Corporate (or company) Fixed Deposits are just like bank fixed deposits. The only difference is that the borrower is a company (and not a bank).

I had written a detailed post on whether you should consider investing in such corporate fixed deposits. The aforesaid post covers various aspects about such fixed deposits from companies.

In this post, I will dig deeper into misleading information about interest rates that many companies may resort to for attracting deposits. I will get to it later in the post.

Why will you invest in Corporate Fixed Deposits?

The only reason why you will invest in Corporate Fixed Deposits (and not bank fixed deposit) is that you get higher interest rates.

Such companies have to offer higher interest rates otherwise nobody will invest.

You take greater risk of default with corporate fixed deposit. Recently, JP Associates, a well known corporate house, defaulted on its fixed deposits. Many real estate companies have defaulted on interest rate payments in the past.

When was the last time you heard a bank defaulting on its fixed deposits in India?

This is not to say all companies that raise money through fixed deposit are bad. Well some of the companies, especially NBFCs and HFCs may be in very good financial position.

For instance, HDFC is at least as creditworthy as or even more creditworthy than many banks. However, HDFC wouldn’t offer you a very good deal in terms of interest rates either.

These fixed deposits are similar to Non-convertible debentures by companies. Just that Fixed deposits are not listed on stock exchanges. You can’t exit in secondary market.

Why companies opt for Fixed Deposits to raise money?

There are two types of companies.

- There are a few companies that can raise money at a much cheaper rate than the bank would offer them. HDFC Limited is probably one of them.

- There are a few companies that bank won’t just lend to or lend at very high rates. Many real estate companies or companies in poor fiscal position fall in this category.

It is the second type that you should avoid.

If you were wondering why a builder will offer to pay interest on your home loan for a few years, you have your answer. That is the cheapest source of finance for them.

Interest Rates can be misleading

Now to the real point I want to discuss in this post.

Sometimes advertisements about interest rates may be misleading.

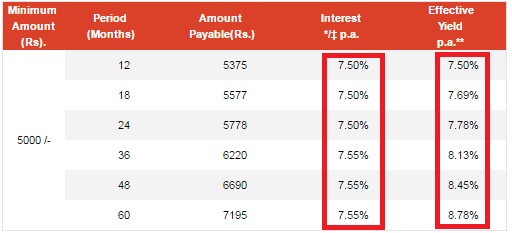

Consider this interest rate table on an NBFC website.

Interest rate is fine. These are rates for cumulative Fixed deposits compounded annually.

Focus on the effective yield. I have no idea what that means.

For me, for a non-tradeable asset (such as fixed deposit) that compounds annually, effective yield should be same as the interest rate.

Clearly, this NBFC uses a different definition.

Why this difference?

Let’s find out.

Rs 5,000 compounds to Rs 7,195 at 7.55% p.a. Fair enough.

5,000 * (1+ 7.55%)^5 = Rs 7,195.

This is assuming there is no TDS. TDS can mute the returns a bit. This aspect is covered in great detail in this post. By the way, TDS is applicable in all kinds of fixed deposits including bank fixed deposits.

Rs 7,195 – Rs 5,000 = Rs 2,195

Rs 2,195/5,000 = 43.8% (Right. Your absolute return is 43.8% of the investment amount)

43.8%/5 years = 8.78% (You divide by 5 years. This is a joke)

To put it another way,

Rs 5,000 * 8.78% = Rs 439

Rs 439 * 5 years = Rs 2,195, which is the difference between maturity amount and investment amount.

Therefore, 8.78% is akin to simple interest (and not compound interest).

I don’t know why the NBFC chose to call it effective yield.

If 8.78% is rate of return, it is as if you earn interest every year but you get it only at the time of FD maturity. No compounding on interest.

We have heard of such stupid mathematics before too, right?

Many insurance agents use this kind of brilliant mathematics while selling traditional life insurance plans. You get bonuses every year but such bonuses simply get added to the maturity amount. You do not earn anything on those bonuses.

We know how very smart sales pitches can be built using such maths.

The actual return is only 7.55% p.a. This is the return you should compare with return on bank fixed deposits. And not 8.78% p.a.

What is the problem?

You may argue that interest rates are clearly mentioned. Therefore, there is no question of misleading.

However, in my opinion, effective yield is clearly to mislead. There is no reason for its existence in the table except to mislead. Do note this data is on the website. Intermediaries can give an entirely different spin with these numbers.

If the bank fixed deposit offers 7% p.a., 7.55% p.a. may not be much of a difference. You may not be willing to take the risk for mere 55 bps of additional returns.

But additional return of 1.78% p.a. may be difficult to turn away.

Do note not all companies may try to mislead.

By the way, this is not a commentary on whether this particular NBFC is good to invest in or not. This particular NBFC may be the best NBFC in India. I don’t know and I don’t care. However, clearly, the heart does not seem to be in the right place.

As an investor, you must look through these kinds of numbers. Whether you choose to invest in a particular FD from a company is your choice. You may be willing to take risk for better returns.

However, do not fall for the misleading information about interest rates.

Book Suggestion: The Behavior Gap: Simple Ways to Stop doing Dumb Things with Money (Carl Richards)

2 thoughts on “Corporate Fixed Deposits: Do not fall for misleading interest rates”

Nice Post Deepesh . Though Effective yield is even used by Bank FD .

I know Canara Bank does that where they list out Interest Rates and Effective Yield separately , So such tactics is not limited to CFD or Insurance players

Thanks Austin for pointing out. Was not aware.

So, it seems banks are never behind in mis-selling.