Arbitrage funds are a variant of mutual funds. In fact, you can call them a variant of equity mutual funds. Ever since the taxation of debt funds became adverse in mid-2014 (holding period for long term capital gain increased from 1 year to 3 years), assets under management for arbitrage funds have grown sharply. So, what exactly are arbitrage funds? How do these funds work? When should you invest in these funds? In this post, I will answer such questions about arbitrage funds. However, before delving deeper into arbitrage funds, let’s understand what arbitrage means.

What is Arbitrage?

According to Investopedia, arbitrage means “The simultaneous purchase and sale of an asset in order to profit from a difference in the price. It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of time.”

So, when we are talking about arbitrage, we are talking about risk-free returns. Don’t be surprised. Many other instruments offer risk-free returns. You can invest in Government Securities and get risk-free returns. You can invest in fixed deposits of large banks and get almost risk-free returns. However, in case of arbitrage funds, we are talking about a variant of equity funds. How can equity funds give risk-free returns?

Well it can happen. Almost. If you could buy share of Infosys for Rs 2000 from X and sell it to Y to Rs 2,050 simultaneously, you will make a profit of Rs 50. Such profit is termed arbitrage. There is no risk that you have taken. You are buying and selling at the same time. Typically, in efficient markets, such arbitrage opportunities must not occur. The transaction costs including brokerage, taxes, turnover charges and stamp duty should close arbitrage opportunities, if any.

Spot and Futures Market: Price Differential

Fund Managers of arbitrage funds rely on price differential in spot and futures markets. Both spot and futures transactions can be done on BSE and NSE. The spot market is the cash market. Generally, when you buy and sell stocks on these exchanges, you are dealing in the spot market.

Under futures transaction, you enter into a contract to buy or sell a security at a specific price on a specific date. So, if you buy Infosys December 2015 futures at 1,050 on December 10, 2015, you are contractually bound to purchase Infosys share at 1,050 on the December 31, 2015 (last Thursday of every expiry month) in this case. In reality, you don’t have to purchase but you just pay (or receive) the difference (cash settlement). So, for instance, if the price at expiry is Rs 1,040, you have lost money. You have to purchase the share at Rs 1,050 when the share is available in the market at Rs 1,040. To account for this loss, you pay Rs 10 to the counterparty. Similarly, if the price is Rs 1,060, the other party will pay you Rs 10 per share. Spot and futures price converge on the date of expiry.

Now, if you could buy a share of Infosys at Rs 1,000 and sell it in the futures market for Rs 1,025, you are guaranteeing yourself a profit of Rs 25 per share (before transaction costs). It does not matter how the share price of Infosys moves in the interim period. You have locked in the profit.

Suppose, on the date of expiry, the stock price is 900. You can sell the stock in cash market booking a loss of Rs 1,00. On the other hand, you will make a profit of Rs 125 in the futures transaction. Net gain of Rs 25. On the other hand, if the stock price is Rs 1,100. You will make a gain of Rs 100 in spot market and a loss of Rs 75 in the futures. Net gain is still Rs 25. Do understand this gain of Rs 25 is before any transaction costs.

That is where the risk-free part of arbitrage funds comes from.

How do Arbitrage Funds work?

Under Arbitrage funds, fund manager try to leverage upon this price differential between spot and futures market (derivatives market) to earn profit for investors.

As I understand, in absence of transaction costs, the difference between the spot and futures prices shall be the risk-free rate. So, the fund manager should be able to earn the risk-free (for the duration) return before accounting for transaction costs easily. That is the reason arbitrage funds offer returns that mimic debt fund returns.

In addition to that, due to market inefficiencies, arbitrage opportunities can occur sometimes and that’s what fund managers tend to benefit from. Market inefficiency can be due to multiple reasons such as low volumes, high bid-ask spreads and information asymmetry.

When there are not many arbitrage opportunities to be found, the fund managers can invest in money market and short term debt securities (or as mentioned in the Scheme Information Document). However, the fund cannot invest more than 35% in such securities otherwise the fund won’t qualify as an equity fund.

Tax Treatment of Arbitrage Funds

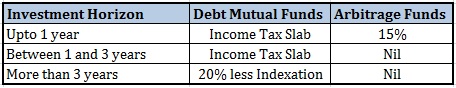

This is where the greatest strength of arbitrage funds lies. Despite giving debt like returns, arbitrage funds get the same tax treatment as equity mutual funds. Actually, as per Section 10(38) of the Income Tax Act, these qualify as equity mutual funds. So, short term capital gains (holding period < 1 year) are taxed at 15% while the long term capital gains (holding period > 1 year) are exempt from tax.

What does it mean? Arbitrage Funds vs Debt Mutual Funds

If you park your short term funds in a debt funds, short term gains (holding period < 3 years) are taxed at your marginal tax rate. Long term capital gains (holding period > 3 years) are taxed at 20% less indexation.

Typically, you park your short term funds in debt mutual funds. However, if you look at capital gains tax rate, it may make sense to park your funds in arbitrage funds. Arbitrage funds offer debt like returns but get better taxa treatment.

Risks with Arbitrage Funds/Caveats

Through this post, it has appeared that the arbitrage funds are without any risk. However, that’s not the case. Arbitrage Funds are not risk-free. Here are a few points that you must consider before deciding to invest in arbitrage funds.

- With sharp rise in demand (or growth in asset under management) for arbitrage funds, the arbitrage opportunities can be expected to go down. Note that arbitrage funds cannot invest more than 35% in debt securities to retain tax treatment of equity mutual funds.

- Arbitrage funds may end up earning lower returns than debt funds. The reason could be lack of arbitrage opportunities and restriction on investing in securities (other than equity) beyond a point.

- Redemption of arbitrage funds may take up to 3-5 days. Hence, it is not as liquid as a liquid fund.

- The arbitrage funds may also take unhedged equity exposure. For instance, under scheme information document for ICICI Prudential Equity Arbitrage Fund, unhedged exposure is limited to 5% of overall portfolio. Hence, there is risk on the unhedged portfolio.

- If you are planning to benefit from favorable interest rate movement, go for long duration debt funds. Arbitrage funds will be relatively immune to interest rate movements.

- The futures are traded in lots. For instance Infosys and Reliance futures trade with market lot size of 500 while Ashok Leyland has a lot size of 7000. So, for every lot of Ashok Leyland fund manager wants to sell Ashok Leyland in futures market, he needs to purchase 7000 shares in the spot market. To take a meaningful position, the fund manager may end up to pushing the spot price up (impact cost of large trades) thereby reducing the arbitrage opportunity. You can see it is not so easy.

There is a lot of noise over whether tax treatment of arbitrage funds should be similar to debt funds (and not equity funds). However, as things stand now, tax treatment of arbitrage funds is same as equity funds. No one knows what will happen in the future. I don’t want to indulge in speculation either. Who knows long term capital gains on equity funds may not be exempt from tax after 5 years? After all, the taxation of debt mutual funds was changed only last year. In fact, change in taxation of debt mutual funds gave a fillip to demand for arbitrage funds.

Returns over the past 3 years

I checked the returns of various arbitrage funds. There was not much variation in returns (at least not as much as we see in equity funds). 5-year return for all the funds varied between 7.81%-8.78% p.a. 3-year return ranged between 7.81% and 8.69% p.a. 1-year return was between 7.01% and 8.39%. Not surprising. Risk and reward go hand in hand. Lower the risk, lower the potential for returns.

Contrast this with liquid funds. Pre-tax returns are similar to arbitrage funds i.e. 1 year (6.05%-8.36%), 3 year (6.65%- 8.71%) and 5 year (6.79%-9.18%). The post tax returns may be skewed in favor of arbitrage funds as arbitrage funds get better tax treatment.

It is not wise to compare fund categories this way but I hope you get the idea.

Should you invest in Arbitrage Funds?

Arbitrage funds cannot be replacement for equity mutual funds in any way. With arbitrage funds, you will only get debt like returns. If you are planning to build long term wealth, arbitrage fund is not the way to go. Arbitrage funds, due to the inherent structure, do not offer much growth potential.

If you are looking to profit from favorable interest rate movement, go for long duration debt funds (and not arbitrage funds).

Arbitrage funds are not really that liquid and redemption may take some time (as much time as a regular equity fund takes). So, do consider this aspect before you consider this as an alternative to liquid funds. Moreover, in case of extreme redemption pressure, the fund manager may be forced to unwind positions.

As the asset under management (AUM) for arbitrage fund grows, the potential of arbitrage opportunities will shrink and hence the returns for arbitrage funds may come down.

Arbitrage funds present a credible alternative for parking short term funds. If you are looking to invest your funds for 3 months–3 years, you can look at arbitrage funds. Again, the key is not the returns arbitrage funds offer but favorable tax treatment these funds receive. Your income tax slab will also play a crucial role.

For instance, if you fall in 10% tax bracket and want to park your funds for 6 months. If you invest in liquid or short term funds, short term gains will be taxed at 10% (income tax slab). On the other hand, gains on arbitrage funds will be taxed at 15%. Hence, debt funds offer better tax treatment for such person if the investment horizon is less than 1 year. The situation will be different if you fall in the higher tax brackets or the investment horizon was more than 1 year.

Apart from tax treatment, there is nothing special about arbitrage funds. Do consider your requirements, product suitability and your marginal tax rate before making the choice.

10 thoughts on “Should you invest in Arbitrage Funds?”

Nice Article… Covered most of the aspects… how to choose an Arbitrage Fund…? There are pure Arbitrage and others… Whats the difference how do you weigh them?

Vivek,

The focus should be your need. It is quite clear what arbitrage funds can or cannot do.

I am not sure if you have variants of arbitrage funds. If you have anything specific in mind, please do let me know.

Anyways, go for a pure arbitrage fund if you need. Keep things simple.

Remember the only strength of arbitrage fund is the tax treatment (and nothing else).

Recent proposed changes to EPF taxation tell us that even these tax benefits may not be permanent.

what i want i got it from the article.Excellent and concise piece of information in lucid style.Thanks a lot.

You are welcome Rajasekar!!!

Nice Article.

I have surplus fund of Rs 15 Lacs for 95 days,I fall in 30% bracket of taxation , where should I park my fund :- FD or Arbitrage Fund or Liquid fund

Thanks Dushyant.

From taxation viewpoint, arbitrage funds look better because short term gains are taxed at 15%.

However, there may not be enough arbitrage opportunities to exploit. May underperform or outperform debt funds.

Given you fall in 30% tax bracket, you can look at arbitrage funds.

should one go for growth or dividend reinvestment while looking at an investment horizon of 12-18 mnths in these funds?

I prefer growth.

I have seen HDFC equity saving ; ICICI equity income & Kotak equity savings as hybrid arbitrage funds.

They are giving higher returns. Whether they will work in bearish markets? Whether dividends decaltred by them do not attract Dividend distribution tax? Whether we should opt for growth, divident reinvestment or dividend option. we r in 20-30% tax bracket.

Hi Ajay,

These are not exactly hybrid. One nomenclature for such funds is Equity Savings Fund.

Suggest you go through the following post.

https://www.personalfinanceplan.in/mutual-funds/pfp-primer-what-are-equity-savings-funds/

There is significant equity portion in such funds. Hence, you can expect volatility to be high.

In equity funds (these fund get tax treatment of an equity fund), I prefer Growth option.