If you are a value investor, your investment philosophy must be to buy beaten-down stocks that are trading below their value. However, not everyone thinks alike. There is another school of thought that does not bother about struggling stocks. Quite the reverse in fact.

Welcome to the world of Momentum investing. The motto: Buy High and Sell Higher. The practitioners of momentum investing buy stocks that have been rising and hitting all-time highs. To value investors, this is blasphemy. Fair enough. You cannot agree with everyone and not everyone can agree with you.

What does the data tell us?

In this post, we will compare the performance of the Momentum portfolio against Nifty 50, Nifty Next 50, and Nifty Midcap 150. For the momentum portfolio, we shall use the S&P BSE Momentum Index TRI. Let us try to understand if momentum investing works in India.

Over the past few months, we have tested various investment strategies or ideas and compared the performance against the Buy-and-Hold Nifty 50 portfolio. In some of the previous posts, we have:

- Assessed whether adding an International Equity Fund and Gold to an Equity portfolio has improved returns and reduced volatility.

- Considered the data for the past 20 years to see if the Price-Earnings (PE) multiple tells us anything about the prospective returns. It does or at least has in the past.

- Tested a momentum strategy to shift between Nifty 50 and a liquid fund and compared the performance against a simple 50:50 annual rebalanced portfolio of Nifty index fund and liquid fund.

- Used a Simple Moving Average Based Market Entry and Exit Strategy and compared the performance against Buy-and-Hold Nifty 50 over the last two decades.

- Compared the performance of Nifty Next 50 against Nifty 50 over the last two decades.

- Compared the performance of Nifty 50 Equal Weight vs Nifty 50 vs Nifty 50 over the last 20 years.

- Compared the performance of 2 popular balanced funds against a simple combination of an index fund and a liquid fund.

- Compared the performance of a popular dynamic asset allocation fund (Balanced advantage fund) against an equity index fund and see if it has been able to provide reasonable returns at low volatility.

How stocks are selected in the S&P BSE Momentum Index?

The basis of Momentum investing is that the stocks that are rising keep on rising for some time. And vice-versa. The intent is to ride onto such stocks as long as they keep rising or until you can find better momentum stocks. I understand this is in stark contrast to how many of us think.

Conventional investment approach is is Buy Low and Sell High.

Momentum investing is: Buy High and Sell Higher.

For the momentum index, S&P calculates momentum value as the price performance of the last 12 months, excluding the most recent month. The momentum score is divided by the stock’s volatility (standard deviation) to arrive at a risk-adjusted momentum value. This ensures that more volatile stocks get lower scores. Thus, even in a momentum portfolio, the preference is towards stocks that have had a smoother rise. Subsequently, certain statistical procedures (Z-score calculation and Winsorization) are performed to reduce the impact of outliers.

You can read about the methodology in detail on S&P website.

The index is rebalanced every 6 months.

Now, the important question: Does momentum investing work in India?

Performance Comparison: S&P BSE Momentum Index

We will use the following 4 indices for performance comparison.

- Nifty 50 TRI (Total Returns index)

- Nifty Next 50 TRI

- Nifty Midcap 150 TRI

- S&P BSE Momentum index TRI

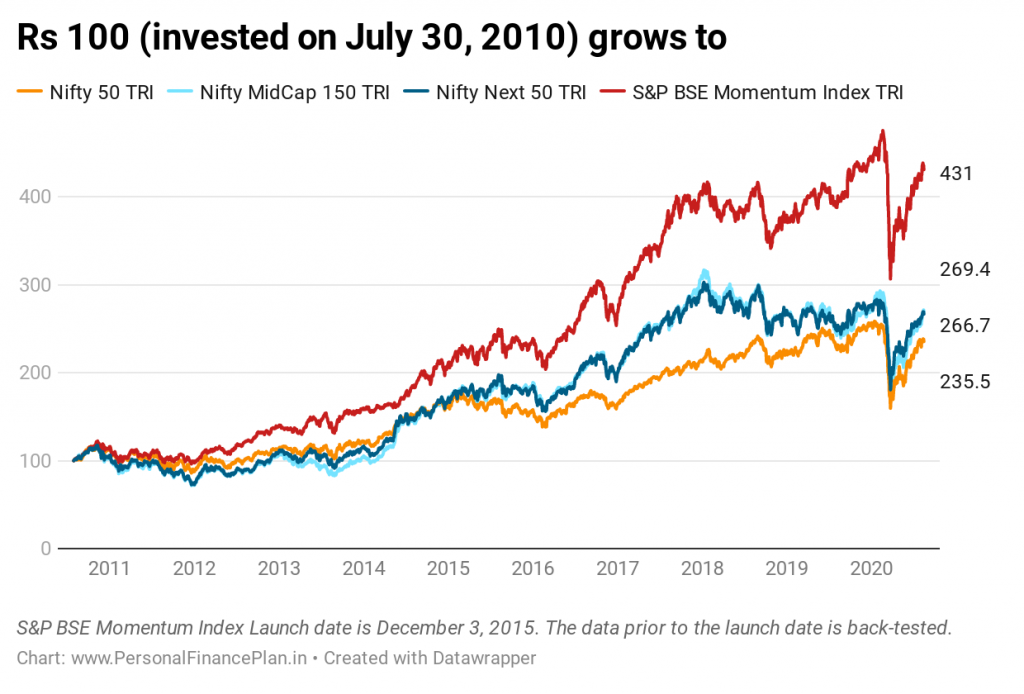

I compare the performance for the last 10 years since July 30, 2010.

Note that S&P BSE Momentum Index was launched in December 2015. In this post, we are comparing performance over the past 10 years. Hence, the data before December 3, 2015 is backtested.

You cannot expect S&P to launch indices based on a methodology that has NOT worked in the past. Indices will be launched around strategies that have been successful in the past. Hence, in this post, you must consider the performance before December 3, 2015 with a pinch of salt.

I copy this excerpt about S&P BSE Momentum index from S&P website.

The index Launch Date is Dec 03, 2015. All information for an index prior to its Launch Date is backtested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back-tested returns

The Results: Does Momentum Investing work in India?

Does the Momentum index deliver superior performance, better returns, or lower volatility or both?

Let us find out.

You can see the S&P Momentum index has delivered the highest performance. Since July 30, 2010 (until August 14, 2020), the Momentum Index has delivered CAGR of 15.66% p.a.

Nifty 50 TRI: 8.9% p.a.

Nifty Next 50 TRI: 10.26% p.a.

Nifty Midcap 150 TRI: 10.37% p.a.

Since the Momentum index was launched only in December 2015, let us compare the performance since its launch.

The Momentum index wins again.

Since December 3, 2015, the S&P BSE Momentum index has returned 14.05% p.a.

Nifty 50 TRI: 9.18% p.a.

Nifty Next 50 TRI: 8.63% p.a.

Nifty Midcap 150 TRI: 8.32% p.a.

The Calendar Year Performance

The S&P BSE Momentum index has beaten Nifty 50 TRI in 9 out of 11 years. It has lost out only in 2014 (only marginally) and 2018.

The Momentum index has beaten Nifty Next 50 TRI in 9 out of 11 years. Lost out in 2012 and 2014.

The S&P Momentum index has beaten Nifty Midcap 150 TRI in 8 out of 11 years. Lagged in 2012, 2014 and 2017.

Quite consistent.

Performance Comparison: Rolling Returns

After an impressive performance in the calendar years, you would expect this. Look at 3-year rolling returns. The S&P BSE Momentum index is at the top almost the entire time.

What about Volatility and drawdowns in the S&P BSE Momentum Index?

This is important. We can see BSE Momentum index has delivered far superior returns than the common market-cap based indices. However, given how the stocks are selected in the momentum index (the stocks with the best price-performance are picked), you would expect that the Momentum portfolio will be more volatile. You would also expect higher drawdowns.

Let us see what the data tells us.

That is right to an extent. Since the index launch (December 2015), the index is more volatile than Nifty 50 TRI, but in line with Nifty Next 50 and Nifty Midcap 150 indices.

At the same time, it is not too volatile either in comparison to Nifty 50 TRI. Note that the S&P BSE Momentum Index construction considers the volatility of stocks. Higher price volatility reduces the chances of selection in the momentum index.

I considered data for 3 years in the above chart. Hence, for the data based on actual performance, you need to look at data beyond 2018 in the chart.

The Momentum portfolio does very well, presumably because it does not hang on to the losers.

If you look at the overall performance, S&P BSE Momentum has been a winner over the past 10 years. Far superior returns at a slightly higher volatility. Lower drawdowns too. Momentum investing (the way S&P has implemented it and for the period considered) seems to work in India.

The Caveats

- The past performance may not repeat.

- Nothing works all the time. The Momentum index looks like the winner over the last 10 years. For the next 10 years, there may be reversal of fortunes/

- The actual data is available for less than 5 years. Not enough to reach a meaningful comparison.

- There are no index funds available to track the Momentum index. Hence, there is no simple way to take exposure to this index or Momentum strategy. In India, the AMC industry is controlled by active fund providers. So, do not expect them to launch an index fund that tracks the momentum index any time soon.

- By the way, we do not know how easy or difficult will it be to track the Momentum index. Or how the wider adoption of the index will affect returns? For all you know, the tracking error may be high.

- There are PMS (portfolio management schemes) that may offer this strategy, but the cost structure can be different and can eat into the returns. A few RIAs have launched their Smallcases modelled on momentum strategy. Interested investors can pay fee and sign up. Do note momentum strategy can be implemented in many ways. There is no guarantee that they are following the methodology used by S&P to construct their momentum portfolios. Hence, the performance of their momentum portfolios can be quite different from S&P BSE Momentum index.

- For instance, S&P BSE Momentum index is rebalanced every 6 months. That makes sense from the perspective of an index provider. From the perspective of potential license buyers (S&P customers), this helps reduce turnover, costs and perhaps also build scale. On the other hand, from what I have seen, practitioners (or a few I know) rebalance portfolios on a weekly or a monthly basis. The weighting scheme can be different. This can result in widely different results.

Where does the Momentum Portfolio find a place in your portfolio?

In my opinion, if you must invest in the Momentum stocks, make it a part of your satellite equity portfolio.

Let us say your core equity portfolio is built around large-cap index funds or large-cap active funds and let us assume core portfolio is 60% of your equity portfolio. The remainder 40% can be your satellite portfolio. You can use the momentum portfolio in your satellite portfolio. You can allocate some money from your satellite portfolio towards momentum stocks.

Disclosure: I invest in a portfolio of momentum stocks.

Additional Links/Resources

S&P BSE Factor Indices Methodology

S&P BSE Momentum Index (Data Source)

S&P Dow Jones Indices: How Do Single Factors perform in Different market regimes in India?

Quantitative Momentum (Wes Gray and Jack Vogel)