You got the pay slip for the last month. It was your first salary after the annual hike and bonus. You are still scratching your head to understand how so much tax got deducted from your monthly salary. Don’t worry. You are not alone. A number of people I know find it difficult to estimate their tax liability. And this is not true for those who recently started working. Even those who have been earning for many years struggle with tax calculations.

I am not saying you have to be a tax expert. You can always seek professional help but it will be helpful if you have basic idea of taxes. If you don’t understand tax calculation, you won’t be able to plan your taxes well.

In this post, I will focus on the basics of taxation and explain how to calculate your income tax liability.

Please understand this is a very simplistic representation of income tax calculation. Actual tax calculations can get a bit complex. There are many online income tax calculators available at FinoTax, TaxMann, ClearTax and even Income Tax website. Some of these calculators are really exhaustive.

In this post, I will not go into exact tax calculations. There are too many ifs and buts to be covered in a single post. The idea is that after reading this post, you should be able to use the aforementioned online income tax calculators effectively.

What is my total income?

Your total income just does end with your salary. You may have other sources of income too.

As per Section 14 of the Income Tax Act, your total income comprises following five heads.

- Income from Salary

- Income from House property (Renting out house)

- Profit or gain from Business or Profession (if any)

- Capital gains (Sale of equity shares, mutual funds, bonds, gold, real estate etc)

- Income from other sources (Includes interest from savings accounts, FD, gifts, dividends etc)

You add up income under all the aforesaid heads to arrive at your total income.

Am I taxed on my total income?

No, that’s not the case. You need to make a few adjustments as follows to arrive at your taxable income.

Gross Income – Exempt Income – Deductions = Taxable Income

A part of your salary is exempt from income tax. So, whole or part of certain allowances such as House Rent Allowance, Conveyance Allowance, medical allowance and leave travel allowance are exempt from income tax.

Must Read: Common Tax-Exempt Allowances

Apart from tax-exempt income, there is an additional way to reduce your taxable income. The Government allows you to claim tax benefits for specific investments and expenses incurred. For instance, investment in PPF, EPF, ELSS (tax saving mutual funds), Senior Citizen Savings Schemes and insurance products is eligible for deduction under Section 80C.

Must Read: Common Section 80C Deductions

Must Read: 15 lesser known Income Tax Deductions

Premium paid for health insurance is eligible for deduction under Section 80D.

Must Read: Tax Benefits of Health Insurance

Home loan principal repayment and interest payment is eligible for deduction under Section 80C and Section 24 respectively.

Investment in NPS (New Pension Scheme) is eligible for deduction under Section 80C and Section 80CCD.

This is not an exhaustive list. There are many more tax deductions available.

Once you have taxable income with you, you can calculate your tax liability as per the following tax structure.

In addition, if you taxable income exceeds Rs 1 crore, you will have to pay a surcharge of 10% on the tax amount. Apart from this, you need to pay education cess of 3% (including higher education cess).

Please note Capital gains do not always follow this tax slab structure. For instance, short term gains on equity mutual funds or shares (holding period < 1 year) are taxed at 15% while long term capital gains (holding period > 1 year) on sale of equity mutual funds or shares are exempt from tax.

Short term gains on gold, debt and real estate (holding period < 3 years) are taxed at marginal income tax rate while long term gains are taxed at 20% after adjusting for inflation. Moreover, there are ways through this income tax on such capital gains can be avoided. Even capital losses in the previous years can be used to capital gains in the current year.

Must Read: Taxation of Short Term Capital Gains

Must Read: Taxation of Long Term Capital Gains

Additional Read: How to save Income Tax from sale of a house?

Case Study

Karthik, aged 30, is a salaried professional. His salary is Rs 25 lacs. There is no other source of income.

Total exempt income under House Rent Allowance, Leave Travel Allowance and other exempt allowances amounts to Rs 1.75 lacs.

He has taken a home loan. During the last year, he made interest payment of Rs 1.6 lacs and principal repayment of Rs 50,000. Additionally, he made investments of Rs 50,000 each in PPF and ELSS respectively.

Additionally, he paid health insurance premium of Rs 20,000 for his family during the year.

What is his Income Tax liability?

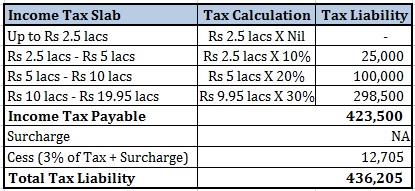

Now that you know Karthik’s taxable income, you can calculate his tax liability as follows.

Since his total taxable income is less than Rs 1 crore, there is no Surcharge applicable. His total tax liability is Rs 4.36 lacs.

Point to note: Suppose he had made a short term capital gain of Rs 50,000 on sale of equity shares. Additionally, there was long term capital gain of Rs 1 lacs on sale of equity mutual fund units. How would this impact his tax liability?

Capital gains may or may not be taxed at your marginal income tax rate.

Long term capital gains on sale of equity mutual fund units are exempt from income tax. Therefore, there is no tax liability on LTCG of Rs 1 lac. Short term capital gain (STCG) of Rs 50,000 will be taxed at 15%. Total tax liability on STCG = 50,000 * 15% + 3% Cess = Rs 7,725. Hence, Kartik’s tax liability would have increased by Rs 7,725.

Are you ready to open an excel sheet and verify the tax calculation on your pay slip?

Image Credit: Blair, 2009. The original image and information about usage rights can be downloaded from Flickr.