If you are an NRI and are returning to India permanently, you need to convert your non-resident accounts (NRO, NRE) to resident accounts. You should be allowed to continue your NRE FDs as resident FDs at contracted rate till maturity. However, when you visit the bank branch to change your residential status, you are in for a surprise.

What Banks typically force returning NRIs to do?

NRE account holders face major issues when they try to re-designate their NRE fixed deposits to resident deposits. Banks typically ask the customers to break their NRE FDs and re-open resident fixed deposits. This can easily be attributed to lack of knowledge.

By the way, the issue is not just limited to NRE accounts. Returning NRIs face issues in re-designating NRO Fixed deposits too.

What is the problem?

You face three major issues if you have to break your NRE FD

- You may have opened your NRE Fixed Deposit at a higher rate. Subsequently, interest rates may have moved down. For instance, you may have opened your NRE FD for 5 years at 9% p.a. After two years, when you have break NRE FD and open a new resident FD, you can open a new FD at only 7% p.a. So, essentially, you lose 2% interest for 3 years.

- Breaking (premature withdrawal) of NRE FD may attract penalty. Apart from that, you get interest for only the period for which you maintained the fixed deposit. Continuing with the above example, let’s assume the rate for 2 year FD was 8.5% p.a. Therefore, if you break the 5-year NRE fixed deposit after 2 years, you will earn only 8.5% p.a. for two years (and not 9% p.a.) If the bank charges a penalty for premature withdrawal, it can further reduce your income.

- NRE FD does not earn any interest if you break the FD before 1 year. Therefore, in extreme scenarios where you have to break before 1 year, you do not get anything.

Even though banks should permit you to continue your NRE FD as resident FDs at the earlier contracted rate, banks don’t allow you to.

Returning NRIs: What happens to your NRE, NRO and FCNR accounts?

Read: How can NRIs invest in Mutual Funds in India?

Someone chose to challenge the Banks

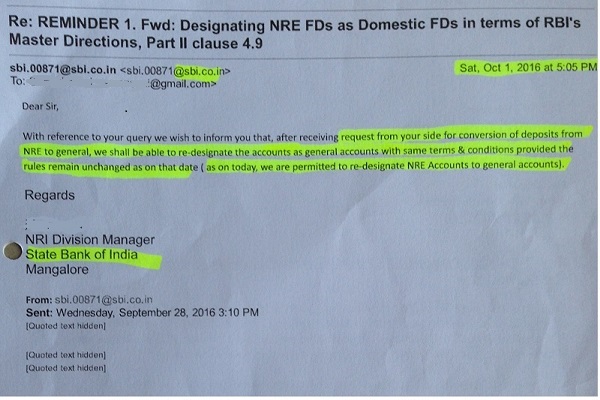

Many investors do not take up the fight with the banking system for they think their efforts will not yield any results. However, Suren (name changed to hide identity), a regular reader of this blog, thought differently and took up the issue with the banks.

He had NRE FDs with 8 banks. He approached all the banks and referred them to Master Directions. He met branch officials, dropped e-mails, dropped reminders and finally was able to get his NRE FD as resident fixed deposits i.e. he did not have to break his NRE FD. With a few banks, it took him up to 6 months to sort out the matter.

He was kind enough to share his experience in a comment and even shared his e-mail communication with the banks with me. And he didn’t stop at that. He also gave me permission to share his e-mails so that others could also benefit.

In this post, I will share his communication with the banks. I have hidden his e-mail details to maintain privacy. If you need his e-mail id, you can drop an e-mail at my support id. I will discuss with Suren. If he agrees to share his e-mail id with you, I will pass on the details.

Suren had NRE FDs with the following 8 banks.

- State Bank of India

- Corporation Bank

- Syndicate Bank

- Bank of Baroda

- Canara Bank

- Karnataka Bank

- Axis Bank

- Vijaya Bank

If you have NRE FDs with any of aforementioned banks and the bank official is not permitting you to re-designate NRE FD as resident FD, you know what to do.

Even if you have NRE FDs with other banks, you can escalate to the senior management of the bank and get it done. Do note the local branches may not be aware of the rules. Hence, it may be necessary to escalate this to senior management.

As Suren pointed out, “Some banks have poor co-ordination between Head Quarters and their branches and they consider it as a not so important matter for sharing with their staff across the country.”

Thank you Suren for sharing your experience.

Excerpts from Communication with some of the Banks

State Bank of India

Syndicate Bank

Canara Bank

On Mon, Oct 3, 2016 at 5:00 PM, CANARA BANK

BALMATTA <cb1333@canarabank.com> wrote:

Dear Sir / Madam,

Facility of re-designation accounts i.e. conversion of Non Resident Indian account to Resident account and vice versa is not available in CBS at present and the same has been taken up with vendor as change request.

Hence system is not deducting TDS for NRE term deposits even though customer category changed from NRI to Individual. The same has to be handled manually till functionality enabled in CBS.

Karnataka Bank

From: mlr.bejai@ktkbank.com

Dear Sir,

We are once again sorry for the inconvenience caused in this matter and once again we clarify that

1. As per RBI guidelines, We will convert the NRE status to Resident without altering due date and interest rate of existing NRE fixed deposits.

- TDS will be deducted as per Resident status on Converted NRE Fixed deposits with effective from the Conversion date( not retrospective).

We hope our answers will satisfy.

Axis Bank

From: nodal.officer@axisbank.com

Dear Sir,

We apologize for the inconvenience caused to you in the matter.

With regards to your concerns we would like to reply as below

- i) to continue maintaining NRE FDs and thereby incur penalties under FEMA law , *while they are mandated by FEMA to get their NRE a/cs re-designated by Banks as Resident accounts, immediately upon return to India,* .

Reply: Please refer RBI Circular-

https://www.rbi.org.in/scripts/ECMUserParaDetail.aspx?Id=525&CatID=14

Quote:

NRE accounts should be redesignated as resident rupee accounts or as RFC accounts (if eligible), at the option of the account holder immediately upon the return of the account holder to India if authorised dealer is satisfied that he has returned to India for taking up employment or for carrying on a business or vocation or for any other purpose with the intention of residing in India for an uncertain period. Where the account holder is only on a short visit to India, the account may continue to be treated as NRE account even during his stay in this country. In respect of funds held in fixed deposits in NRE accounts, interest will be payable at the rate originally fixed, provided the deposit is held for the full term even after conversion into resident account.

Unquote

The Returning NRI can keep the NRE/FCNR Deposit till maturity. However, except the provisions relating to rate of interest and reserve requirements as applicable to FCNR(B) deposits, for all other purposes such deposits shall be treated as resident deposits from the date of return of the account holder to India. The customer can also convert all the deposits to a resident deposit without changing the rate of interest.

Vijaya Bank

From: bijai1300@VIJAYABANK.co.in

Referring to the trailing mail received from the customer, please be informed that :

1) Upon returning to India permanently, the existing NRE FD account of the account-holder is required to be converted to Domestic FD A/c. without changing the maturity pattern. Rate of Interest will remain the same.

2) Applicable TDS will be collected by the system once transfer of account from NRE sub-head to Domestic sub-head is done by the branch.

Interesting Case with Bank of Baroda

With Bank of Baroda, the bank acknowledged that Suren was right. However, it mentioned that its technical systems didn’t support such changeover (re-designation) and that the matter has been taken up with the technical staff of the team. Subsequently, the changes were made.

In fact, it made changes to the web page for facilities available to returning Indians (as told by Suren).

You can check the web page for returning Indians on Bank of Baroda website where it is clearly mentioned NOW that you can continue NRE FD as resident FDs at agreed rate of interest.

You can see what knowledge of regulations coupled with persistence can do.

What about tax treatment of such Fixed Deposits?

Since you NRE FDs have become resident FDs, the interest will no longer be exempt from tax and you will have to pay. The interest income will be taxable and may even be subject to TDS (Tax deduction at source).

In any case, if you are no longer resident as per FEMA, even the interest from NRE account is taxable. Section 10 of the Income Tax Act exempts interest income from NRE account/deposits only for non-residents as per FEMA. By the way, the definition of NRI is different as per FEMA and Income Tax Act.

Interest on NRO deposits is taxable even for NRIs. Therefore, nothing changes on taxation front.

Additional Read

Book: In the Wonderland of Investments for NRIs by A.N.Shanbhag/Sandeep Shanbhag

72 thoughts on “NRI Corner: You do not have to break your NRE FD on return”

What will be the scenario if

First holder or 2nd holder’s residential status changes to RNOR and subsequently RI ?

Dear Deepak,

RNOR and ROR is a residential status as per Income Tax Act (and not FEMA).

As per RBI regulations (https://www.rbi.org.in/scripts/FAQView.aspx?Id=52), NRE and NRO can opened with a resident as joint holder on former or survivor basis.

For an existing FD, if an NRI is the first holder, it should not be a problem.

However, advise you to consult your bank.

Dear Sir,

I need one more clarification . I have equity shares purchased in NRE PINS account . Do I have to change it to ordinary PINs account on return. Do these investments loose their repatriable status. Also Do I have to disclose investments held in FX abroad ( structures, MF, Bonds) to Income tax authorities?

Dear Deepak,

Once you return to India and are a resident (as per FEMA), you need to close PINS account.

PINS account are for NRIs.

Any remittance as a resident will be covered under Liberalized Remittance scheme (LRS).

You can continue to hold assets abroad.

Please talk to a Chartered Accountant for your tax queries. As I understand, you have to disclose.

I have been an NRI for the last 22 years but had to return to India temporarily to look after my father who is really old. i will return back once my responsibilty towards him is over. Can i retain my NRE account and fixed deposits during this period?

It is only a temporary stay. In my opinion, it is not a return. You can continue NRE FDs.

You will be bound by other FEMA rules for determination of residential status.

Request you to consult a good chartered accountant too.

Dear Mr.Deepesh,

I am an NRI planning to return permanently & found your site which is very useful for me. Please advice me.

I am an NRI since 2004 & now I am planning to return to India for permanent settlement. Now I have my NRE FDs for tenures of 5/8/10 yeras which may get mature after few years of my return to India. Now being an NRI the interest earned from my NRE FDs is Tax Free. I am planning to return in November-2017.

Now if I return in November-2017 I will get NRI status for this 2017-18 also & subsequently I will get RNOR status for 2018-19 & 2019-20.

Now I want to get clarify the following because I am getting different information from different people.

I have my NRE FDs fixed for 5/8/10 years which will mature even after my RNOR status. Now interest earned from NRE FDs are Tax Free & it will be Tax Free for this FY 2017-18 also & there is no confusion in this.

When I get my RNOR status for two years(2018-19,2019-20), whether the interest earned from NRE FDs is Tax Free for this two years of RNOR status?

Please help me in this regard if possible.

Rgds,

Rajanna

Dear Rajanna,

RNOR status has nothing to do with taxation of NRE deposits.

Interest on NRE deposits is taxable as soon as you become NRI as per FEMA.

You will become NRI (as per FEMA and not as per IT Act) on day 1 of your return.

You should convert your NRE deposit to resident deposits since only an NRI as per FEMA can hold NRE deposits.

Suggest you consult with a good Chartered Accountant too.

Dear Mr.Deepesh,

Thank you very much for your clarification. However the meaning of RNOR will be treated same as NRI will not have any use I think.

Another point is suppose an NRI in the last year of his return stays more than 180 days abroad & will qualify for NRI status. So in this case whether the NRE FD interest will be Tax Free for that last FY, though he returns to India before the FY ends(before 31st march).

Rgds,

Rajanna

Dear Rajanna,

RNOR status serves a purpose if you have a source of income abroad.

NRE accounts are local accounts. Hence, RNOR status does not help.

In any case, you shouldn’t hold NRE accounts if you are not NRI as per FEMA.

Suggest you go through the following post.

https://www.personalfinanceplan.in/opinion/who-is-nri-as-per-fema-and-income-tax-act/

I am a new NRI. I had a FD as Resident from Dec 2014 maturing in Dec 2017 in ICICI Bank. The bank has been paying @ contracted rate from Dec 2014 to June 2017.(for 2 yrs 6 months). My domestic account was converted in Aug 2017 as NRO. I find in Aug17 statement of the bank, it has reduced by 0.75% and while crediting in Sept 17 the interest due has reduced the rate since Dec 14 & deducted the difference (between contracted rate paid so far & the reduced rate). I have FD receipt showing the interest rate.My understanding was that FD will only be redesignated ( converse of those quoted by SBI/Karnataka Bank etc) My attempts from USA thru Customer care has not yielded any result.

Pl advice me how to go about. Can you pl give reference to Notification/Circular/instructions by RBI in this respect (similar to one quoted

Dear Subramanian,

Please drop an e-mail to ICICI CEO. Your issue should get sorted out soon.

Dear Deepesh

I moved out of India in 2015 as a company transfer on secondment . My original employment is still in India and I receive a salary in India( my Provident Fund is still being deducted ) . In Parallel I have an income overseas as well and both the incomes( in total) are tax paid in my current overseas country due to the existence of two countries tax treaty . I had two saving accounts with two banks ( one in each) in India and I had not converted them to NRE account when I left in 2015 .

I have been confused with the rules of FEMA and Income tax interpretations of NRI status

However I have converted one of them to NRE account and my saving account was converted to NRO account parallely . I could send a certain portion of my income overseas to this NRE account .

However my salary account with the other bank in India is still a resident account where I also have a ppf account . I would like to transfer the savings ( tax paid from my income) of my salary account to overseas account or NRE account with the other bank

Please advice

1) Whether I should transfer all of them through a overseas remittance to my foreign account or should I transfer this to my NRO account in the other bank and then transfer it to NRE account( giving 15 CA and CB) or both options are fine

2) Is it mandatory to convert all the accounts to NRE account as the is a corporate salary saving account is still a resident account

3) Should I transfer all my savings ( International and local income) to my NRE account ?

3) My return to India is highly dependent on the requirements of my company and for next few years I may not return but it may happen that I may be posted back temporarily

Dear Mr. Deepesh,

I was an NRI and returned to India recently on a permanent basis. I am eligible to hold RNOR status for 2 years. Kindly clarify the following doubts:

a) Status of NRE FD’s :

I have many FD’s that mature after 5/6 years. I was under the impression that the NRE FD’s would continue till maturity on the contracted rates. One of the Banks have informed that the FD’s can continue as such till the completion of RNOR status and then be converted to Resident FD’s on the interest rates prevailing at that time. Please let me know the latest rule (Government Reference No.) regarding the same. Also I would like to know whether the interest on NRE FD during the RNOR period is taxable.

In case the status gets converted to Resident directly, what will be the status of NRE FD’s?

b) Can I have an RFC account being a RNOR / Resident? If so, is the interest taxable?

Please reply

Srinivasan

Dear Srinivasan,

a) Since you have returned permanently, you are a resident now as per FEMA. Therefore, you should convert NRE FDs to resident FDs.

NRE FD has no relation to RNOR status.

Whether you can hold NRE FD is decided as per FEMA.

RNOR is a status as per Income Tax Act. No relation between the two.

Even if you continue to hold NRE FDs, interest is exempt only for NRI (as per FEMA). Since you are no longer NRI as per FEMA, the interest becomes taxable.

b) Interest income from RFC is tax-exempt so long as you are RNOR.

Suggest you also consult a Chartered Accountant.

Dear Deepesh Raghaw: Thank you for your articles. However, I am still confused on the issue of Taxability of NRE-FDs , FCNR-FDs, and RFC ACs, when one is RNOR.

In your response of 20-September, it was mentioned “…..NRE accounts are local accounts. Hence, RNOR status does not help….” But even FCNR-FDs and RFC ACs are ‘local’ accounts, and are ‘Tax-free’ for RNORs.; so why is the same logic not applicable to NRE-FDs?

Is there any ‘Official’ notification on this subject, which does provide clarifications explicitly on this subject. Appreciate your feedback. Thank you

Dear Kris,

Please refer to Section 10 of the Income Tax Act.

Dear Deepesh,

Thanks for the informative article. I have a question for which I am not able to find answer anywhere. Perhaps you may help me out.

I am an NRI since 15 years. I visit every year in India and spend approximately 60 days.

This financial year 2017-18, due to family reasons, I have spent around 240 days and now I am back in UK.

I have some NRE FDs which give me an interest of about few Lacs every year and till now I have been filing return as NRI thus getting exemption from Income Tax being an NRI.

Since this year I have already spent 240 days in India so I was thinking of filing the tax return for this financial year 2017-18 as RNOR in July 2018.

My questions are:

1. If the interest on my NRE FDs will be exempt or I have to pay the tax as being RNOR? (From your article it looks like that for RNOR only FCNR interest is exempt and not NRE FDs)

I presume, as far as under FEMA laws, I am an NRI as my return to India for 270 days was temporary and now I am back in UK. I did not ask banks to change the status of my NRE bank account to resident as my stay in India was only temporary. So under FEMA laws, it looks like interest earned on NRE FDs is exempt as I am eligible to hold on to NRE accounts even filing my tax return as RNOR.

Many Thanks

Dear Sunil,

Please understand I am not a tax expert. My knowledge is fairly limited.

Even though I will express my opinion, request you to verify this with a CA.

The interest income on NRE accounts is exempt from NRIs as per FEMA (and not as per Income Tax Act).

Therefore, so long as you qualify as NRE as per FEMA, you wouldn’t be taxed.

Since FEMA consider preceding year and not previous year (and now you are back in UK), you should be fine. No tax on interest income on NRE account.

In my opinion, RNOR status has little role to play in your case.

Suggest you go through this post.

https://www.personalfinanceplan.in/opinion/who-is-nri-as-per-fema-and-income-tax-act/

Hello Sir, I will be returning to India in April after living outside for 17 years. I have NRE and NRO Fixed deposits. Within how much time I should convert NRE/NRO FDs?

I will be quite busy upon returns searching for houses to purchase, so I may not have time to go to the bank. Is there any time limit for converting?

Also, I have appeared for interviews and I expect to get a job but not sure also that may not materialize till June. Should I wait till I know the final outcome for converting NRE FDs to Resident FDs because I may not be able convert back to NRE FDs if I go out again.

Appreciate your help.

Hi Krish,

FEMA does not specify any time limits. So, you have discretion to some extent.

However, if you are returning permanently, do it within reasonable time.

If there is uncertaintly about your return for the next 4-5 months, you can continue to hold such accounts till such time.

Please understand “uncertainty” can be subjective. Can be called into question.

Thanks Raghaw a lot. It helps me. One related question-Can I transfer my retirement benefit and other money lying in my bank abroad to India in that period as NRI? Because once I declare as Resident (if I do not get a job) that will be added in my income, right? So should I wait for transfer till my status is certain?

Thanks Raghaw a lot.

One related question-Can I transfer my retirement benefit and other money lying in my bank abroad to India in that period as NRI? Because once I declare as Resident (if I do not get a job) that will be added in my income, right? So should I wait for transfer till my status is certain?

IF a lumpsum is lying there, you can transfer to India.

Merely transfer of monoey to India does not give rise to tax liability.

Thank you so much for detailed answers.

I was residing outside India till 2 years ago. While I’m now employed at an Indian company, the plan was to be living outside India. So I let my NRE account stay in status-quo. There was no FD however it did get the savings interest rate.

Since then, I’m now in India and not clear when I start residing outside again. Since the account was NRE the savings account has been tax-free.

Given the situation I think it’s best to convert the NRE to resident and re-open an NRE account when I do get NRI status. However, what should the tax implication be on the savings interest on the NRE account over the 2 years?

Any insight will be much appreciated.

Thank you.

Anya

Hi Anya,

If you are working in India, you should close NRE accounts.

Since you have been resident as per FEMA for two years, NRE interest is anyways taxable.

NRE interest is tax-exempt only for those who are NRIs as per FEMA.

I am completing my present employment in Oman after working here for 33 years by end of March and return to India. However, I have a visit Visa for Canada and USA valid till 2026 and 2022 respectively. In each place I can stay for Six months each. Hence if I stay in Canada/ USA for more than six months in the year 2018-19, is it necessary to inform bank to convert my NRE accounts as my stay outside India will be more than six months in 2018-19?

Dear Sir,

If you stay outside India for over 6 months every year, you can keep NRE/NRO accounts.

Dear Deepesh

I have been an NRI for the last 9 years and am returning to India shortly. Should i inform my bank (SBI) now for the conversion of the account or wait till i arrive in India. What happens to my FD’s. what if I don’t inform the bank about my changed status and wait till FD’s are matured (maturity in October). Can I operate the account while i am back in india or i have to wait till i convert my NRE account.

Dear Vimal,

Inform when you are back.

Continuing Non-resident accounts when you are a resident (as per FEMA) is a violation of FEMA.

In any case, NRE interest is exempt only for person outside India (as per FEMA).

So, better to convert NRE FDs to resident.

Btw, you don’t have to convert NR account to resident on day 1. You can take a few months to convert.

Dear sir

I was an NRI and now I am a resident

I have Ana NRE a/c and I was not aware about the convertion to resident a/c

Now I am converting the same can you please suggest some tax saving deposit for me

Dear Sir,

Interest on any fixed deposit will be taxable for you.

Dear Sir

I was NRI from last 4 years and just back to India finally in April2018.

I am holding NRE & NRO Accounts and also having FD in NRE Account which will getting matured in Dec2018.

Please advise me on the following.

1. How long I can hold my NRE & NRO Account?

2. What about the FD Status? can i wait till maturity.

3. I joined the employment in India from may2018.

SUGGEST ME THE BEST WAY TO MANAGE MY PORTFOLIO.

Please reply.

MUKUL

Dear Mukul,

1. There is no defined deadline. You must do it within reasonable time.

2. Can’t wait till maturity. Convert to resident within a few months.

Dear sir,

Iam maintaining my NRI status for the past 10 yrs.I have an NRE account. I also have NRE FD which is tax-free.I don’t have any other source of income in India. My query,

1) Am I require to file IT returns in India.

Dear Sir,

If your interest income exceeds Rs 2.5 lacs, you must file returns in India.

Dear Sir,

Can I have your valuable advice regarding the following:

I have to file the tax return for this assessment year 2018-19.

Last financial year 2017-18, I was in India for more than 182 days but in the same financial year in January 2018, I went back to abroad.

I have calculated the past visits and I came to a conclusion that for the Assessment year 2018-19, I need to file the IT return as RNOR

Now my question is:

Can I file the income tax return as RNOR and also avail the Tax benefit for my NRE Fixed deposits as tax free?

Thanks in advance

Dear Suresh,

RNOR status has nothing to do with taxation of NRE FDs.

Taxation of interest on NRE FDs depends on your residential status as per FEMA.

RNOR is a status as per Income Tax Act.

Namaste Deepesh Raghaw ji,

My Son returned from UK in Jan. 2018. He has various NRE Deposits getting matured till end of Nov. 2018 with various maturity dates, but not completed 1 year. In FY2017-18 he did not stay in India for more than 182 days. Therefore his 182 stays period in FY2018-19 will complete by end Sep. 2018. When asked our bankers to re-designate the NRE (IRs) deposits to Resident General Deposits, they told us that we have to wait for the 182 days cooling period till they take this re-designation process.

My questions are:

1. Is their statement of 182 cooling period really considered to be ends by 30.09.18?

2. When NRE Fixed Deposits are converted as Resident General Deposits, the maturity dates and ROI continues till the contractual period? or do we have to lose the interest for the period ran (less than one year NRE deposits does not get any interest) and new FDs will start with new date and new interest rate?

3. One employee in the bank that they can be re-designated and the Manager says that we have close the NRE FDs and lose the interest and then open new Resident SB Account and open the new deposits.

They have no clear cut knowledge. Since all the deposits are getting matured by end Nov. 2018, can I allow them to run till maturity period and then close the NRE Account and pay the Income Tax on the interest when I submit the IT Returns during AY2019-20?

4. I wish to follow the rules, even at the cost of losing the interest by prematurely closing the deposits.

5. Kindly advise the rules in this regard.

Regards

Dear Sir,

Since your son has returned permanently, he is NRI from day 1 of return.

Therefore, he must convert NRE FDs to resident FDs within reasonable time. “Reasonable” is not defined.

1. Never heard of any such things as cooling period. Guess they are confusion the definition as per FEMA and income tax act.

2. You should get contracted rate of interest till maturity.

3. Manager is wrong. NRE interest is taxable for residents are per FEMA (Which your son is). Think paying tax on interest on NRE deposits should be fine too.

Don’t worry much. Drop an e-mail to customer care and seek confirmation. That will be your defence in case some mess happens later on (very unlikely though).

If you are willing to pay tax on interest on NRE deposit, you should not face any issues.

FEMA is enforced by IT officials only. If you are paying your taxes properly, they wouldn’t be bothered.

Thank you very much for your response. I will visit the branch once again and try to finalize the issue. If there is any other issues/vague statements crop up, I will seek your guidance. Kindly help. Regards

Dear Sir

I am NRE Since 1999 and now planned to return India.

Question: I have NRE FDs which will be matured in 2022/2023 but i am returning India in 2020.

Will My NRE FDs continuous till matured period without deduction TDS/TAX ?

Can you provide Mr. Suren Email so that i may send him email for my query.

Appreciate

Thanks

Suresh

Dear Sir,

Interest on NRE FD is exempt only for those who are NRI (as per FEMA).

As per FEMA, you cease to be NRI from day 1 of your return.

Therefore, such interest income on NRE FD after your return is taxable.

The bank may not deduct TDS but you must file taxes properly to avoid any issues later.

Dear Sir,

I am a NRI since Sept 2016. I am thinking of returning to India for good in Dec 2018 or early 2019. I have NRE fixed deposits in ICICI Bank & Indian Bank both of which are maturing on 20th April 2019.

1. Which time for return would be the least troublesome. for dealing with banks. to ask them to contimue on the same rate of interests till maturity?

2. Am I correct that the interests from NRE FDs from the date I become Resident would be taxable? My income would be less than Rs. 2.5 lakhs and I am 80 years old now.

Thanking you & best wishes,

Subramanian.V

Dear Sir,

Since you are 80 years old, your exemption limit will be Rs 5 lacs (if you qualify as resident for a partucular financial year). As per IT Act.

So, if you were to return in the last week of September, 2018, you will qualify as resident for FY2019 (as per IT Act). However, you will be resident (as per FEMA) from day 1 of return.

FEMA talks about converting accounts within a reasonable time. For your age, 6-8 months is not unreasonable.

Since your FDs are maturing in April, 2019, there is no need to rush to close those FDs either. You can let them run till maturity. There is no need to run after banks.

You simply pay tax (or disclose as taxable income) on the interest earned on FDs after you return to India. Given the information shared, it is unlikely you will have to pay any tax.

Even if you return later (than September 2018), it is not much of a problem either. In such a case, you will qualify as NRI (as per IT Act) for FY2019. For NRI, the exempt tax limit is Rs 2.5 lacs irrespective of age. However, since you mentioned that your total income is less than Rs 2.5 lacs, there is nothing to worry about on the tax front.

The gist is that do not let your NRE FDs affect your timing of return to India. Come back as per your convenience.

No need to chase banks. Let FDs run till maturity. Pay tax on the interest income from the day of return.

Hope this helps.

Hi,

I would like to asking some question, When I return to India and my NRE account balance amount how long tax free? there is any particular period?

If I convert my NRE account to normal saving account what about my balance amount it is taxable or not.

up to how much interest tax free? if I have more than 50 lakes in my NRE account after that I return to India and how to transfer this amount to tax free another account? If I FD for 5 years this whole amount how much I have to pay taxes?

Hi Biswas,

It is taxable from day 1 of your return.

There is no tax on conversion from NRE to a resident savings account. The entire interest earned is taxable.

An RFC account can be an option. However, you have to look at the utility too.

Suggest you go through the following post.

https://www.personalfinanceplan.in/returning-nri-what-happens-to-your-nro-nre-and-fcnr-accounts/

Hi

Iam NRI from Aug’2012 and planned to return India in Apr’2019, I have NRE – FD accounts which will be maturing in Dec’2019.

Please suggest the procedure to convert to resident FD and tax implication.

On your return, convert your NRE FD to resident FD. Please check the process with the bank.

After you return, the interest is taxable.

Hello Deepesh,

Assuming an NRI returns to India after 15 years, Could you please clarify the following

(a) Can NRE FD’s be run till maturity like in 3 years and then decide to whether we want to switch the deposit over to RFC or resident FD’s OR does this need to be done immediately like in few months upon return to India permanently?

(b) If we decide to designate the NRE FD’s as resident FD’s, is it possible to convert all the money to dollars like say 100,000 if in future we need it like for some purpose OR we decide to become an NRI again ? If this is possible do we just open an FCNR account and convert the INR to dollars? I would like to know whether it is possible to convert the INR money to dollars if in future I become an NRI or it is locked in as INR.

Thanks

Hello Deepesh,

Could you also clarify this in addition to the above question for the same scenario (NRI returning to India after 15 years.)

(c) If we designate NRE FD’s as Resident FD’s and I become a NRI again AND if it is not possible to convert these FD’s in to FCNR deposits, do these FD’s automatically become NRE FD’s at that point since I became a NRI? Now are the funds from these deposits (Principal and Interest) fully repatriable abroad since I’m an NRI?

(d) If some of the NRE FD’s that have been converted to Resident FD have matured and I have opened another FD from the maturity do those FD’s too become NRE FD’s if I become an NRI ? Now are the funds (Principal and Interest) from these deposits fully repatriable abroad if I become an NRI ?

Hi,

I am not a FEMA expert. I will list down my understanding.

1. Once accounts have been converted to residents, all the accounts will become NRO accounts when you regain NRI status. Repatriation limits as per NRO accounts will apply. If there are plans to regain NRI status, better to keep money in RFC accounts.

2. Nothing becomes NRE when you attain or regain NRI status. Everything gets marked as NRO.

a. To be converted on return (within a few weeks or months).

b. IF you plan to go back in the near future, keep the money in RFC account.

Thank you very much Deepesh. Do we at least have the option to let the NRE deposits run till maturity and then convert these funds to RFC ?

Thanks

On return to India permanently, you become resident on day 1 of return as per FEMA. So, NRE FD can’t be continued.

You do not have to break NRE FD. You need to convert the NRE FD to resident and you can continue till maturity.

Please note interest on NRE FDs in exempt from tax only for persons outside India as per FEMA (NRI as per FEMA).

Therefore, there is no point trying to continue NRE FD.

Thanks, Got it. So the NRE deposits have to be converted RFC within few months of return. It cannot be converted to RFC if I wait till maturity of the deposits.

Dear Mr. Deepesh

I am a NRI since last 7 years in gulf , if I return to India permanently before completing 180 days (i.e. before September month) of current financial year will my end of service benefit and salary which will come before 180 days will be fully taxable or only the interest on it taxable . If yes what is the remedy

Dear Ujwal,

Since the amount involved is likely to be big, suggest you work with a good CA.

The advice can be different depending on the specifics of the case.

Thanks Mr. Dipesh for prompt reply

Regards

ujwal

Hello Deepesh,

This article http://nareshco.com/blog/?p=454#comment-261615 states it is possible to convert NRO deposits to NRE deposits. Do you know if it is possible and whether NRO deposits can be converted to RFC deposits?

Thanks

Dear Mr. Deepesh,

My bank says. for a returning NRI, the NRE fixed deposits can be continued till maturity, with the contracted rate of interest and with tax liability, like a resident FD.

But the NRE recurring deposits need to be prematurely closed .

Is this correct- do RDs need to be closed for returning NRIs?

Thank you .

Dear Sir

I had opened NRE account with my wife several years ago when she was with me overseas but she came to India 10 years ago. I am the first account holder in this account. Due to education of kids she has stayed in India . I visit her often and she also visits me but she is in India for big part of the year.

She is still the joint holder in my NRE A/c where I get my salary and we also have FDs under joint name. However she has been a housewife throughout and never earned any income. In other words she does not have taxable income. She also has continued to keep the resident card of the country where I work . It is renewed for me and her every year.

Is there any problem for her to continue as joint holder with me in my NRE A/C or should her name be removed from the NRE A/C?

Please advise .

Thanks

John

I was abroad in middle east from 1996 till 2012. for 16 years. I was non resident all those 16 years as per NRI definition. I had invested in NRE FD and some of them are maturing in 2020. I changed the status of my NRE SB A/c to Domestic SB A/c. My bank told me to continue the FDs under NRI status till maturity. This was the rule I think in 2012. If this rule has changed subsequently, then the new rule may not apply to me. Besides since I was in middle east continuously for 16 years as NRI under NRI definition, after return I had the status as RNOR for two more years after returning to India. As I come under the older 2012 or before rules, I am continuing my FDs without changing status and will change status after maturity. Also one NRE FD which matured during my RNOR status in 2013-14 was renewed under NRI status.by the bank. Am I legally correct. My Auditor also told me in 2012 that your status of FD will remain NRI FDs till maturity date. Could you please clarify the rules for that period 2012. Thanks.

Dear Sir,

As I understand, the rules have been the same for a long time. Can’t be sure though.

You become resident from day 1 of return and hence must not continue NRE FDs.

My experience is that the bank branch officials know very little about these things. Hence, no point in trusting their word.

Please talk to a competent chartered accountant.

You can also seek clarification from the bank customers care by writing an e-mail.

Dear Sir,

I want to convert my idbi bank NRE FD to Domestic FD but they said I have to break it.

Hello Deepesh Raghaw

I am an NRI and will be returning to India in June 2020 , Theoretically I will be India resident when I pay taxes for AY 20 – 21 . When I repatriate I would be have income in form of Income for 3 months of april may and June .I will also be liable to withdrawal all my retirement benefits (401K which will be taxed in US ) and liquidate my Employee stock purchase plan Shares (This is already taxed on allocation of shares ) .

The question is that I have is will I be liable to pay taxes on all three components visa a visa Income / Retirement benefits & Stock liquidation amount .

secondly If I transfer my money to NRE and then transfer it to saving account post June 2020 will it be taxed ?

I have a query regarding NRI status after return to India.

I am been in usa from Oct-2015 and never been visited in India till now. My work permit over in oct-2021 and I will return to India. If I stay for few months in India (6-9 months) and again travel any other country for work purpose, can I continue my NRE account till I travel ?

or I should have to convert/close NRE account and again re-open while I travel

Thank you in Advance.

Dear Mr. Deepesh,

Could you kindly provide the link to the RBI regulation which allows NRE FDs to continue until maturity for returning Indians. I searched a lot but could not locate it.. My bank insists on closing the NRE FDs and creating it afresh and says it is as per RBI regulation.

Many Thanks

Pooja

Dear Pooja,

NRE deposits can’t be continued until maturity.It must be converted to resident FDs.

Just that the deposit can be continued as a resident deposit until maturity.

Banks sometimes insist on breaking the NRE FD and making resident FD at previaling rates, which is wrong.

https://www.rbi.org.in/scripts/ECMUserParaDetail.aspx?Id=525&CatID=14

Dear Mr. Deepesh,

It is really informative.

Can you please inform that if NRE FD is converted to RFC FD, till how long I can have the benefit of re-conversion to NRE, upon re-gaining NRI status. In other words, after gaining Ordinary resident status how long such RFC FD can be kept – note the deposit is in INR & not any foreign currency.

In this regard, please note that I was NRI for two years only so I don’t have RNOR status.

Regards

Dear Mr Deepesh

With regards to Mr SUREN’s case ( name changed) mentioned above , i am also in the same situation and having NRE account with BOB..

As usual got same reply from my branch that their system not allowing to convert NRE deposits/Fds to Resident Deposits/Fds.

Could it be possible for you to share with me the E mail id of BOB to which SUREN had written.regarding his problem.

Thanks and regards