If you are planning to buy a term life insurance policy, what is the greatest concern you have?

Your greatest concern most likely is: Whether the insurer will settle the claim on my demise?

And this question is very important because if the insurer does not pay the claim, all the premiums paid go waste. More importantly, if the insurer rejects the claim, your family can face serious financial problems. Think about your outstanding home loan. Or kids’ education. Or parents’ wellbeing.

Therefore, as a prospective buyer, you would want to assuage such concerns, wouldn’t you?

How do you reduce chances of claim rejection?

Well, there are two ways.

- Pick up a company that has a good record of settling life insurance claims AND

- Do not give any chance to the life insurer to reject your claim. You do this by making complete medical disclosures while purchasing the plan.

We will come to (2) in the later part of this post. Let’s focus on (1).

For (1), we can look at the past claims settlement data of life insurance companies. If a company has a good claims payment record, you can expect it to continue the good record. Yes, there is no guarantee. However, it is still a better choice than a company with a bad claim settlement record. Agree?

In January 2022, IRDA, the insurance regulator, published the claim settlement data for life insurers for FY2020-2021. Let’s look at the data and see what it tells us.

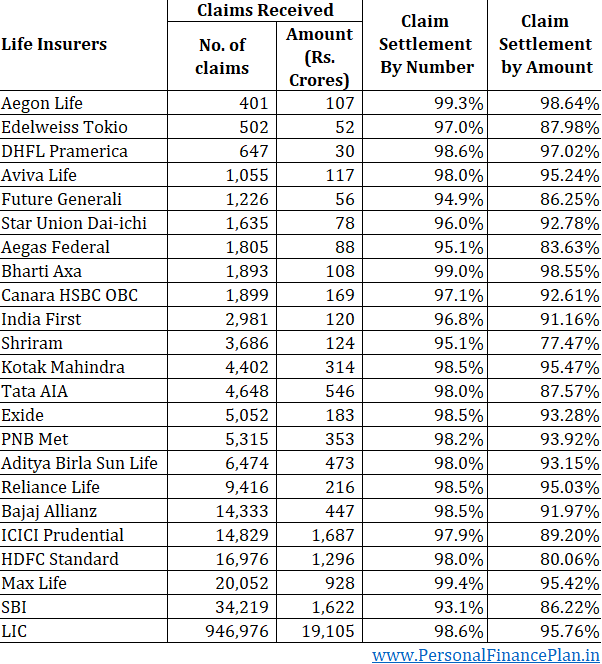

Claim Settlement Ratio of Life Insurance Companies (FY2020-2021)

A 95% claim settlement ratio means the company settled 95 out of every 100 claims received.

Obviously, higher the better.

All but 2 companies report claims settlement ratio of 95% or more.

14 out of 23 companies boast of a settlement ratio greater than 98%.

3 companies report more than 99%.

That’s good.

But there is a problem. Sometimes, the numbers can hide more than they reveal.

This data is for all types of life insurance policies combined.

What if the insurance company is settling low value claims (in ULIPs or traditional plans) but rejecting high value claims (in term insurance plans)?

And that is possible. After all, the claim amount is a much bigger multiple of annual premium in the case of term insurance plans. For instance, a premium of 12K-15K per annum can get you a term life cover of Rs 1 crore. Sum Assured is 600-700X annual premium. Therefore, the insurance company (or the reinsurer) must pay a much bigger amount from its pocket in case of term plans.

Contrast this with traditional life insurance plans and ULIPs, where due to the tax rules and product structure, the Sum Assured usually is 10X annual premium.

With such economics, you would expect the life insurance companies NOT to pay claims happily in case of term insurance plans. They would investigate more and be keener to find ways to reject claims.

Now, since you want to buy a term life insurance plan, you would want to know the claim settlement record for term insurance plans. Unfortunately, neither IRDA nor the life insurance companies provide such data.

Fortunately, we have a proxy. The IRDA annual report provides claim settlement data by benefit amount too.

Claims Settlement Ratio by Benefit Amount (FY2020-2021)

Let’s say a life insurance company receives 1000 claims in a year. It approves 990 claims and rejects 10 claims.

Claim settlement ratio by number= 990/1000 = 99% (That’s good)

Now, let’s say, out of these 1000 claims, 950 claims were from traditional plans and ULIPs. And the remaining 50 claims were from term plans.

Let’s further assume that 950 claims were Rs 5 lacs each. And the term plan claims were Rs 1 crore each. The insurance company settles 100% of 950 claims from traditional plans and ULIPs but settles only 80% of the claims (40 out of 50) in term plans.

If we look at the claim settlement ratio by number, the claim settlement ratio is still 99%.

However, if we look at the claim settlement by benefit, the number is much lower.

The insurance company received claims worth 97.5 crores (950 x 5 lacs + 50 X 1 crore).

The insurance company settlement ratio worth 87.5 crores (950 X 5 lacs + 40 X 1 crore).

Claim settlement ratio by benefit amount = 89.75% (this number does not look good).

HDFC Life has a claim settlement ratio of 98% by number and only 80% by benefit amount. Not good.

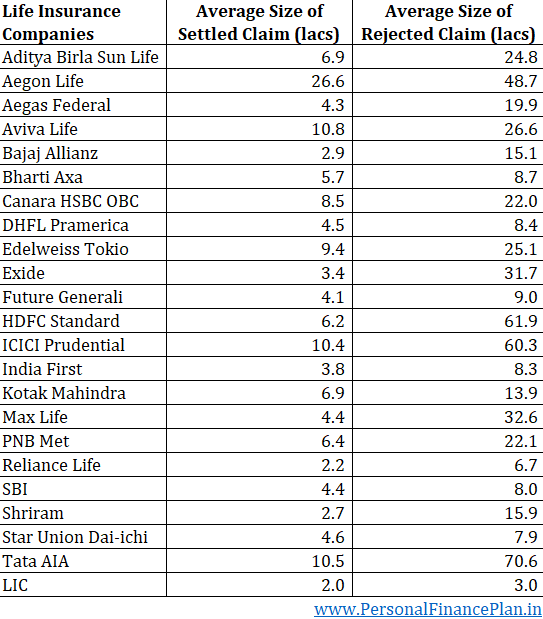

I also reproduce below the average size of settled and rejected life insurance claims (for individual policies) in FY2021.

You can see the size of average rejected claims is much higher than settled claims.

You should expect greater scrutiny of high value claims but…

Yes, you must expect greater scrutiny because more money is at stake. Moreover, if one intends to defraud an insurance company, he is likely to do this by buying a high value policy like a term life insurance plan. However, it is not wise to assume that genuine cases are not rejected (where there was no intent of fraud).

Why would genuine cases get rejected?

Because of material non-disclosures.

If you do not disclose your health conditions at the time of policy purchase, the underwriting team cannot price the policy properly and the insurer is justified in rejecting the claim (after it discovers about undisclosed conditions).

Non-disclosure could be a case of omission. You forget to share a health condition with the company. Please don’t do that.

Or an act of commission. You deliberately hide details from the insurance company. No mercy for such buyers.

However, I know of cases where the sales executives from insurance companies mislead and encourage buyers to not disclose certain conditions as that would reduce chances of policy issuance. This is bad judgement on part of the buyer and the insurance companies share the blame. As a buyer, you must understand that salespersons’ incentives are linked to the number of policies they sell. Not linked to whether the claim on the policy sold was settled or rejected.

You can’t blame the life insurance company for rejecting claims for non-disclosures

If a company says they got too many fraudulent claims (or non-disclosure claims), please don’t buy the argument.

How is it possible that a particular company is getting more than its share of fraud and non-disclosure cases? Why would buyers hide try to defraud or hide their health conditions only from that insurance company? Makes no sense, right?

If a particular insurance company has a history of low claim settlement ratios by benefit amount, it is an indictment of their sales practices and their claim settlement culture.

You can review my posts on Claim settlement ratio of life insurers in the previous years. FY2016 FY2018

Buy the term insurance plan from an insurer with more than 98% claim settlement ratio by number and more than 95% (or at least 90%) claim settlement ratio by benefit amount. Additionally, focus on the trend. If there is a sharp divergence between the 2 claim settlement ratios for a company for many years, you have a reason to be skeptical of such life insurer.

Don’t become complacent because of Section 45 of the Insurance Act, 2015

As per Section 45, a life insurance claim cannot be rejected if your insurance policy is over 3 years old. Thus, even if you hid a medical condition from the insurance company at the time of purchase, the insurance company has 3 years to find out about non-disclosure. After three years, the policy can’t be rejected on grounds on non-disclosure.

While this is comforting, don’t become complacent. Two reasons for this.

- The demise can happen before completion of 3 years, in which case the claim will likely be rejected, and your family will be left high and dry.

- Even if the demise happens after 3 years, the insurance company can reject the claim on some grounds and force you to approach the ombudsman or the courts. While Section 45 tilts the balance in your favour, you can never be certain of the case outcome. Moreover, the delay in the claim settlement and legal costs will burden your family.

Always remember, even a company with 99.5% claim settlement ratio by number has rejected 0.5% of the claims. If you are NOT diligent, you could fall in those unlucky 0.5% of the rejected claim applications. And a company with 95% settlement ratio settles 95% of the claims. Your case could be in those 95% settled claims.

Term Life Insurance plans are simple

Term life insurance plans have just one insured event. Demise of the policy holder. Unlike a health insurance plan where there can be disconnect between whether a particular treatment is covered or not, the insured event in a term insurance plan is rather objective. It is difficult to have a difference of opinion over whether a person is dead or alive. Therefore, the only cause of rejection could be that you did not make proper disclosures (medical or financial) at the time of policy purchase.

Hence, make complete health (and financial) disclosures while purchasing a life insurance plan. You don’t decide what information is material or not. Let the insurance company decide that.

Remember you won’t be around to contest any flaws in your application. Your family will have to fight it out. Only the insurance companies have access to the “recorded lines,” not your family. How will they contest the claims of the insurance company?

Therefore, if you are buying the policy over phone and disclose your health conditions to the sales executive, make it a point to share the same information with the insurance company over an email too. Copy such emails to a family member too. And ensure those health conditions are captured in the proposal form attached with your policy.

The insurers issue the insurance policies in good faith since there is a lot of information asymmetry. You know much more about your health than the insurer does. Keep your end of the bargain.

The post was first published in February 2022.

9 thoughts on “The Best Life Insurance Company for Term Plans (2022)”

Found your website yesterday and have read several posts now. I must say these are very intriguing and informative to say the least. I love the extra mile you went in providing some very concealed facts related to insurances which others fail to write.

I also find your opinions useful as sometimes we as laymen are unable to make good decisions on some subjective matrices.

Coming to opinions,

1) I want to know your opinion on the cheapest term plans which are credible too.

2) I also want your opinion on TATA AIA Sampoorna Raksha Supreme and the best term plan from PnB Metlife holistically.

3) What is the best premium paying term (in years) according to you?

4) There is a compulsory rider with TATA AIA Sampoorna Raksha Supreme called the term and terminal illness rider which gets its sum assured from the total sum assured (a portion of it). I have talked to the executives but no one has given me a convincing or clear answer on whether I will get this amount in terminal illness only or in both cases of terminal illness and death (combined with the base sum assured in death). If you can help me on this.

And Finally Thank You for your patience for such a long comment cum query.

Hi Piyush,

Thanks for the kind words. Please do share with friends and family. If you found it useful, they might find this post useful too.

1. Term insurance plans are commodity. Go with the cheapest insurer you are comfortable with.

2. As mentioned above, all term plans are very similar and customizable. Not much to choose.

3. Until the age of 60 (or your planned retirement). The answer may change depending on your requirements.

4. Terminal illness riders usually come at no extra cost (or at very little cost). This rider is usually an accelerated rider (and not an additional benefit rider). Diagnosis of the terminal illness simply accelerates the payment (does not increase it). You get no extra money. Instead of the family getting the money after the policyholder’s demise, the policyholder gets the money before demise. In contrast, Accidental death rider is an additional benefit rider. The family gets extra money if the demise happens in an accident. Wrote this post ages back (https://www.personalfinanceplan.in/all-you-need-to-know-about-life-insurance-riders/). Might help.

Thank You Deepesh for the useful insights on the queries.

I will certainly share it with my friends and family this post truly deserves it, thanks to the time and efforts you have put in it.

Dear Deepesh,

have a query,

Term plan that offer Surrender Value factors for limited pay policies.

Should one use it and when >

thanks

Pradeep

Hi Pradeep,

It’s more about convenience than anything else.

If you just want to pay for a few years and forget about it, you can do that. Otherwise, regular premium payment is a better choice.

Excellent article ..

Thank you Sri!

Hi Deepesh,

Thanks a lot for writing very informative articles every once in a while. I really appreciate that.

In this article, you have suggested to make complete health (and financial) disclosures. Health I can understand. Regarding financial disclosures, I have three questions.

1) What kind of financial information we must disclose honestly?

2) While buying, they ask for exiting insurance policies. Will they reject my claim, if I hide it from them?

3) This question is continuation of previous question. Is having over-insurance illegal in our country? I mean, Term Plans Insurers allow maximum coverage of 25 to 30 times of annual income. Can I buy 3 term plans from 3 different companies with maximum allowable coverage?

Regards,

Naman

Thanks Naman!

1. Financial information disclosure is quite simple. You just have to share your payslips or ITR. Difficult to mess up here unless you do it intentionally. People can fudge up income papers just to get higher term life cover. That can be a problem.

2. Don’t hide. Hiding is yet another form of financial non-disclosure. The insurers need to know about your other covers because that also forms part of financial underwriting. Just to give an example, a person has income of say Rs 5 lacs. The insurers do not want to offer life cover of more than 20 times annual income (let’s say). That means this person can only buy life cover of Rs 1 crore (from across the industry). He/she goes and buys Rs 1 crore cover from 5 insurers (by not disclosing covers bought from other companies). Total of Rs 5 crores. That’s where the problem lies. If I were an insurer, I would not be comfortable selling life insurance to this person. Because I don’t know what’s going through his mind.

I have not heard about any claims being rejected for this reason. I do think it is a feeble ground for claim rejection. But yes, always better to disclose.

3. Answered in Point 2. Not illegal but insurers have that tacit rule.