Consider giving your equity investments a longer rope. Data suggests 7-year and 10-year investment horizon and SIP tenure increase chances of “good” returns. Longer is better. With shorter durations, you are leaving a lot to chance. Additionally, the performance of the small cap index fails to impress.

Equity investments do well over the long term. We read and hear this all the time. Don’t we?

Fine. Equity investments have indeed done well in India over the long term.

However, there is still one question that we must answer.

For equity investments, how long is long term?

As per tax laws, a holding period over 1 year is long term.

Then, should you expect to earn good return within 12 months? Or you need to give yourself a longer rope. Again, how long? 3-year, 5-year or even 10-years?

What should be your investment horizon so that “Equity investments do well” materializes for you?

If you are lucky, even a few days or a few months of holding period can do wonders. But you don’t want to bank just on your good fortune. A responsible investor would want to understand what has worked in the past and accordingly decide the investment horizon.

Or let’s think of a more practical problem: You want to invest money for 3 years. If the odds of earning good returns in equity markets are not very high for a 3-year investment horizon, you would be wary of investing that money into stocks.

As an investor, you want to work with an investment horizon where your odds of earning good returns are higher. No guarantee. Just better odds.

Looking at the past data also helps set your expectations right. Many investors struggle in the equity markets because they have irrational return expectations. If you want to double your money in just 6 months and the odds of that happening are 0.5% (just saying), then you are preparing yourself for disappointment. To stick to investment discipline, it is extremely important to get the expectations right. And looking at the past performance can help on this front.

In this post, we will try to do exactly that. Look at the data and figure out the investment horizon and SIP tenure where your chances of earning good returns are higher.

Which Equity indices should we consider?

Nifty 50 is the bellwether index. Hence, if I had to pick up just one index for this analysis, I would have picked up Nifty 50 TRI.

However, as investors, we have preferences for different kinds of stocks. Therefore, I have included Nifty Next 50, midcap and small cap indices too in this analysis.

In this post, we look at rolling returns for the following indices since inception until July 2022.

- Nifty 50 TRI (since July 1999)

- Nifty Next 50 TRI (since November 2002)

- Nifty Midcap 150 TRI (since April 2005)

- Nifty Smallcap 250 TRI (since April 2005)

To reduce my work, I have considered only the monthly data for each of the above indices.

Rolling returns are a more reliable indicator of long-term performance since these don’t suffer from start-point bias. And we look at the two types of rolling returns.

- P2P (Point-to-Point) Rolling returns (more suited for analyzing the performance of lumpsum investments)

- SIP Rolling returns (for analyzing the performance of SIPs for various durations)

What are Rolling returns?

In the P2P rolling returns chart, each point on the 1-year rolling returns chart represents the return from the investment made exactly 1 year earlier. Similarly, each point on the 3-year rolling chart reflects the performance of the investment made exactly 3 years earlier.

1-year rolling returns (as on June 30, 2022): Represents the returns from the investment made on July 1, 2021.

3-year rolling returns (as on June 30, 2022): Represents the returns (CAGR) from the investment made on July 1, 2019.

In the SIP rolling returns chart, each point on the 3-year rolling returns plot represent the returns for the SIP that started 3 years back.

For instance, 3-year SIP rolling returns (as on June 30, 2022): represents the returns from a SIP that started 3 years back. 36 SIP installments. Invested on last day of each month. First installment on June 30, 2019. Last installment on May 31, 2022. Portfolio value as on June 30, 2022.

What is a good return to expect from equity markets?

This is very subjective.

But I am sure most of us want to do much better than a bank fixed deposit.

Why?

What’s the point of taking risk if you don’t do better than a bank fixed deposit?

Given that the bank FD rates have mostly ranged between 6-8% p.a. over the last couple of decades, I would want to earn at least 10% p.a. from my equity investments to compensate for the additional risk (compared to bank FDs). If your target “good” return is different, you can view the analysis in that light.

Here is how I have defined various return ranges (and you don’t have to agree).

Clearly, you would want to earn “Good”, Very Good” or “Excellent” returns.

Moreover, from the perspective of deciding investment horizon, there should be 80% chance of “good” returns.

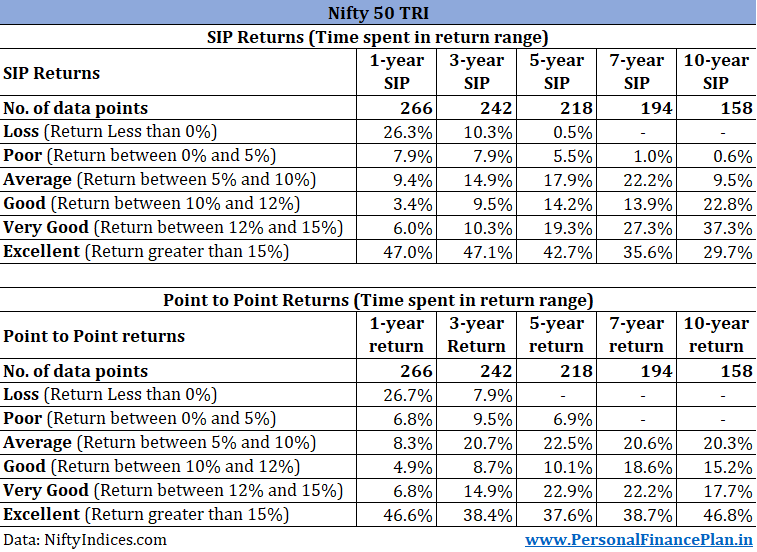

Nifty 50 TRI

As you can see, the 1-year performance is like toss of a coin. The patterns emerge when we increase the investment or SIP duration.

The chances of earning good (very good returns or excellent) returns improves with the duration of investment.

For P2P returns (lumpsum investment), if the investment horizon is 7 or 10 years, the returns have exceeded 10% p.a. approximately 80% of the time. No instance of loss or poor returns either.

For SIPs, a 10-year SIP has 90% chance of delivering more than 10% p.a. For 5-year and 7-year SIP, the probability drops to 76% and 77% respectively.

So, if you are looking to invest in Nifty 50, have an investment horizon of at least 7-10 years for better chances of earning “good” returns. Note that, irrespective of the tenure you choose, there is no guarantee of good returns with equity investments.

I could have looked at a longer tenure (say 12 and 15 years) too but then the number of data points would have reduced.

Nifty Next 50 TRI

The performance is quite impressive here. Just looking at returns and not volatility.

For a lumpsum investment for 10-year period, the chances of “Good” returns are 94%. Almost 90% chance of earning over 12% p.a. for a 10-year investment horizon.

For 7-year lumpsum: ~92% chance of “good” returns. ~80% chance of “Very good” returns.

For 10-year SIP: 97% chance of earning of “Good returns”. ~92% chance of earning “Very Good” returns.

For 7-year SIP: 86% chance of good returns. 73% chance of “very good” returns.

Again, if investing in Nifty Next 50, you should brace for at least 7-10 years. The longer, the better.

Nifty Midcap 150 Index

From the returns point of view, the performance is as good or even better than the Nifty Next 50 index.

Nifty SmallCap 250 Index

The performance of Nifty Smallcap 250 index is much worse compared to Nifty 50, Nifty Next 50 and the midcap indices.

7-year SIP has ~38% chances of resulting in loss, poor or average returns. Even for 10-year SIP, the number stands at 20%.

For lumpsum investments, there is 30% chance of loss, poor or average returns for investment horizon of 7 or 10 years. 35% chance of <10% returns if the investment duration is 5 years.

The return performance of Nifty Smallcap 250 index fund does not inspire much confidence. You are better off sticking with midcap index.

If you are keen to invest in small caps, you have 3 options.

- You need lots of luck. Happen to enter/exit at the right time.

- You need to figure out a strategy to enter or exit at the right time. Can you pull this off?

- Consider an actively managed small cap fund. That has its own set of risks.

When I say that investing in a small cap index is not a good idea, I am referring to only Nifty Smallcap 250 index. Other small cap indices (or factor based small cap indices) may have a different methodology and the outcome may be different.

Performance Comparison of various indices

What does all this mean?

If you are looking to invest in equities by way of lumpsum or SIPs, give yourself a longer rope. At least 7 to 10 years. Longer is better. If your investment horizon is shorter, you are leaving a lot to chance.

The results (chances of good returns) improve secularly with time.

Nifty Next 50 delivers the most impressive performance.

The performance of the smallcap index is the most pathetic. Lower average returns. Lower chances of good returns. And we know small cap stocks are more volatile too.

The Caveats and the Points to Note

- This analysis is only for a Buy-and-Hold investor. If you are a skilled trader and can time your entry/exits well, this analysis may not be relevant for you.

- Do remember that timing the market is a double-edged sword. No one gets it right all the time. However, if you get it right more often and size your trades properly, you will outperform Buy-and-hold investors. On the other hand, if you don’t, you will underperform a simple Buy-and-hold approach. The problem is when you think you belong in the first category, but your results place you in the second category.

- Additionally, I have considered broad-based diversified indices in this analysis. This approach may again not be very relevant if you plan to take concentrated bets and invest in specific stocks.

- Past performance does not guarantee future performance. Therefore, take any set of back test results with a bucketful of salt. This analysis is no different.

- We have a much longer history for Nifty 50 index compared to other indices. Nifty 50 TRI data is available since June 1999. Nifty Next 50 from November 2022. Nifty Midcap 150 and Nifty Smallcap 250 from April 2005. Hence, we have different number of data points for these indices.

- For the Midcap and Smallcap indices, the data won’t show the full impact of bull run from 2004 to 2007. You need to analyze performance in that light. However, both midcap and small cap indices faced this limitation. And the midcap index has done much better than the small cap index.

- I have considered the Total Return indices (TRI) for this analysis. The index funds tracking these indices will have tracking error. And you can expect tracking error to be higher as you move down the market cap. Hence, small cap index funds will likely have a much higher tracking error/difference than Nifty 50 index funds.

- In this post, I have focused only on returns. But the performance is not just returns. What about volatility and the risk-adjusted returns? Since the post was about the returns, I have not considered those aspects. For such aspects, refer to this performance comparison of cap-based and factor indices.

I have also prepared a video presentation on this topic where I discuss all the above aspects in great detail. Do check out.

Data Source: NiftyIndices.com

Featured Image Credit: Unsplash