Life is fickle. Anything can happen. You purchase insurance to protect yourself financially against such unfortunate events. A good insurance portfolio ensures that you (or your finances) are covered against all eventualities. Life insurance proceeds will ensure that your family achieves the financial goals in your absence. A health insurance plan will ensure quality health care for you and your family. Many of us are inclined to feel that if we have adequate life and health insurance, your finances (and the financial goals) are protected.

Is that true or are we missing something?

What about an accident or an illness that causes total or partial disability, which in turn compromises your ability to earn income at the level before accident. Life insurance will typically not cover such a scenario. Health insurance covers only hospitalization expenses. You can see there is a gap, which is not covered. It is in such cases that a Personal Accident Cover can come in handy. Personal Accident Insurance plans offer very limited coverage but are still better than nothing.

In this post, we shall discuss what a personal accident plan covers and what it does not cover. We will also discuss whether a personal accident plan is a must-have in your insurance portfolio.

What is a Personal Accident Insurance Policy?

As the name suggests, a personal accident plan covers damage to the insured in an accident.

A personal accident policy covers death, permanent total disability, permanent partial disability and total temporary disability due to an accident. First of all, these events have to happen in an accident. If the insured person dies or gets totally or partially disabled through a natural illness, such disability (or death) will not be covered under a personal accident policy.

What is an Accident?

An Accident is a sudden, unforeseen, involuntary event caused by external and visible means. This is standard definition of “Accident” as per IRDA Guidelines on Standardization in Health Insurance, 2013. Therefore, all the personal accident policies should have same definition of an “Accident”. In some of the policies I read, “External and visible means” was replaced by “External, visible and violent means”.

As per aforesaid IRDA guidelines, “Injury” means physical body harm excluding illness or disease solely and directly caused by external, violent, visible and evident means which is verified by a medical practitioner.

It is quite clear with this definition that injuries and damages (or even death) that happen due to natural causes (or perhaps even due to negligence) will not be covered under a personal accident policy. The definition of accident makes it a grey area. By the way, insurers love subjectivity. It gives them greater leeway in rejecting claims.

As I understand, some accidents of the truly personal nature will not be covered in the personal accident policy. I doubt you will be paid for disability due to fall in your bathroom or slip on the stairs in your house. In fact, for any accident that happens inside the confines of your houses, the insurance company will have too many cards up its sleeves.

However, if you happen to slip on the stairs/ escalators in a mall or encounter an accident on road, you should be covered.

What does Personal Accident Policy Cover?

A personal accident policy covers four major events:

- Death due to accident or accidental injuries

- Permanent total disability due to an accident or accidental injuries

- Permanent partial disability due to an accident or accidental injuries

- Total temporary disability due to an accident or accidental injuries

A personal accident plan may or may not cover all four. You can read the terms and conditions in the policy wordings to find out about the exact nature of coverage.

A point to note: Personal Accident Policy is a defined benefit policy i.e. on occurrence of an insured event; the insurance company pays Sum Insured (full or partial as defined under the policy) to the insured. There is no relation to hospitalization expenses. This is in contrast to regular health insurance plans, where only the hospitalization expenses are indemnified. Critical Illness Plans are defined benefit plans too.

For example, if the Sum Insured is Rs 10 lacs, on permanent total disability, the insurer will pay you Rs 10 lacs. On the other hand, in case of permanent partial disability, it may pay you Rs 5 lacs (50% of Sum Insured). The payout is irrespective of the hospitalization expenses incurred.

Certain personal accident policies may provide additional benefits such as Children’s education benefit and reimbursement of medical expenses. However, these are pure marketing gimmicks. You can safely ignore them. Your health insurance should take care of your medical expenses. Children’s education benefit is too small to be meaningful.

How is Accidental Disability defined?

IRDA has no standard definition for the extent of damage to your body to be classified as total or permanent disability. You will have to refer to policy wordings to understand the exact definition.

Though the exact definition will vary across policies, I will put down some of the common aspects from the policies I reviewed.

Exact list was quite long and hence I have not included. Please note the extent of coverage (or the definition of disability) will across policies. You are advised to read the policy terms carefully.

Common Exclusions

Self-inflicted injury or injuries sustained during suicide attempt, participating in hazardous sports, war, civil commotion, terrorism, strike, riot, participating in a criminal activity, any hazardous occupation, influence of drugs or alcohol etc.

Please note individual policies can relax certain conditions or even add a few more exclusions. A specific policy may cover injuries sustained during acts of terrorism.

You are advised to read the term and conditions carefully.

Documents for Claim

- Claim form

- Police Panchnama/FIR/Post mortem report/ Death certificate, if applicable

- Disability/medical certificate from the treating doctor. Medical examination may be required

- Leave certificate from the employer (in case of total temporary disability)

Please read the policy document carefully to get the exact list of documents.

Tax Benefits for Personal Accident Insurance Plan

There is NO tax benefit for the premium paid for personal accident plan under Section 80D. Please understand insurance decisions should never be driven by tax considerations.

Does Personal Accident Insurance cover a gap?

We have discussed various aspects of personal accident insurance plan. Now, let’s discuss the most important question. Do you need a personal accident plan?

To find out the answer, we need to see if the personal accident plan fills an insurance gap in your portfolio.

A personal Accident plan covers four events due to an accident: Death, Permanent total disability, Permanent Partial Disability and Total Temporary Disability. Let’s see if you have other products in your portfolio that cover these events.

- Death of the Insured in an Accident: You should have enough term life cover to take care of your family and all your financial goals after your demise. The cause of the death is immaterial. Since you already have adequate life cover, there is no need to purchase a plan that pays the insured only when he/she dies in an accident. You don’t need a personal accident plan to take care of this scenario. If you have not calculated your life insurance requirement yet, use this Microsoft Excel based calculator to calculate your life insurance requirement.

- Hospitalization Expenses: You should have enough health insurance cover. Again the cause of hospitalization is irrelevant. It can be due to a natural illness or due to an accident. You must have sufficient health cover. Thus, you don’t need a separate personal accident plan to take care of these expenses.

- Total Temporary Disability: This can lead to loss of income since you won’t be able to take up employment for a few weeks or months. However, I feel you should have enough emergency corpus to tide over this short term crisis. I wouldn’t recommend a personal accident cover for this reason either.

- Permanent Total or Partial Disability: This is the situation where a personal accident plan can fill an insurance gap and add value to your insurance portfolio. Such disability can compromise your ability to earn money at the level before accident. In many cases, the ability may be compromised completely. You need risk coverage for such cases. Life insurance covers only death. Health insurance will cover only hospitalization expenses. Though the personal accident plans provide very limited coverage, these plans become unavoidable to take care of such situations.

You need a Personal Accident Cover.

How much Personal Accident cover do you need?

In my opinion, personal accident cover is required only to take care of permanent disability (total or partial). Your life insurance, health insurance and emergency corpus should take care of accidental death, accident related hospitalization and temporary loss of income.

Permanent disability, total or partial, can compromise your earning ability. In fact, it can even add to your expenses. You may require domiciliary treatment (treatment at home), physiotherapy sessions or nurse support. No health insurance cover will cover such expenses beyond a point.

Hence, in the worst case scenario, where the insured gets permanent total disability, the amount should be enough to

- Maintain family lifestyle

- Meet all financial goals

- Cover expenses for own care (home treatment, physiotherapy sessions, nurse expenses etc)

The first two parts were covered while calculating life insurance requirement too. This means personal accident cover should be at least as large as your term insurance cover (life insurance cover).

So, if your life insurance requirement is Rs 1 crore, your personal accident cover should at least be Rs 1 crore.

As you term insurance requirement keeps fluctuating as you acquire responsibility or achieve your financial goal, your personal accident insurance requirement will fluctuate too.

I can purchase an accidental disability rider on my term insurance cover

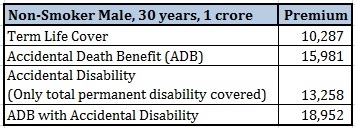

Yes, you can. A number of insurance plans allow you to purchase accidental death benefit and accidental disability rider along with your term plan. You shouldn’t be much bothered about accidental death benefit if you already have adequate life insurance. However, accidental disability rider can be useful. Accidental disability rider is not very expensive either.

I reviewed a few term life covers. Accidental disability riders with such plans covered only permanent total disability. Permanent partial disability was not covered. This is a drawback with such riders.

HDFC Click 2 Protect Plus Plan (Term Plan)

Under the accidental disability rider, the insurance company agreed to provide 1% of Sum Assured per month for 10 years. For a term cover of Rs 1 crore, the insurer will pay Rs 1 lac per month for 10 years.

You can see that for an additional Rs 2971 (Rs 13,258 – Rs 10, 287), you can purchase accidental disability rider of Rs 1.2 crores (ignoring discounting).

The drawback is partial disability is not covered. Secondly, such cover is linked to your base life cover. If you terminate your life cover, the rider cover will automatically lapse.

Life insurance can only be an individual policy. A personal accident cover can cover the entire family. I wouldn’t worry much about this aspect. You need to ensure that the earning members of the family should have adequate life and disability cover. All the members should have adequate health cover.

What does the Premium of Personal Accident Insurance Plan depend on?

Premium for personal accident cover depends on:

- Nature of occupation

- Risk coverage

Given the nature for product, it does not depend much on the age of the insured person. This is in contrast to other insurance plans, where age is one of the most important parameters. I calculated premium for a number of plans. The premium hardly changed because of age of the insured.

For Bajaj Allianz Personal Guard Policy, premium for a 30-year old and 50-year old was same given the occupation did not change.

Under Bajaj Allianz Personal Guard Policy, occupation of the insured falls under one of the three risk levels.

You can see the premium is a function of your occupation.

Since the premium is dependent on your occupation, it is a good idea to inform the insurance company about change in occupation at the earliest. This is to avoid hassles at the time of claim especially if the accident happens while you are on job.

Maximum Sum Insured under most plans was limited to Rs 20-30 lacs. Maximum Sum Insured is also a function of your annual income.

For Apollo Munich Personal Accident Premium Plan, for a person with annual income of less than 2 lacs, the maximum Sum Insured was Rs 15 lacs. On the other hand, for a person with an annual income of Rs 10 lacs and above, the maximum Sum Insured was Rs 5 crores.

So, the premium depends on the nature of occupation. Riskier the occupation, greater the chances of getting injured during work. It goes without saying the premium will depend on the extent of coverage too.

Please note the premium for the plan is independent of age.

For a number of professions such as commercial drivers and miners, the policy could not be bought online. Hence, the premium for such professionals was not available. For such professionals, the insurance company needs to assess risk properly before issuing the policy.

You can see that the cost of insurance is not very high. In fact, the premium rates are comparable to those of term insurance.

PersonalFinancePlan Take

It is quite clear that Personal Accident Insurance Plans cover a gap in your insurance portfolio. Though even personal accident plans will not secure you completely because disability due to natural illness is still not covered. However, as I understand, there are no plans that cover disability due to natural causes. So, you can’t really do much about it.

Your life and health covers won’t be able to keep you financially secure in case of partial or total disability. So, you must purchase a personal accident cover.

However, there is a problem. The Sum Insured for most personal accident insurance plans (apart from Apollo Munich Plan) was capped between Rs 20-30 lacs. To me, this is not adequate. Just because the insurance company does not offer higher coverage, it does not mean your insurance requirement has gone down.

You need to purchase higher personal accident cover. If you can find an insurance company that is willing to offer you high enough cover, then you can purchase such personal accident cover.

Alternatively, you can purchase a personal accident cover up to the maximum amount and also purchase an accidental disability rider on your term insurance plan. The rider will cover only permanent total disability but that’s where the greatest risk lies. Personal Accident plan will cover partial disability while total disability will be covered by both personal accident plan and term plan rider. It does not look the prettiest solution but I cannot think of another solution.

Don’t forget to pray to God regularly. If the God goes after you, no amount of insurance is ever going to be enough.

Rider with Term Insurance or Standalone Personal Accident plan?

If you need a total temporary disability or permanent partial disability cover, it is a no brainer. You must go for Standalone Personal Accident Cover.

Hence, you must see how disability affects your ability to work and earn income. That will depend on your skill set and the nature of your employment.

For instance, a software programmer may still work with a permanent partial disability but a site engineer may find it difficult to discharge duties after loss of a limb. You know your work better.

If your employer has a policy to provide paid medical leaves for 3-6 months to employees, that does away with the requirement of cover for temporary disability. If your employment contract provides for limited paid medical leaves, then the need for cover for temporary disability may go up.

If you are self-employed, the need for temporary disability cover is relatively high. This is because temporary disability to a self-employed person may result in complete loss of income.

In my opinion (as mentioned above), you can accumulate enough emergency corpus (and medical fund) to tide over temporary disability.

However, you need to consider affect of permanent partial disability on your ability to work.

Here are a few additional points to note:

- Rider with term life insurance will cover only Permanent Total disability. A few riders may cover accidental death too.

- Standalone personal accident covers are quite comprehensive. In addition to Permanent Total and Partial disability and accidental death, temporary total disability is also covered.

- Accident disability rider provides coverage only as long as your term insurance plan is in force. With Standalone Personal Accident Cover, you can renew your plan lifelong.

- If you have planned your finances well, then you should not need life insurance after you have retired. Typically, you choose policy tenure to coincide with retirement. However, the need for accidental disability cover may still be there after retirement. But yes, you can expect accidental disability coverage to go down too since you do not need to make up for the loss of income. It should only be needed for own care.

- Your life insurance requirement keeps changing. It is quite possible that, after a few years, you may not need a life cover but may still need a disability cover. In such a case, you will have to keep your life cover in force just to keep accidental disability coverage.

- By the way, you can purchase a Standalone Personal Accident Cover once your life cover (and along with it your disability rider) ceases. As I understand, most illnesses will not jeopardize your chances of getting personal accident cover. But that may be a risky approach. You may develop mobility or other sensory issues (arthritis, seizure disorder etc), which can affect your chances to purchasing accidental cover.

If you are confused about which one to purchase, go for a Standalone Personal Accident Cover because it is a safer choice. Even though you are paying an extra amount, you get much comprehensive coverage and better flexibility. Or as mentioned in the previous section, you can go for both. Remember to purchase the cover for the right amount too.

Do note not all accidental disability riders or Standalone plans may provide coverage as mentioned in this post. You are advised to go through terms and conditions of the rider (with term insurance) and standalone personal accident cover before making a choice. Do not just go by the premium amount. An insurer can simply reduce the scope of coverage and therefore, the premium.

If you have an experience to share about your personal accident policy, do let me know in the comments section.

The post was originally published on October 17, 2015 and has been updated since.

Disclosure: I am still learning about personal accident plans. I do not know anyone who has made claim under a personal accident. None of my clients, so far as I am aware, have made a claim under a personal accident plan. Thus, my practical knowledge about personal accident plans is fairly limited. My understanding about the product will evolve over a period of time. Therefore, it is quite possible that my opinion or recommendation may change over a time too.

38 thoughts on “Do you need a Personal Accident Insurance Plan?”

Thanks for this wonderful article.

Thanks Abhinay. Glad you liked the post.

Very good article. In fact I have not find many in net explaining the importance of disability rider in term plan is useful or not

Thanks. Am glad you found the useful.

hi.. v good article.. quite informative

Thanks Deepika!!! Glad you liked the post.

dear sir

is there any limitation for taking accidental policies or any body can take any amount

Dear Mahesh,

There is no such restriction. However, insurance companies may start getting uncomfortable beyond a point.

Dear Deepesh,

Its really good & effective informative article.

Thanks for sharing.

Thanks Kiran. Please do share with friends and family.

Great article. Very helpful.

Thanks!!!

Good article.which company’s policy is best?

Thanks Murali!!!

Depends on what you are looking for. Like health insurance, coverage under personal accident covers can vary significantly.

Set your requirements.

Go to sites such as PolicyBazaar. Compare and shortlist a few plans.

Go through policy wordings in detail and make a decision.

The Personal accident Policies have a GAP. In case the person is already a disabled person, The Insurance Companies do not cover such a person. My Son 21 Years met with a accident and was diagonised as a Paraplegic Patient. Now when i want a policy for him the same is denied. Can you guide me on the same. My mail Id is pankajkhola@yahoo.com

Regards

PANKAJ YADAV

Yes Pankaj.

Most insurance plans have gaps. Insurance companies prefer to issue insurance to only young and healthy individuals.

Sorry to hear about your son’s unfortunate accident.

Why don’t you try a public insurer?

How much maximum PA insurance can i get against my current income of Rupees seven lac per annum ?

is there any guidelines from IRDA for the limitation of PA sum insured of a person with multiple insurance company policy ?

Why do i have to mentioned existing PA policy detail while applying for new additional PA policy ?

As I understand, IRDA does not have any guidelines in this matter.

Will depend on insurer.

Typically, insurers ask for information about older policies.

An insurer may suspect wrong intent if the overall coverage amount is too high.

As per MAX BUPA, I am eligible for 12 times of my CTC . As per apollo I am eligible for 10 time of my CTC. Can I buy both the policy & will not be any issue if the claim come in future ?

You can purchase and make claim from multiple policies.

However, if the insurance company seeks declaration at the time of purchase of policy and you lie about it, you/your nominee may face problems at the time of claim.

You shouldn’t purchase both policies then.

Personal accident insurance article very much informative. Good to have clarity and awareness. Excellent

You are welcome!!!

Please do share the post on your social media pages so that others could also benefit.

Hi Deepesh

My company covers me with PA policy from public insurer. Shall I still buy another PA policy from other pvt insurer? Will my nominee faces any problems during claim?

Dear Sundarraj,

If the coverage is your liking, there is no need.

Nominees can face issues in either case.

Your article is informative. I have also attempted an article on personal accident insurance.

Why road safety week is the right time to draw attention to personal accident insurance?

mymoneystreets(dot)com/2017/01/why-to-buy-personal-accident-insurance.html?m=0

Thanks Debashree for sharing insights.

Best part of this article is honest “Disclosure” note at the end!

नमस्कार सर ।

एक व्यक्ति अपने लिए कितनी दुर्घटना बीमा का लाभ ले सकता है ?

अभी तो काफी सारे प्लान में १ करोड़ या उससे ज्यादा का भी दुर्घटना बीमा मिल जाता है|

Will personal accident policy cover from day one, means if I take policy today if something happens to insurer tomorrow will I get all the benefits and the full some assured money

Typically from day 1. You can check the policy wordings just to be sure.

Excellent artical for those who are confused if they go only for Term Insurance(with necessary riders) or to get PA as well in combination with Term Insurance to avail its benefits.

And its very helpful that you are answering all quires promptly. Hope you can answer below quires as well –

1. Which is the best PA plan for 2017 with 50 Lakh to 1CR support?

2. Is PA also has claim ratio to compare like Term Insurance?

3. If I have Term Insurance & going to take PA or vice versa do I have to give details of each plan?

4. What if both Insured person & nominees demise in same accident, then who will get claim?

Thanks Pravin.

1. Difficult to comment. Not many insurers offer plans of such high value. You can go through terms and conditions of a few plans and make a choice.

2. Will have to check. I am not very sure.

3. Share all the details that are asked.

4. Amount will be given as per the will of the policyholder. in absence of a will, it will be given to legal heirs as per succession law.

Sir

Handicapped persons eligible for the P.A. policy..who are able to walk….

Dear Krishna,

There is no rule that prevents a handicapped person from taking an accidental policy.

However, you must talk to the insurance company if they are willing to issue a cover (for the specific case).

Insurance companies can have internal guidelines and they do have a number of customer unfriendly guidelines.

Q#1 Standalone Personal Accident Cover comes with long term or it is standard 1 year policy renewable or auto review each year?

Q#2 Standalone Personal Accident Cover premium are same for each year or will increase each year?

1. You have to renew every year.

2. The premium may change over time (unlike term insurance). However, the premium of personal accident covers does not depend on age. It depends on your profession.

Personal accident insurance article very much informative. Good to have clarity and awareness. Excellent