Long-term capital gains tax on the sale of equity and equity funds has now been introduced.

Earlier, if you sold the listed shares or equity oriented mutual funds after 1 year, the resulting capital gains were exempt from income tax.

This is no more the case.

How will Long-Term Capital Gains on Sale of Equity Mutual Funds/shares be taxed?

Such long-term capital gains are exempt only to the extent of Rs 1 lac per annum.

If such LTCG (from the sale of equity and equity funds) exceeds Rs 1 lac per financial year, excess LTCG will be taxed at flat 10% without the benefit of indexation.

Clearly, this is not a move that will please equity investors.

At the same time, all gains up to January 31, 2018, will be grandfathered. (explained later)

This means you will not be taxed on any gains that you have already accumulated till January 31, 2018.

Let’s assume you purchased the stock on March 15, 2017 at Rs 100 and the highest stock price on January 31, 2018 (or the ending NAV on January 31, 2018) is Rs 120.

Now, suppose you sell the stock/equity mutual fund on July 10, 2018 at Rs 170. Since the holding period is greater than 1 year, the resulting gains will qualify as long-term capital gain.

Under the older regime, you wouldn’t have to pay any tax on the gains since LTCG on the sale of listed shares and equity MF units was exempt from tax.

Under the new rule, you will have to pay tax on Rs 50 (Rs 170-Rs 120). Do note your purchase price was Rs 100 and Rs 120 was the highest price on January 31, 2018.

Even though your LTCG is Rs 70, you have to pay tax at 10% only on the Rs 50.

By the way, if the price on January 31, 2018, is lower than your purchase price, your purchase price will be considered for the purpose of calculating the long-term capital gains and the resulting tax.

I have explained the calculations through various scenarios later in the post.

Do note the tax is applicable if such LTCG exceeds Rs 1 lac in the financial year.

If you are a small investor, you may be able to avoid some tax hit by keeping LTCG on the sale of equity/equity shares by keeping your Long-term capital gains below Rs 1 lacs per financial year.

Dividends from Equity funds to be taxed at 10%.

This is in line with the introduction of Long-term capital gains tax on the sale of listed shares and equity fund units. Since LTCG is now 10%, the dividend income from such equity funds will also be taxed at 10%.

Essentially, the AMC will deduct the tax in form of dividend distribution tax (DDT) of 10%. So you will not have to pay any tax. Earlier, there was no DDT for equity-oriented funds. Do note that the tax that AMC pays comes from your money.

So, if the dividend is Rs 10 (your NAV will go down by Rs 10), you will get only Rs 9 in your hand (in fact slightly cess due to surcharge and taxes).

If you see, your effective tax hit will be higher than 10% due to surcharge (12%) and cess (now 4%). Your tax liability will be 11.65%. Frankly, the way DDT calculation works, it will be even higher. Read this post for the calculation of dividend distribution tax on equity funds.

If you are relying on dividend from equity funds (a bad idea in the first place), you will have to pay tax dividends received in the future.

A few fund houses had been promoting dividend schemes of equity funds for tax-free regular income. I believe many investors will bid goodbye to dividend schemes now.

The dividend on listed equity shares is taxable at 10% if such dividend income exceeds Rs 10 lacs in the year (this change was made in the last year’s budget). I believe the rule stays the same.

Points to Note

Short-term capital gains (for holding period < 1 year) shall be taxed at 15% (unchanged).

Tax-saving mutual funds (Equity linked saving schemes or ELSS) will also be hit.

Arbitrage funds will be similarly hit.

The taxation of capital gains for debt mutual funds remains unchanged. Short-term capital gains (holding period < 3 years) will be taxed at your slab rate. Long-term capital gains (holding period > 3 years) will be taxed at 20% after accounting for indexation.

For equity funds too, DDT will be applicable at 10%. Therefore, you effective liability will be 11.65%.

Will I have to pay tax if I sell before March 31, 2018?

You will not have to pay any tax if you sell on or before March 31, 2018. The new rule comes into effect only from April 1, 2018.

So, should you rush to redeem before March 31, 2018?

Don’t think so. In any case, there is no tax liability for the gain made until January 31, 2018.

So, unless your stock or MF NAV is sharply higher from the price on January 31, 2018 (or actual purchase price, whichever is higher), it does not help much to sell and book profits this financial year.

However, if prevailing price is sharply higher than the price on January 31, 2018 (or actual purchase price, whichever is higher), you can sell your holding before March 31 and wouldn’t have to pay any tax. I assume you will sell and buy back the asset.

Do note if you purchase a share or MF now (after Feb 1) and sell before March 31, 2018 for a profit, it qualifies as a short-term gain and you will have to pay tax at 15%.

My Opinion

There is no need to rush to redeem your MF investments now. It will not help any bit. Taxes need to be paid on any appreciation after January 31, 2018. You may redeem some investments this financial year so that your LTCG on sale of equity does not exceed Rs 1 lac. You can reinvest the amount later. That’s it. There is no other benefit in rushing to redeem your existing equity investments.

The new taxation might promote the habit of keep booking profits gradually. For instance, I have a holding in ABC Fund. I may keep selling my units in the fund after 1 year (and buy the units again) so that I keep leveraging the exemption on the initial Rs 1 lac of LTCG every year. I am not sure if this approach will attract any tax-avoidance provisions of the Income Tax Act.

The tax on LTCG will be a problem if you are planning to shift from regular to direct funds. You will now have to exercise greater care in shifting from regular plan to direct plan of equity mutual fund schemes. Chartered Accountants, financial planners, and RIAs have their task cut out.

Dividend option in equity mutual funds never really appealed to me. Growth option was always a better choice (barring a few exceptional cases). With dividend now being taxed at flat 10%, growth option is clearly a better choice since you at least have a buffer of Rs 1 lac of capital gains.

Now that the long-term capital gain on sale of equity funds and listed shares is taxable, you can expect long-term capital losses on the sale of equity shares or equity mutual fund units to set off capital gains. Additionally, you will be able to take a deduction for investments made in PPF etc against long-term capital gains.

Unit-linked savings schemes (ULIPs) now have a great tax advantage over equity mutual funds. No new tax has been introduced for insurance policies. ULIPs already had the benefit of tax-free switching. I am not saying that you should go start investing in ULIPs in place of equity mutual funds. ULIPs have their own set of issues. However, the advantage on the taxation front is quite easy to see. No surprise insurance companies are rejoicing. They are already out with ads highlighting the issue.

Rebalancing your portfolio may have an extra tax burden. Shifting from debt to equity always had tax implications. However, shifting from equity to debt may now have an additional cost involved.

Long-Term Capital Gains Calculation with Examples

How is the purchase price of your share or MF units determined?

When you calculate capital gains, you need two inputs, the purchase price, and the sale price.

Indexation benefit is not permitted for equity shares and equity mutual fund units. So, we don’t need to worry about indexing the cost of purchase.

You will know the sale price when you actually sell the asset (stock or MF unit).

About the purchase price, you need to make a minor adjustment because of grandfathering clause.

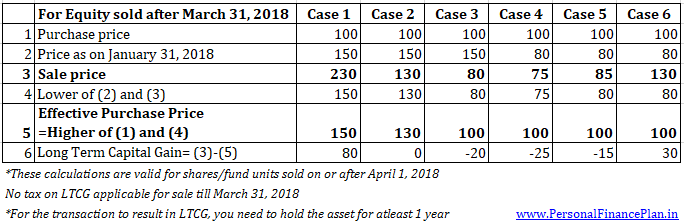

As per the proposal, the effective purchase price (to be considered for calculation of capital gains) shall be:

Higher of

- Actual Purchase Price

- Lower of the following two:

- Highest price on January 31, 2018 (For MF units, it shall be the day-end NAV)

- Actual Sale price

Let’s try to understand with the help of a few examples. I have tried various permutations and combinations to show the impact of the new rule.

In the first case, the effective purchase price is Rs 150 (price as on January 31, 2018). Therefore, the capital gain is only Rs 80 (Rs 230-Rs 150). You have saved gains worth Rs 30 (Rs 130 – Rs 100) due to the grandfathering provision.

Points to Note

- The relaxation of Rs 1 lac is for the financial year and not per scrip or fund unit.

- For NRIs, they will have to pay tax on Rupee gains. Provisions of Section 48(1) do not apply.

- Indexation benefit is also not available.

- No Long-Term Capital Gains tax on sale made till March 31, 2018.

Please understand these are still budget proposals. These will not come into force till such time the Budget is passed by the Parliaments. In the past, many of the budget proposals have been withdrawn. However, this is tantamount to speculation. I am not a tax expert either. You are advised to talk to a Chartered Accountant before taking any decision.

35 thoughts on “Budget 2018: Long Term Capital Gains Tax on Equity Mutual Funds and Listed Shares Introduced”

Well explained as usual.

While not pleasing to equity investors, it can be argued that it’s only fair to tax all gains be it equity or not. On the other hand, isn’t there a transaction tax on purchasing/selling equities (believe not on mutual funds). Never fair to tax twice. Moreover, this 10% tax on gains can open the door for future tax increases on long term equity gains.

As for “might promote the habit of keep booking profits gradually”, investor would need to take into consideration the transaction tax (0.1% + 0.1% of the total investment).

Hi John,

Thanks. Please share the post with your friends too.

Yes, I think that’s fair too.

Yes, the door is open for future increases.

STT impact is likely to be minimal. Impact of LTCG tax will be high. Exit loads can be worked around.

Nice article, provided a lot of clarity. By the way can I claim tax credit or adjust against my other sources of income any loss in capital gain? I feel no since any loss say -50000 < +100000. Am I correct?

Thanks Shuvam.

As I understand, LTCL can be set off only against LTCG, not other sources of income.

The budget introducing LTCG on shares @10% is for AY 19-20. The finance bill says the amendments to the IT Act are effective April 1st 2019. So any shares sold prior to 31st march 2018 which have been held for one year plus should be exempt in AY 2018-19. Please correct me if i am wrong.

Hi Basant,

I have read this argument. To be honest, I am a bit unsure too. The Government needs to come ahead and clarify.

However, in my opinion, the change has to be effective immediately (once budget is passed). Otherwise, it leads to very heavy selling before March 31.

January 31 is a more prudent choice.

In my opinion, no LTCG tax for the shares sold before 1st Apr 2018. Because, this is just the budget PROPOSAL for the FINANCIAL YEAR 2018-19. Nothing in this budget proposal will be effective until it is approved by the parliament.

Hi Navada,

I am coming around to your thinking too. Earlier, I had thought it should be after January 31.

January 31, to me, is a more prudent choice.Therefore, I thought, when this bill is passed, it will be made retrospective.

However, now I believe (after going through the bill in some detail), this taxation comes into the picture on April 1, 2018.

So, no tax before March 31.

Thanks for pointing out. Appreciate your inputs.

I will update the post accordingly.

Yes, Mr Deepesh; further, this need NOT result in panic selling before 31st March. All you need to do is sell and then buy the same – that too only if there is any gain AFTER 31st January!

Hi Deepesh

Nice article. Have one query on the LTCG. please help clarify

if the LTCG more than 1 lakh, let’s say 1.5 lakhs, would the tax be 10% of 50000 (5000) or the Tax will be 10% of entire 150000 (15000) ?

Vasanth,

In your example, tax will be 5000 (not 15000)

Hi Vasanth,

Tax will be on the excess amount i.e. on Rs 50,000.

Nice article. Will this be applicable for shares which were bought in 2015? Say I purchased some shares in 2015 for Rs. 100, and on Jan 31st it was Rs. 180. And I decide to sell in Jul 2018 for Rs. 210. Will I be taxed at 10% on the Rs. 30 per share profit?

Can you please clarify?

Thanks

Yes, you are right Rakesh

You are right, Rakesh.

You will have to pay tax on Rs 30 (and not Rs 110).

Would I still need to pay LTCG if i sell before 31/03/2018?

This is a bit of a grey area for me. In my opinion, yes.

However, I have read a different interpretation too (where there are no taxes till March 31).

The Government needs to come ahead and clarify. or let the dust settle first.

Will the taxes be applicable to entire Capital Gain or only on portion of Capital Gain in excess of Rs. 100000/-

eg., if someone makes CG of Rs. 150000, then will he have to pay LTCG on 50000 or entire 150000/-. Please clarify.

only on the excess amount i.e on Rs 50,000

Thanks for the article.

Let’s Assume, I purchase a fund for 1 lakh & sell it after 10 years (assume sell price is 4 lakhs).

Now how LTCG tax will be calculated? Does overall gains(4-1=3 lakhs) after 10 years will be taxed or will they check whether individual FY exceeds 1 lakh & apply LTCG tax.

Thanks in Advance.

Hi Vivek,

You will have to pay tax on Rs 3 lacs.

There is no relation to how many years you held the stock.

The limit of Rs 1 lakh comes into picture only in the year of sale (and not the intervening years).

In the above example, i have to pay LTCG tax @ 10% for 2 lakhs not 3 lakhs right? Because gains is 3 lakhs and 1 lakh is exempted.

Yes, right. If there is no other similar LTCG, the tax has to be paid only on Rs 2 lacs.

Thanks for pointing out.

In this case, instead of waiting for 10 years, sell once the profit just exceeds 1 lakh and then repurchase it. So LTCG tax may be avoided.

How does that help ?

Are you saying you don’t have to pay tax on the gains made on repurchase ?

Ok got it now.

You are converting profit into cost here and hence less LTCG gain for future. Smart.

Great!!!

Mr. Deepesh,

Thank you for the well explained post on LTCG on equity MF.

I have got the account statement on 31st Jan 2018 of one of my SIP investments in XYZ equity mutual fund,-Regular-growth option. (in which I am investing since approximately

5years)The summary is:

Cost of investment :3.1lakh

Current value 4.53lakh

NAV 42.06

Unit balance 10,790

How will the LTCG be calculated for it? Please explain.

The gain from Rs 3.1 lakhs to 4.53 lacs i.e. 1.43 lacs is safe from tax (irrespective of when you sell it now).

If you sell after March 31, 2018, the gain will be calculated as sale price – 4.53 lacs. You will have to pay tax at 10% on the amount.

Even on this amount, the tax is applicable only on the gains in excess of Rs 1 lacs.

Hope this answers your query.

As per Grandfathering Clause, now LTCG tax will be applicable only for gains on securities based on the difference between their sale price and their highest price as on 31 Jan 2018. I have 2 queries:

1. As now there will be difference in the total long term capital gain and the long term capital gain (as calculated for taxation purposes due to Grandfathering Clause). Shall we require to show both these amounts of LTCG in income tax returns ( one portion under exempted income and taxable portion in non exempted income) or only the taxable portion.

2. Should Long Term Capital Loss be compensated against total long term capital gain or it can be compensated against taxable portion of long term capital gain thereby reducing the effective long term capital gain and hence the tax.

1. That will depend on the return form. Can’t comment.

2. Yes, you should be allowed to set off long term gains against losses too now.

Dear Sir,

You have mentioned the highest rate of 31/01/2018.In some sites they are mentioning as closing price of 31/01/2018.Please clarify.

Hi Shankar,

Highest price for direct equity

For MFs, since there is no trading, day end NAV shall be considered.

Hi Deepesh,

Thanks. What about NFO’s which are closed for e.g. 3 years ? There is no possibility of exiting upon

reaching 1 lac LTCG & repurchasing it. But it is possible in existing open ended MF’s.

Will it discourage people from buying NFO’s and instead prefer open ended MF’s ?

Hi Rahul,

The tax applies to NFOs and close-end funds too.

Right, if you can’t exit before 3 years, you can’t churn to utilize Rs 1 lac exemption every year.