Stock market scams are rising. Many fraudsters/finfluencers/unregistered people approach investors on social media pretending to be SEBI registered investment advisers or research analysts.

They often show fake profit screenshots and forged SEBI certificates and convince investors to transfer money as fees or investments. By the time investors realize the truth, their money is gone.

The real problem?

Most investors don’t know how to check if they are dealing with a genuine SEBI-registered intermediary or a trickster.

To tackle this, SEBI (the market regulator) has launched two new investor-friendly tools:

- SEBI Valid UPI Handles, and

- SEBI Check Feature

Introduced through a circular on June 11, 2025, these tools make it easy for you to verify who you are paying and help you avoid scams.

Let’s understand how they work.

Why did SEBI introduce Valid UPI Handles?

Fraudsters love UPI because it’s instant, easy, and familiar.

They often ask victims to transfer money directly to their mobile number via apps like PhonePe, Google Pay, or Paytm.

Unlike NEFT/IMPS, UPI doesn’t make you pause. So, you have no time to think twice.

That’s exactly why SEBI stepped in.

Now, with Valid UPI Handles, you can immediately tell whether you are paying a registered intermediary or a fraudster. Just by looking at their UPI ID.

There are other ways too, and I have discussed those in this post (Beware of Fraudsters!). However, in this post, let’s focus on these new SEBI measures.

Here is the video explainer on Valid UPI handles and SEBI check from BSE India Youtube channel.

What are SEBI Valid UPI Handles?

Every SEBI-registered intermediary (Investment Adviser, Research Analyst, etc.) must now use a special UPI ID format approved by SEBI, BSE/NSE, and their bank.

The format makes it clear who you are dealing with.

<username>. <intermediary category> @ valid <Bank Name>

Valid UPI handles would have “valid” embedded in the UPI address itself.

A few examples.

ABC is a Registered Investment Adviser and uses ICICI Bank for fee collection.

A possible valid UPI handle could be abc.ia@validicici

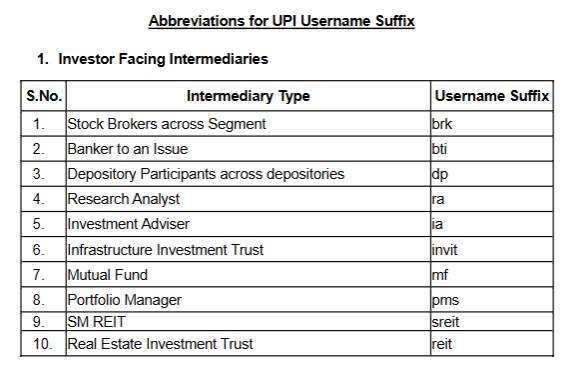

“ia” written between “.” and “@” denotes the nature of the intermediary’s registration with SEBI. In this case, since ABC is an investment adviser, “ia” is suffixed to username in the UPI handle.

XYZ is a Research Analyst (RA) and uses HDFC Bank for fee collection.

A possible valid UPI handle could be xyz.ra@validhdfc

In this case, since XYZ is a research analyst, “ra” is suffixed to username in the UPI handle.

“@valid” is the defining feature of valid UPI handles. All such handles will have “valid” added to the UPI handle.

If the keyword “valid” is missing from the UPI handle shared with you, this means you are NOT dealing with a registered intermediary and must avoid engaging with such a person. Please note “valid” comes AFTER “@” AND NOT before.

What if you are given a QR code?

A UPI QR code is just a visual representation of UPI address and eventually translates to a UPI address only.

Before paying,

- Scan the QR code and check the UPI address that appears. It must follow valid UPI handle format. If it does not, you are dealing with a fraudster.

- Check if the QR should has a thumbs-up icon in the middle. Like the following image.

Method 1 Is more reliable method 2.

Why?

Because, as I understand, a thumbs-up icon may not be difficult to place for a charlatan too. Moreover, I have seen some relaxation from SEBI on this thumbs-up icon at least for now. Hence, you may get a QR code without thumbs-up from a genuine intermediary too.

Therefore, even if the QR code looks genuine, ensure that the resultant UPI handle follows the valid UPI format. There is no concession on the valid UPI format.

What if you are asked to transfer money through NEFT/IMPS/RTGS?

Fraudsters might skip UPI and share bank account details instead. And ask you to transfer money through NEFT/IMPS/RTGS.

No worries. SEBI has solution for this problem too.

You can now verify any account number or IFSC through the new SEBI Check feature and see if it belongs to a genuine registered intermediary.

How does SEBI Check Feature work?

You can verify the authenticity/genuineness of the following using the SEBI Check feature.

- QR code: Upload the QR code and check

- UPI Address: Type the UPI address to check

- Bank details: Enter the IFSC and the bank account number to verify

If the QR code/UPI address/bank details shared with you for payment fails the SEBI Check, you are dealing with a charlatan. Stop right there. Do not transfer any money or deal any further with such fraudsters.

You are dealing with fraudster if

- The QR code/UPI address/bank account details shared with you fail the SEBI Check. OR

- The UPI address shared with you for payment is NOT a valid UPI handle. OR

- You are asked to transfer payment to a mobile number using PhonePe/GPay/Paytm. SEBI Registered intermediaries including Investment Advisers (IAs) and Research Analysts (RAs) can accept UPI payments only on Valid UPI handles.

With SEBI Valid UPI Handles and SEBI Check, you no longer have to guess who you are paying. Just verify the details and protect your hard-earned money.

Stay alert. Stay informed. Don’t let fraudsters profit from your trust.