Quality healthcare is getting expensive with each passing day. And it is important to buy adequate health coverage to have some cushion against the rising health care costs.

However, buying health insurance is not easy.

Why? Because the insured event is not very objective.

Contrast this with life insurance. There is just one insured event. The demise of the policyholder. And it is an objective one too. If the policyholder has passed away, the insurance company must pay. There is no confusion about whether the policyholder is dead or alive. And all the plans cover the same insured event. You can just go with the cheapest life insurance plan (do look at the claim settlements too).

In health insurance, there are tons of insured events. There is always an element of subjectivity involved. You can’t be sure whether a particular treatment is covered unless you check with the insurer.

There are multiple variants. Individual, family floater, top-up and Super top-up plans. Moreover, different policies offer different coverage. For instance, Policy 1 covers procedure X and not Y. Policy 2 covers procedure Y and not X. There are waiting periods, sub-limits, co-payment clauses, disease-wise capping, no-claim bonus, restore benefits and many more. And plans will vary on these parameters too. Not just that, each company has 5 different plans. Different coverage and premiums.

This makes choosing a health insurance plan difficult. You can’t just go by the lowest premium. You must understand the coverage and features of the plan to understand whether this is right fit for you.

In this post, we look at a critical parameter that you must consider before buying a health insurance plan. Room-rent sublimit. If you get this wrong, your insurer will not reimburse/cover the full cost of treatment even if the treatment is covered under the plan.

What are Sub-limits?

As the name suggests, within the overall Sum Insured, the insurance company covers a particular expense only up to a certain limit. For instance, even though the Sum Insured is Rs 5 lacs, the policy may cover treatment for a certain illness only to the extent of Rs 50,000. If you incur Rs 65,000 on hospitalization for such illness or procedure, you will have to pay Rs 15,000 from your own pocket.

Sub-limits can be structured in any way. There is no specific IRDA guideline on the matter. You must read the terms and conditions of the health cover plan to understand if there are any sub-limits in the plan. With these sub-limits, the insurer can limit its liability to a certain extent.

Therefore, health insurance plans with sub-limits are likely to be cheaper than those without any sub-limits.

One of the most important sub-limits in a health insurance plan is the cap on room rent. With this cap, the insurance company caps its liability on room rent per day.

Peculiar nature of hospital charges

Hospital charges are linked to the type of room you have taken. Doctor’s visit to a shared room will cost you Rs 1,000. However, if you have taken a private room, visit by the same doctor will be charged at say Rs 2,000 per visit. It makes no sense but that’s the way it is.

A simple X-ray that costs Rs 500 for a shared room may cost Rs 1,000 if you have taken private room. You have to go to the same X-ray room and stand before the same machine but the charges are different.

In other words, the hospitals charge you on the basis of your ability to pay.

And what better indicator of your payment ability than the room you have chosen to stay in!

From your perspective, your coverage will deplete fast if you are staying in an expensive room. And you can’t ignore that if your treatment is prolonged.

How does this affect your insurance claim?

Since the charges are linked to the type of room or the room rent, your medical bill for the same treatment goes higher if you choose better accommodation.

If your health coverage is without sub-limits, there is not much insurer can do. It will have to pay for all the covered expenses.

However, if your insurance plan has sub-limits, be prepared for a surprise. In this case, if the room rent per day exceeds the prescribed sub-limits (cap), the insurance will pay charges only in the proportion of rent sub-limit to actual rent.

Suppose room rent cap (or sub-limit) in your health plan is Rs 3,000 per day and the actual room rent is Rs 7,000. You get hospitalized for 4 days and run up a bill of Rs 1 lac. You might feel that insurance company will pay everything apart from excess room rent i.e. Rs 1 lacs – 4, 000 * 4 days = Rs 84,000. Well, that’s not the case.

The reimbursed amount will only be Rs 1 lacs * 3000/7000 = Rs 42,857. Even though you had total cover of Rs 5 lacs, it does not matter since the reimbursed amount will be in proportion of sub-limit and actual room rent. This will certainly come as a shock to someone who is not aware.

Typically, this is done for hospital services. Medicines are reimbursed at MRP irrespective of the room rent.

Illustration

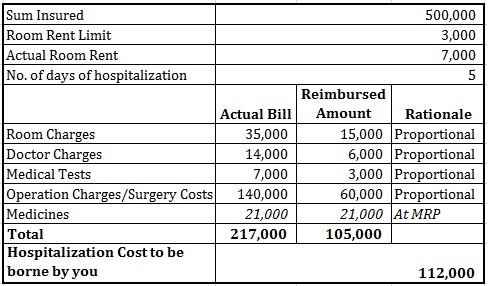

Please note that the cost for medicines to be reimbursed is same as the actual cost. You have to pay Rs 1.12 lacs from your own pocket.

Please note that the cost for medicines to be reimbursed is the same as the actual cost. You have to pay Rs 1.12 lacs from your own pocket.

What should you do?

Avoid purchasing health insurance plans with room-rent sublimit, especially if you are living in bigger cities.

Health insurance plans from public insurers (National, Oriental, United) tend to have room-rent sublimit. Usually daily room rent is capped at 1% of the Sum Insured. For ICU, it is 2% of the Sum Assured.

If you already have a plan with room rent sub-limit, you can port to a new plan without sub-limits while retaining continuity benefits (waiting period).

However, not everyone can afford a health insurance plan without sub-limits. In that case, you can purchase a plan with sub-limits. Before finalizing the plan, try to get an idea of room rents in the hospitals in the vicinity or those hospitals where you would like to get treated. Subsequently, pick up a plan where room rent cap is enough for taking a room of choice at those hospitals.

Sometimes, your hand may even be forced. Even though you want to go for a shared or a cheaper room, it may not be available. In that case, you will have to pick a private room or take treatment in another hospital. In case of emergency, that is not an option. You take whatever is available.

So, if you can afford, pick up a plan without sub-limits. If you can’t, be aware and be prepared.

Other posts on Health Insurance Plans

Tax Benefits for Purchasing a Health Insurance Plan

Use this smart Health Insurance Strategy to get higher cover at a lower premium

How claim is settled if you have two Health Insurance Policies?

Individual Health Insurance Plan Vs. Family Floater

What are Top-up and Super Top-up Health Insurance Plans?

How Health Insurance Companies can easily trick customers?

Health insurance plans you must avoid

Top 10 Exclusions under your Health Insurance Plans

Should you purchase Critical Illness Plans?

Should you purchase a Health Insurance Plan with Maternity Benefits?

Should you purchase a Health Insurance Plan with Restore/Refill Benefit?

What is a Hospital Cash Insurance Plan?

Featured Image Credit: Unsplash

The post was first published in November 2015 and has been updated since.