In one of the earlier posts, I discussed taxation of short term capital gains for various asset classes. In this post, we focus on taxation of long term capital gains.

As mentioned in the aforesaid post, if you hold a capital asset for more than 36 months, it gets classified as long term capital asset. Any gains/loss arising out of sale of such asset is treated as long term capital gain.

For a few capital assets such as equity, equity mutual funds, listed bonds and debentures etc, the holding period requirement is only 12 months. Hence, you need to hold these assets only for a period of 12 months for them to be classified as long term capital assets.

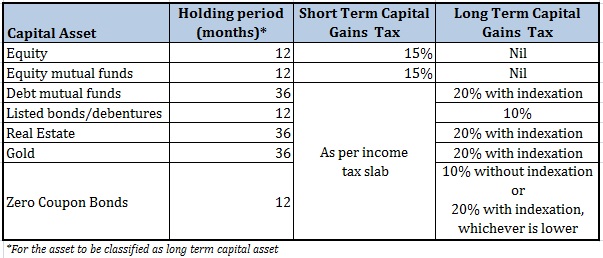

Tax treatment of Long Term Capital Gains

Long term capital gains tax varies based on the type of capital asset.

Generally, Long term Capital gains are taxed at 20% with indexation. Assets such as real estate, gold and debt mutual funds fall under this category. Gold ETFs and gold mutual funds also fall under the same category.

However, there are a few exceptions.

- For listed bonds and debentures, long term capital gains are taxed at 10%. There is no benefit of indexation available for such securities.

- For equity and equity funds, which have been sold on recognised stock exchanges and STT has been paid; the long term capital gains are exempt from tax.

- For some assets such as zero coupon bonds and select listed securities, you have an option to select between two rates. Flat 10% without indexation or 20% with indexation. You can choose which gets you a lower tax liability.

Surcharge and cess shall be charged, as applicable. I have not used surcharge and cess for calculating total tax liability in this post.

Long Term Capital Gains Tax Rates

What is Indexation? How is Long Term Capital Gain calculated?

Indexation is rise in cost of the asset due to inflation. The Central Government notifies cost inflation index every year. The idea behind giving indexation benefit is that you are not penalised (taxed) for the rise in value of the asset due to inflation. You are taxed for gains over and above inflation.

You can check the cost inflation index here.

The benefit of indexation is available to only long term capital assets.

Long Term Capital Gain is calculated as

Full value of Sales Consideration – Expenditure related to sale of asset – Indexed Cost of acquisition – Indexed cost of improvement, if any

Indexed cost of Acquisition equals Cost of acquisition X (Cost of inflation index of the year of transfer of capital asset/Cost of inflation index of the year of acquisition)

Indexed cost of Improvement equals Cost of Improvement X (Cost of inflation index of the year of transfer of capital asset/Cost of inflation index of the year of Improvement)

Please understand indexed cost of acquisition or indexed cost of improvement shall be used only for assets, where indexation is allowed.

Illustration 1 (Real Estate)

You purchased a residential property in the May 2005 for Rs 20 lacs. You spent Rs 10 lacs in June 2007 to add a floor to the house. You sold the house in June 2014 for Rs 80 lacs.

Cost inflation index for the year 2005 -2006 is 497. Cost inflation index for the year 2007-2008 is 551. Cost inflation index for the year 2014-2015 is 1024.

You held the residential house for 108 months, which is more than 36 months for the real estate investment to be classified as long term capital asset. Hence, long term capital gain needs to be calculated and taxed at 20% after allowing for indexation.

The long term capital gain is equal to Rs 20.2 lacs. The gains will be taxed at 20%. Total tax liability comes out to Rs 4.04 lacs. Please note we have already taken indexation into account while calculating long term capital gains.

Illustration 2 (Stock Markets)

Suppose you purchased 100 shares of Reliance Industries on June 5 2013 for Rs 800 per share. You sold those 100 shares on July 8, 2014 at Rs 950 per share.

You held the stocks for more than 12 months, which qualify the stocks to be a long term capital asset.

Let’s ignore the brokerage and other transaction costs. However, do remember to add brokerage and other transaction costs (except STT) to cost of acquisition and deduct brokerage and transaction cost (except STT) from sales consideration.

Ignoring the transaction costs, the long term capital gain comes out to Rs 15,000.

As per Section 10(38) of the Income Tax Act, long term capital gains on equity and equity mutual funds are exempt from tax.

Hence, your tax liability will be Nil.

Illustration 3 (Tax-free bonds)

You purchased 100 tax-free bonds of NHAI on July 10, 2012 at Rs 1,200 each. NHAI bonds are listed on stock exchanges. You sold the bonds on stock market on August 12, 2014 for Rs 1,400.

For listed bonds, you need to hold the bonds for over 12 months for the bonds to be classified as long term capital asset.

Since you held the stocks for over 24 months, the bonds will be qualified as a long term capital asset.

As per Section 48 and Section 112, long term capital gain on listed bonds and debentures is taxed at 10%. Indexation benefit is not available for such bonds.

Ignoring adjustments for transaction costs and brokerage, LTCG comes out to Rs 20,000.

At 10% tax, long term capital gains tax comes out to Rs 2,000.

Long Term Capital Gains Tax rate is irrespective of your income tax slab

It does not matter whether you fall in the highest or the lowest income tax bracket.

You will be taxed at LTCG tax rate for long term capital gains. As discussed above, applicable LTCG tax rate will depend on type of asset.

Adjustment of LTCG against basic tax exemption limit

Basic tax exemption limit refers to the level of income up to which the taxpayer is not required to pay any tax.

The basic tax exemption limit is Rs 5 lacs (for resident 80 years and above), Rs 3 lacs (between 60 and 80) and Rs 2.5 lacs (below 60). For NRIs, the tax exemption limit is Rs 2.5 lacs irrespective of their age.

Adjustment against basic tax exemption limit depends on taxpayer’s residential status.

Residents are allowed to adjust LTCG by the amount their total income (excluding LTCG) falls short of basic tax exemption limit. So, if your total income is Rs 1.5 lacs and LTCG for the year is Rs 3 lacs, you will have to pay LTCG tax only on Rs 2 lacs. (Rs 3 lacs – (Rs 2.5 lacs – Rs 1.5 lacs))

Non-resident Indians (NRIs) cannot avail this tax benefit.

Deduction under 80C to 80U for Long Term Capital Gains

The treatment is same as for STCG for equity shares/equity mutual fund units (as defined under Section 111A).

No deduction under Section 80C to 80U is allowed for Long Term Capital Gains (LTCG). This applies to both residents and non-residents (NRIs).

If you make LTCG of 8 lacs in a financial year (and there is no other income) and invest Rs 50,000 in PPF, your LTCG will adjusted by Rs 2.5 lacs since your total income excluding LTCG falls short of basic tax exemption limit. You will have to pay long term capital gains tax on Rs 5.5 lacs. There will be no tax benefit for investment in PPF.

What if I incur Long Term Capital Loss (LTCL)?

You can use such loss to set off LTCG on any other capital asset during the same financial year.

For example, LTCL on real estate can be used to set off LTCG on gold.

Please note LTCL can be used to set off only long term capital gains. On the other hand, STCL (short term capital loss) could be set off against both STCG and LTCG.

In case, you do not have enough LTCG to set off against the loss, you can carry forward loss for 8 subsequent years. You need to file income tax return on time to carry forward the loss.

Long Term Capital Loss cannot be set off if Long Term Capital Gains tax is Nil

For assets such as equity and equity mutual funds, long term capital gains are exempt from tax. For such assets, it is understood the long term capital loss arising out of sale of equity and equity mutual funds cannot be used to set off against any Long Term capital gains.

Thus, LTCL due to sale of equity shares cannot set off LTCG on sale of residential property or gold or debt mutual funds. You will anyways not need to set off LTCG on equity shares since those are tax-exempt.

A Mumbai tribunal recently ruled against this treatment. The tribunal allowed adjustment of long term capital losses on equity shares. However, more clarity is awaited on this matter.

Exemption for Capital Gains Arising out of sale of Residential Property

For the Long Term Capital Gains arising out of sale of residential property, there is some relief under Section 54 of the Income Tax Act.

The benefit is only in case of long term capital asset (or gains). There is no such relief for Short Term Capital gains on sale of residential property i.e. no relief shall be available if you sell the residential property before completion of 3 years from the date of purchase.

You can avoid paying long term capital gains tax on sale of residential property if:

- You purchase a residential property within a period of 1 year before or 2 years after the sale of such residential property; or

- You construct a residential property within a period of three years from the date of sale of residential property

There are other sub-conditions to be met before you avail this relief. I will discuss the exemption under Section 54 in a subsequent post.

To Sum up

Long term capital gains get favourable tax treatment as compared to short term capital gains. Holding a capital asset for the long term can decrease your tax liability, especially for those who fall in the higher tax brackets. Do consider this aspect while making your investment decisions.

Additional Reading: You can also refer to Long term capital gains tutorial available on Income Tax website. You can download the tutorial from here.

Image Credit: Simon Cunningham, 2013. The original image and information about usage rights can be downloaded from Flickr / Lendingmemo

Disclaimer: I am not a tax expert. This is a simplistic description of income tax laws. The exact rules may have multiple sub-conditions. It is not possible to include all sub-conditions in this short post. You are advised to consult a tax consultant to understand your tax liability better.

Deepesh is a SEBI registered Investment Adviser and Founder, PersonalFinancePlan.in

23 thoughts on “Capital Gains Tax Simplified: Part II – Long Term Capital Gains Tax”

It is surely another one in the series of really useful articles, Deepesh. Thanks for sharing your knowledge and insight. We will wait for the next one on “Section 54 demystified”.

Thanks!!! Btw, I have already written the post on Section 54 here. You can read the following post http://www.personalfinanceplan.in/financial-planning/how-to-save-tax-on-gains-from-sale-of-house/

Thanks for the post. Very useful like the one on STCG

Thanks Rohan!!!

REQUEST ADVICE ON CAPITAL GAIN TAX ON COMMERCIAL PROPERTY’S ACQUIRED BY THE GOVT OF TELANGANA FOR HYDERABAD METRO RAIL PROJECT -UNDER NEW LAND ACT 2013. [THIS ACT UNDER SEC 97 CLEARLY STATES THAT – NO INCOME TAX OR STAMP DUTY TO BE COLLECTED., BUT THE GOVT IN DEDUCTING 10% AS TDS. PLEASE ADVICE.

THANKS

PRASAD CHOUDHARY.

Dear Prasad,

I have not gone through the referred Act. So, cannot really comment.

As I understand, TDS is covered under Section 194-IA of the Income Tax Act. There, the buyer needs to deduct TDS at the rate of 1% if the transaction value exceeds Rs 50 lacs.

However, in case of compensation (as your case seems), the TDS is 10% if the transaction value exceeds Rs 2 lacs. This is specified in Section 194LA.

Personally, I don’t think Land Act can overwrite Income Tax Act. Specific changes have to be made in the Income Tax Act to effect the desired change.

Please understand I am not a tax expert and there can be many other conditions that can impact taxation.

If excess tax has been deducted as TDS, you can claim refund at the time of filing returns.

sir i want to ask why listed debentures and listed bonds are not indexed

My mother (housewife) aged 66yrs purchased open plot in 1998. Now she wants it sell at 85lacs. How to save income tax investing fd in banks, distributing it to son, daughter in law etc.

Dear Ravindra,

First, there will be some capital gains tax liability. Contact a tax consultant for assistance on calculating tax liability.

Please go through the following post.

http://www.personalfinanceplan.in/financial-planning/how-to-save-tax-on-gains-from-sale-of-house/

Exact tax saving strategy will depend on many other aspects.

sir what is turnover ? how to calculate when you keep in mind income tax authority rule income >> 2 crore (fy 16-17 ) earlier was >> 1 crore

I have capital loss of Rs 10117 and ledger is 18545 minus( capital loss + more than Rs 7000 for DP,stamp duty , tele call charges and service tax )

the turnover in brokerage report is 1,43,09814 rupees

the turnover in STT certificate for NSE is 7403885

the turnover in STT certificate BSE is Rs 33850.

in statement of capital gain mentioned buy value at year end 7176898.36

in statement of capital gain mentioned sell value at year end 7166780.60

what is Turnover figure that consider at Income tax capital gain at filling or reply to notice to for non-filling?

what is my turnover? puzzle kindly guide !

Will take long to explain.

There is a good post on this matter on Zerodha website.

You can go through the post http://zerodha.com/z-connect/traders-zone/taxation-for-traders/taxation-simplified

Alternatively,sit with a Chartered Accountant. He/she will help you out.

Dear Deepesh,

I have a query regarding unlisted 0% debentures which are reedemed at premium by the issuer on premium. What are the tax implication on that transaction from investor perspective, if debentures are listed or non listed, in both scenario.

Dear Mohit,

Should be 20% after indexation (for long term) and at marginal income tax rate (for short term).

As per third proviso to Section 48, no indexation benefit will be available in case of bonds & debentures.

Guess you are right in this case.

If you read second proviso of Section 112 (along with second proviso of Section 48), for zero coupon bonds, LTCG shall be 10%.

Please understand I am not a tax expert. You are advised to verify this with a chartered accountant.

Dear Mr Deepesh, As per income tax act, we need to consider deduction of brokerage only [excluding other costs such as service tax, stamp duty, STT] on sale of equity shares only. However, your article says to deduct brokerage and other costs excluding STT on both occasions ie. while acquisition [purchase of shares] and sale of shares. May I kindly request your clarification on this.

sir…….why no indexation benefit is available in case of listed debentures and bond

Hi Neeti,

For interest bearing securities, you get interest income of regular intervals. You can use the interest whichever way you want.

Hence, the need for indexation benefit goes down.

Hi,

Is this really the case. The only mention of indexation not being available for bonds and securities is in Sec 48, but it is in the context of non-resident. I can’t find anything in Sec 112 or Sec 48 that says indexation is not available for bonds and securities. Even the ITR2 form has a separate section for “From sale of bonds or debenture” under LTCG (schedule CG, Part B) that allows for indexation, There is a separate one for non-residents (For NON-RESIDENTS- from sale of shares or debenture of Indian company) where indexation is not allowed. The tutorial on Capital Gains on the income tax website also talks about indexation not being available for bonds and securities only in the context of non-residents.

Is there any section in the IT act that clearly states that indexation is not available for bonds and securities?

Hi,

Indexation benefit is not available for interest bearing securities.

When the investor is paid interest every year, the need for indexation benefit automatically goes away.

Thanks Deepesh for this insightful article.

I received a capital gain statement when I sold my equity MF after holding for more than 5 years or so. It shows LTCG with indexing as well as without indexing. Now I understand that LTCG from equity mutual fund is tax exempt. But slightly confused as to which amount should I show in ITR Exempt Income section (the one in LTCG with indexing column or the one in without indexing)?

Thanks

You are welcome, Vaibhav!!!

For equity funds, indexation does not matter.

For equity funds, you show long term capital gains without indexation in your returns.