No one wants to take on debt. After all, no loan comes free and you have to pay interest on the loan. Interest cost is the cost that you pay for convenience. Convenience is the comfort of owing an asset or financing a goal/need beyond your current means.

Sometimes, debt is unavoidable since you may not be able to acquire an asset through own funds. If you feel the asset value appreciates quickly, it may even make sense to acquire the asset as early as possible by taking on debt. A home loan is a prime example. I am not saying that real estate always appreciates. However, if you feel prices in your locality are going to rise in the near future, an affordable home loan is a good option. Similarly education cannot be compromised and you may be forced to take a loan to fund education. On the other hand, you also have avoidable debt which goes towards consumption, such as personal loan for vacation.

If you are reckless and pick up excessive debt, you can get into a debt spiral, which is very difficult to come out of. More often than not, in such a situation, you will be forced to take loan at a high rate of interest. You were struggling with even low cost debt. A fresh high cost debt will only compound your problems.

Therefore, as you need discipline with investing, you also need a lot of discipline when it comes to managing your debt. Remember, the more you pay towards interest, the less you have to invest to meet your other financial goals. In this post, we discuss 8 tips you will do well to remember when taking on fresh debt or managing your existing debt.

Tips to manage debt effectively

- Do not borrow unnecessarily: This is the most important rule. These days, there are loans available for almost everything from home furnishing to a vacation. With personal loans, you do not even need to specify the end use of funds. This ease of getting loans can sometimes make you reckless. Avoid loans that do not create any tangible assets. An education loan is an exception. Avoid personal loans and credit card debt unless in case of an emergency.

- Do not borrow more than you can repay: Affordability is the key. You must borrow only as much as you can afford to repay i.e. EMIs for all the loans combined must not exceed 40-50% of your total monthly income. 40-50% is only a ballpark number. The idea is that you should have a comfortable cash flow position even with these EMIs.

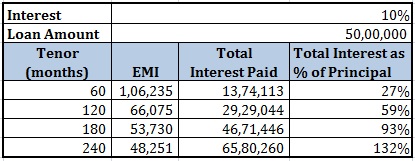

- Borrow for shorter tenure: The longer the tenure, the more you pay in terms of interest. This is best demonstrated through an illustration. For a home loan of Rs 50 lacs at 10% p.a., let’s look at the total interest cost paid for different tenors.

It is evident from the example you can bring down the absolute interest cost if you keep the loan tenure shorter.

When you invest, the power of compounding works in your favour i.e. the longer you stay in the investment, the more you earn in terms of absolute returns. However, when you take a loan, the power of compounding works in the opposite direction. The longer you stay in the loan, the more interest bank earns from you.

Please note a shorter tenor also means a higher EMI. As pointed out before, affordability of EMI is the key. Do not make the loan EMI so short that affordability becomes an issue.

- Repay as fast as you can: Taking forward from above point, pick up as high an EMI as you can afford. As your salary increases, contribute more than your EMI towards loan repayment. You will save a lot of money in the long term. Let’s consider an example, EMI for 20 year home loan of Rs 50 lacs at 10% p.a. is Rs 48,251.

If you manage to pay one more EMI per year i.e. repay amount equivalent to one EMI per annum out of annual bonus or other excess funds, you will repay your loan in 195 months. Therefore, by paying 16 additional EMIs, you will save 45 EMIs.

Alternatively, if you can increase your EMI payment by 5% every year, you will repay your loan in 142 months (11 years and 10 months). If you can do both, you will be able to repay loan in 129 months (10 years and 9 months).

Again, affordability is the key. If you have multiple loans and not sure which debt to prepay first, please go through the following post.

- Be on a lookout for lower interest rates: If your bank is slow in passing on the reduction in interest rates to you, be prepared to switch to other lenders which offer lower interest rates. While doing so, do not compare just interest rates. Look at overall cost of switching. You will have to account for prepayment penalty, if any, processing fees and other documentation charges. Not to forget, do consider operation hassles in switching the loan before making the decision.

If switch your loan (Rs 50 lacs, 10% p.a., 20 years) to a lender offering you 9% p.a., you will repay the loan in 201 months (16 years 5 months) if you keep the EMI same. On the other hand, if you keep the loan tenor unchanged (at 20 years), EMI will go down from Rs 48,251 to Rs 44,986. Any additional switching costs have been ignored.

This is not just for home loans. If you get to opportunity to refinance your debt at a lower rate, do explore that option. Sometimes, consolidation of debt into a single loan can also help as it makes for easier tracking.

- Do not borrow to invest/speculate in equity markets: When the markets are rising, even the most conservative of investors tend to get very creative. For instance, if you have excess funds, what will you do? Will you prepay your existing loans or invest the funds for higher returns? I have seen a few people pondering over whether they should take personal loans for investing in equity markets. Makes little sense. While the returns in equity markets are not guaranteed, you cannot default on your interest payments. If the markets nosedive soon after investing, you can find yourself in a very uncomfortable position. A leveraged position magnifies not only your gains but also your losses.

- Tax benefits only reduce the cost of loan: A number of people vouch for home loans that offer tax benefits. Home loan is a prime example. However, you must understand that there is still interest cost to be paid. There is nothing wrong in picking up affordable debt for ensuring financial security of the family or necessary convenience. However, do not borrow just for the sake of tax benefits.

- Make your debt payments on time: If you do not make EMI or credit card payments on time, your credit history will suffer. Since the banks now refer to your credit history for sanction for fresh loans, this may make it difficult for you to take any loans in the future or may increase the interest cost of future loans.

PersonalFinancePlan Take

The rules of managing debt are quite simple. First and foremost, do not borrow recklessly. Keep the EMIs affordable. Cut down debt aggressively as and when you get the opportunity. And do not score self-goals by borrowing to speculate.

Credit: Got the idea to cover this topic from the cover story in ET Wealth September 14, 2015. Most of the discussions points have also been borrowed from the ET Wealth article. You can read the story in ET Wealth here.

Image Credit: StockMonkeys,2012. The original image and information about usage rights can be downloaded from Flickr/StockMonkeys.

Deepesh is a SEBI registered Investment Adviser and Founder, PersonalFinancePlan.in

7 thoughts on “8 Tips to Manage Debt Effectively”

Hi,

Your articles are a joy to read… Informative as well as they have a personal touch…

Thanks Dr. Biswadeep!!! Appreciate your kind words.

sir all your articles always comes with facts and figures and to the point, but viewvership of your work is less in numbers.

thanks for article.

Thanks Jatinder.

Please share the post with your friends and on Facebook/Twitter handles. Will help reach wider audience.

Dear Mr. Deep – Thanks for Nice Article and in fact I am cautious in not taking any debt that includes even building a home as I saved money for the past 7 years to fulfil my wishes as I want debt-free. I have a question regarding investing in Equity Market when Market is way way down just it happened in 2002 and 2008. When the entire market comes down heavily and the Stocks are at bargain basement with Fire Sale due to very low valuation (Due to severe recession/global meltdown – Everything will be on Sale but some stocks do have excellent value due to macro issues), Can one take a loan at reduced rate and invest in Stock Market? May be, it sounds stupid but folks who have invested during deep recession of 2008 saw huge gain after couple of years where they can sell 50% of stocks and could have completed the entire loan with Interest. Have you done any research on the above situation??

Dear Bavan,

Thanks for your inputs.

About taking a loan to invest in stock markets when the markets have crashed, I would still advice against it. There are a few reasons for this.

1. It is not possible to call a bottom. Markets may fall even further just when you thought it couldn’t possibly go lower.

2. Sequence of returns matters a lot. Suggest you go through this post. it is not that relevant, it has an example how sequence of returns plays am important role. http://www.personalfinanceplan.in/mutual-funds/what-do-you-worry-more-about-your-existing-corpus-or-the-next-sip-installment/

For instance, you took Rs 10 lac loan at 12% and invested in equity markets. You have to pay interest annually and the principal at the end of the loan term. Suppose markets go down 10% in the first year. Your holding goes down to Rs 9 lacs. Now, you need to pay interest of Rs 1.2 lacs. You will be forced to sell some of holdings at a low price because you need to repay loan. Rs 9 lacs becomes Rs 7.8 lacs after payment of interest.

Your notional loss just became permanent. At the end of first year, you have loan of Rs 10 lacs and equity holding of Rs 7.8 lacs. Now, the odds are stacked against you.Even if you make good returns in the next few years, it will be difficult to recover from this poor luck.

3. Your loan to invest in markets will be quite expensive. It wouldn’t be as cheap as a home loan.

Btw, you can always get lucky. However, you need to see if the risk is worth it. I don’t think so.

Just what I need. Thanks for the tips.