Regular readers of this blog would already know that I have no love lost for traditional life insurance plans. I have written many posts advising readers to stay away from traditional life insurance plans.

In an earlier post, I had reviewed LIC New Jeevan Anand, a participating non-linked endowment plan.

In this post, I will review LIC New Money Back Plan-25 years, a participating non-linked money back plan from LIC.

As the name suggests, under Money back plans, the insurance company gives you some money back at regular intervals even during the premium payment term.

Let’s find out more about LIC New Money Back plan-25 years and see if such a plan can be a fit in your portfolio.

Must Read: Say No to Traditional Life Insurance Plans

How LIC New Money Back Plan-25 years works?

The policy term is 25 years. You pay premium every year for 25 years. You get 15% of Sum Assured at the end of 5th, 10th, 15th and 20th years. Balanced Sum Assured, along with bonuses is paid at the time of maturity.

Survival Benefit (if the policy holder survives the policy term)

You get 15% of the Sum Assured at the end of 5th, 10th, 15th and 20th year.

At the time of maturity of the plan, you get 40% of the Sum Assured along with accrued simple reversionary bonuses and Final Additional Bonus.

Simple reversionary bonus is announced every year by LIC. It is typically expressed in per thousand of Sum Assured. So, if the bonus announced is Rs 30 per thousand of Sum Assured and Sum Assured under your plan is Rs 10 lacs, your bonus is equal to Rs 30,000 (Rs 30 * 10 lacs /1,000).

Do note this is bonus is not paid right away. It merely accrues and does not even earn any interest. The total accrued bonus is paid at the time of maturity of the policy.

Final Additional Bonus (FAB) is announced every year and paid at the time of death or at the time of maturity of the policy. FAB is tricky. If LIC does not announce good FAB in the year your policy is maturing, you simply lose out.

Do note the two bonuses are not fixed and may vary across years.

Death Benefit (if the policy holder dies during the policy term)

The nominee gets 125% of Sum Assured + Vested Simple Reversionary Bonus + Final Additional Bonus.

No deduction is made for the survival benefits already paid. For instance, if the policy holder dies in 12th year, he would have already received 30% of the Sum Assured (15% at the end of 5th year and 15% at the end of 10th year). Death benefit is over and above survival benefits already paid.

You can read policy wordings here.

Benefit Illustration (LIC New Money Back Plan)

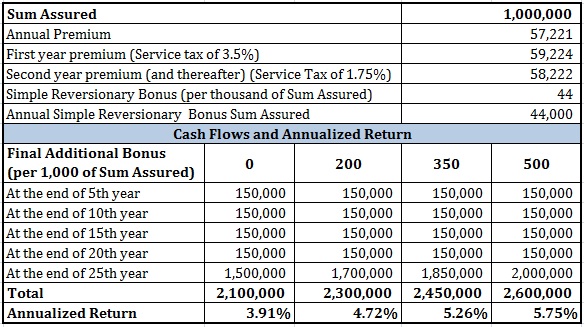

I have considered premium for a 30 year old for Sum Assured of Rs 10 lacs. You can find out the premium for the plan here.

Let’s consider various scenarios if the policy holder survives the term.

As for the values of Simple Reversionary Bonus, LIC has announced bonus of Rs 44 per Rs. 1,000 of Sum Assured for the last six years. So, Rs 44 is a fair assumption. Final Additional Bonus is applicable in the year of maturity (or death) only. Hence, a lot depends on your luck.

I have taken various values of FAB and tried to assess the impact.

For Sum Assured of Rs 10 lacs, you get Rs 1.5 lacs each (Rs 10 lacs * 15%) at the end of 5th, 10th, 15th and 20th year.

The payment at maturity depends on Simple Reversionary Bonuses announced during the policy term and Final Additional Bonus in the year of maturity.

At FAB of Rs 500 (per Rs 1,000 of Sum Assured), you get Rs 4 lacs (40% of Sum Assured) + Rs 11 lacs (Accrued reversionary bonuses Rs 44,000 *25) + Rs 5 lacs (FAB 500 * Rs 10 lacs/ 1000) = Rs 20 lacs

You can see the returns are extremely poor. The safest PPF gives 8.1% at present.

It is one of the reasons I ask investors to stay away from traditional life insurance plans including money back plans. These products provide guaranteed poor returns.

How poor are the returns of LIC New Money Back plan?

For this, let’s try to compare the performance against a combination of term plan and Public Provident Fund.

I consider a term insurance plan of Rs 50 lacs for a 30 year old for a term of 25 years. I have picked up e-Term plan from LIC. Hence, claim settlement ratio of private insurers is no longer a point of concern.

The annual premium is Rs 9,462. That means the remaining amount can go to PPF investment. I assume a return of 8% p.a. on PPF.

If survive the entire 25 years, you will end up with Rs 38.6 lacs in PPF account at the end of 25 years. Annualized return of 6.85% p.a. (premium for term plan reduced the return from 8% to 6.85% p.a.). Still much better than LIC Money Back plan.

You can see return from combination of term plan and PPF easily beats even the most optimistic estimate from LIC Money Back plan.

What about Death Benefit?

You purchase life insurance so that your family is taken care of in case you were not around. In the previous section, we found out that LIC New Money Back Plan – 25 years fared badly if you survive the policy term. What about demise during the policy term? Does the LIC Money Back Plan fare any better in that case?

Let’s find out.

I will compare the scenarios if the policy holder were to die during the policy term. I consider FAB of Rs 500 per Rs 1,000 of Sum Assured in the year of demise.

2,120,000 = 125% of Rs 10 lacs + 44,000 *5 (Reversionary bonus) + 500* 1000 (FAB) + 1.5 lacs (Survival benefit at the end of 5th year)

You can see a simple combination of term plan from LIC and PPF easily outperforms money back plan in every scenario.

Then, why will anyone purchase LIC Money Back plan?

As with any traditional life insurance product, LIC Money Back Plan – 25 years is neither a good insurance product nor a good investment product. Must be strictly avoided.

Then, why will anyone purchase this product?

In my opinion, they fall for the sales pitch. Let’s see how a typical sales pitch for a money back plan goes.

Let’s say you are in 20% tax bracket.

“Sir, you need to pay Rs 59,000 per annum for 25 years. You get tax benefit of 20% on the annual premium under Section 80C. You are paying only Rs 47,000 per annum. And you get Rs 44,000 at the end of the year. So, effectively, you are paying only Rs 3,000 per annum.

And you get an additional Rs 1.5 lacs at the end of 5th, 10th, 15th and 20th year. At the end of 25th year, you will get Rs 9.5 lacs.”

If the product were like that, the return is a cool 16.8% p.a. (even without considering tax benefit).

Wow!!! Could there be a better plan?

We know there is a catch. And what’s that?

You are given the impression that you will get Rs 44,000 every year. In reality, you will get this Rs 44,000 only at the end of 25 years. Is Rs 44,000 today same as Rs 44,000 after 25 years? Of course not.

Moreover, Rs 44,000 merely accrues and does not even earn you any interest.

And therein lies the problem, which most investors tend to overlook.

I do concede it is not right on my part to paint everyone with the same brush. A salesperson cannot turn a bad product into a good product. He/she can only make a bad product appear good. And that’s what insurance agents do.

PersonalFinancePlan Take

This is not a commentary on LIC New Money Back plan alone. I have nothing against LIC. All money back plans (from LIC or private insurers) are equally bad and must be strictly avoided.

In general, traditional life insurance plans provide low life cover and guaranteed poor returns.

The decision is yours.

Still planning to purchase a money back plan?

Let me know your inputs in the comments section.