You invest in pension plans to replace your salary during your retirement. Apart from pension plans from insurance companies and New Pension Scheme, there are retirement plans from mutual funds too.

Though not pension plans in the strictest sense, you can use retirement plans from mutual funds to save for your retirement. These plans differ from pension plans in many ways. For instance, there is no mandatory purchase of annuity. At the time of retirement, you can use the funds as you wish.

I have written about pension plans, including NPS, in many of my earlier posts. In this post, I will discuss retirement plans (or pension plans) from mutual funds houses in detail.

Pension Plans from Insurance Companies

Under pension plans from insurance companies or NPS, accumulation phase is followed by distribution phase. Hence, you contribute to the pension plan during your working years and the accumulated corpus is used to purchase an annuity plan at the time of retirement.

This is in principle. There are minor variations. That maturity period of pension plans may or may not coincide with your retirement. Up to one-third of the accumulated corpus in pension plans from insurance companies (40% in NPS) is allowed to withdrawn as lump sum at the time of maturity/retirement. The lump sum withdrawals are exempt from income tax. Annuity income is taxed in the year of receipt.

Read: Pension Plans from Insurance Companies

Retirement Plans from Mutual Funds

Under retirement plans from mutual fund houses, accumulation is similar to the pension plans from insurance companies. Your investments are pooled in debt or equity based on investment mandate which is disclosed upfront.

Distribution phase is markedly different. There is no mandatory purchase of annuity. You can withdraw the entire amount if you wish. You can also set up a Systematic Withdrawal plans (SWP) to get regular income. Alternatively, you can redeem units as and when required.

Salient Features of Retirement Plans from Mutual Funds

- There is no concept of annuity in retirement plans from mutual funds. You can accumulate corpus using the retirement plan and withdraw periodically from the corpus after retirement.

- By the way, you can use the retirement corpus to purchase an annuity plan (making it closer to a pension plan). It is your choice. There is no compulsion to purchase an annuity plan at the time of retirement.

- The allocation between equity and debt will vary based on choice of scheme in the retirement plan.

- Withdrawals before retirement are discouraged through exit load.

- Investment in notified retirement plans from mutual fund houses is eligible for tax benefits under Section 80C of the Income Tax Act. Only a few retirement plans have been granted such status by the Government.

- Withdrawal from Retirement corpus gets tax treatment just like redemption from regular MF schemes does. Hence, if you were investing in a debt scheme in the retirement plan, you will get indexation benefit (taxed at 20% less indexation). If you were investing in an equity scheme, long term capital gains will be exempt from tax. This is a huge positive.

- There is no minimum contribution per year.

- You can invest lump sum or through SIP.

- Different retirement plans from mutual funds may have different terms and conditions.

- It is better to invest in Direct Plans of these Retirement plans than Regular plans of these retirement plans. You will earn better returns.

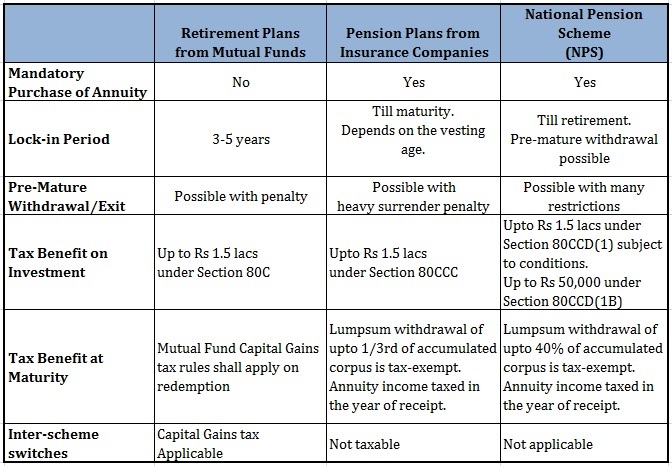

Comparison: MF Retirement Plans and Pension Plans from Insurance Companies

Examples of Retirement Plans from Mutual Funds

The features of these plans are best explained through some of the schemes on offer. There are not too many retirement plans from mutual funds around. Demand is not too high either. I will discuss the reasons in a subsequent section.

Should you invest in Retirement Plans from Mutual Funds?

You may find value in these plans. These retirement plans from mutual funds are better than pension plans from insurance companies in many ways. There is no mandatory purchase of annuity. Tax treatment at maturity or retirement is favourable. You can exit if needed by paying a small penalty. These plans are better for those planning an early retirement.

Still, I do not see any reason why you should be investing in these plans. Why?

Because there is nothing special aboout Retirement plans from mutual funds.

- Almost everything that you do with a retirement plan, you can do with a regular mutual fund scheme.

- Retirement plans do not add anything extra to the investment discipline either. There is no minimum investment per annum. You can set up a SIP in a regular (non-retirement) scheme too.

- Exit load is not too high to discourage redemption.

- You will not get tax benefit under Section 80C if you invest in regular (non-retirement) MF schemes. Even that you will get if you invest in an ELSS (equity linked savings scheme or tax-saving mutual funds). I concede you get this benefit even for debt-oriented schemes in retirement plans. The tax benefit under Section 80C is not available to debt mutual funds. However, I wouldn’t worry too much about it. Many debt instruments such as PPF, 5-year FDs offer tax-benefit under Section 80C.

Why would you invest in a retirement plan with so many restrictions when it provides no additional benefit over regular (non-retirement) MF schemes?

You can simply start investing in diversified equity funds or balanced funds and shift your money to debt funds (or hybrid-debt funds) as you move closer to your retirement. Simple. No restrictions.

To build a retirement corpus, you do not necessarily need to invest in a product that has Retirement written on its brochure.

Stay away from retirement plans from mutual funds.

10 thoughts on “Should you invest in Retirement Plans from Mutual Funds?”

Good article. Was trying to figure out what so special about these plans. I guess nothing in particular. Discipline should be good enough for a decent corpus.

Thanks K.K.

I agree.

Hello Deepesh,

If at all possible, I request you to do a write-up in detail about Systematic Withdrawal plans (SWP).

Thanks

Ram

Sure Ram.

Will cover this in a post in near future.

Thanks for the suggestion.

Sir,I am 38, my income 180000p/a ,I want to invest 1000 p/m for retairment, pls suggest me, thanks. Bujji

Difficult to comment without looking at other aspects.

Would suggest invest Rs 1,000 per month in a balanced fund say HDFC Balanced Fund.

My reply may change as I find out more about your finances.

an enlightening article but uti rbp has advantage of bonus etc apart from other benefits of like mfs

Thanks Dr. Singh.

I have gone into such specifics. So, won’t comment.

However, please understand it is your money. They won’t pay bonus from their pocket.

Nice write up Deepesh , It is better to stick with regular MF for retirement and stick to equity based balanced fund for long term growth.

Thanks Austin!!!