan amount eligible for subsidy would have been only Rs 9 lacs but the interest subsidy would have been higher at 4%. The subsidy will be Rs 2.35 lacs.

The EMI saving in that case would have been Rs 2.268 per month. Total saving of Rs 5.44 lacs over the loan tenure.

Points to Note

- The interest subsidy is available only to first time home buyers.

- If you already own a house in India, you will not get any benefit under Credit Linked Subsidy Scheme (CLSS).

- If you are a dual income household, do consider income of your spouse too check your eligibility.

- There is no upper cap on the loan amount. Just that the loan amount eligible for subsidy is capped for various income segments.

- Interest subsidy will be credited upfront to the loan account of the borrower, effectively reducing the home loan amount and the EMI.

- CLSS for MIG is initially implemented for 1 year with effect from January 1, 2017. It may be extended in the future. However, there is no clarity as yet.

- There is mention of preference (under MIG segment) to women (with greater preference to widows and single working women), persons belonging to SC, ST and OBC categories, disabled and trans-genders. In my opinion, this means not all loans may get approved under the scheme. This may depend on availability of budget for the scheme.

How to claim subsidy under Credit Linked Subsidy Scheme?

You need to apply for Housing loan under CLSS at any bank branch.

As I understand, you need to submit declaration that you do not own a pucca house in India. You will also be required to submit income proof. A self-declaration will also do.

Useful Resources

- Subsidy Calculator for EWS/LIG segment

- Subsidy Calculator for MIG-I segment

- Subsidy Calculator for MIG-II segment

- Pradhan Mantri Awas Yojana website

Disclaimer

I have relied on information available in public domain. I have not talked to or interacted with bank officials. Operational reality may be quite different. You are advised to contact your bank branch to understand such operational procedures.