When it comes to index investing, most of us do not think beyond the Nifty 50, Sensex and Nifty Next 50 index funds.

However, do you know there are ways to take passive exposure to midcap funds too? And you don’t need to limit yourself to just the large cap index funds.

How can you do that?

Well, there are 3 ways to take passive exposure to midcap stocks.

- Nifty Midcap 150 index funds and ETFs (ICICI, Nippon, Motilal, ABSL)

- Nifty Midcap 150 Quality 50 index funds or ETF (DSP has recently launched an ETF. UTI has filed with SEBI to launch an index fund)

- S&P BSE Midcap Select ETF (ICICI Prudential has ETF based on this index)

Note: While I have mentioned product names (ICICI Midcap Select ETF and DSP Nifty Midcap 150 Quality 50 ETF) in the topic, I will compare the performance of respective indices (and not the products). The comparison for products is also not possible because almost all the midcap index/ETF products are quite new and do not have much performance history. By the way, ICICI Prudential Midcap Select ETF has been around for a long time (since July 2016). However, it has not caught investors’ imagination. The total AUM for the fund is only Rs 27 crores.

What are the 3 midcap indices?

Nifty Midcap 150 is a cap-based index based on the SEBI’s definition of midcap stocks. As per SEBI, stocks ranked 101st to 250th on market capitalization shall be classified as midcap stocks. The index was launched in April 2016 (base date is April 1, 2005). This means live data is available only from April 2016. Any prior data is backfitted.

Nifty Midcap 150 Quality 50 index selects 50 stocks based on quality scores from the universe of Nifty Midcap 150 stocks. The quality scores are decided based on return-on-equity (ROE), Debt-to-equity (D/E) and variability in EPS growth. For more on this index, suggest you refer to this post. Launched in October 2019. (base date is April 2005).

S&P BSE Midcap Select index consists of 30 largest and most liquid stocks from S&P BSE Midcap index. Launched in June 15, 2015 (base date is September 6, 2005). Read the methodology here.

Performance Comparison: DSP Nifty Midcap 150 Quality 50 ETF VS S&P BSE Midcap Select ETF

I have compared the performance of Nifty Midcap 150 and Nifty Midcap 150 Quality 50 index from 2005 until mid-2021 in an earlier post. We saw that the quality midcap stocks (Nifty Midcap 150 Quality 50) fared much better. However, we need to take this analysis with a pinch of salt. The Midcap quality index was launched only in October 2019 and thus you can expect backfitting to enhance performance.

We shall the compare the performance of the following Total Return Indices (TRI).

- Nifty Midcap 150

- Nifty Midcap 150 Quality 50

- S&P BSE Midcap Select

Compare the performance for the last 10 years (From November 30, 2011 until December 10, 2021). Let’s see how these indices have fared.

I have used “S&P BSE Midcap Select” and “S&P BSE Select Midcap” interchangeably in the posts.

Performance comparison

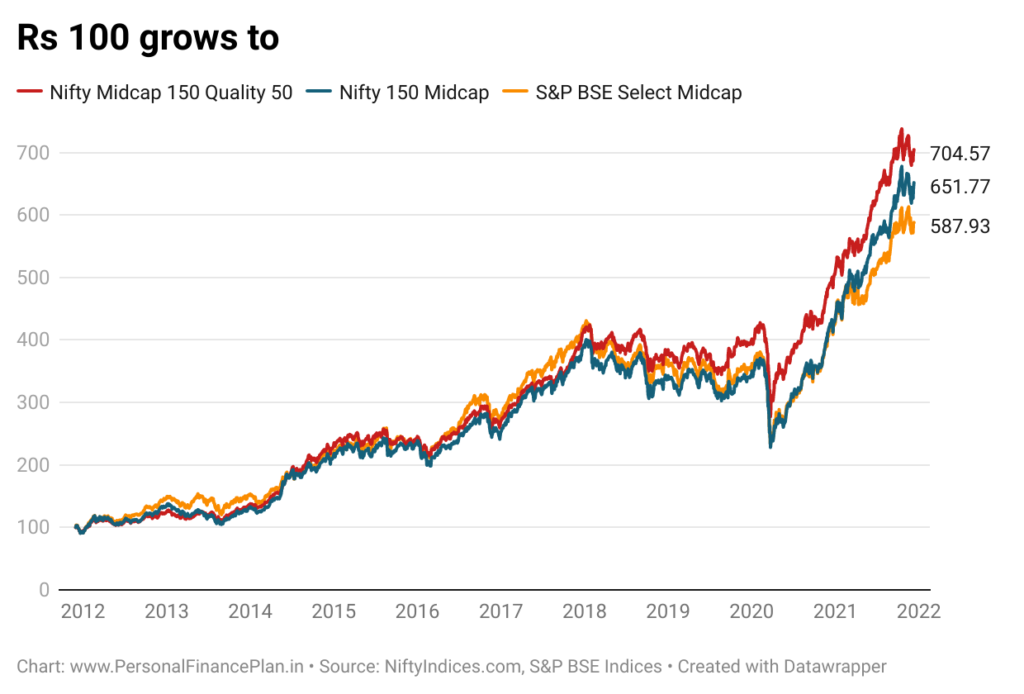

Nifty Midcap 150 Quality 50 has done the best. Rs 100 invested has grown to Rs 704.57. CAGR of 21.49% p.a.

Nifty Midcap150 index grows to 651.77. CAGR of 20.55% p.a.

S&P BSE Select Midcap index grows to 587.93. CAGR of 19.32% p.a.

To avoid start and end point bias, let’s look at the calendar year performance and the rolling returns data.

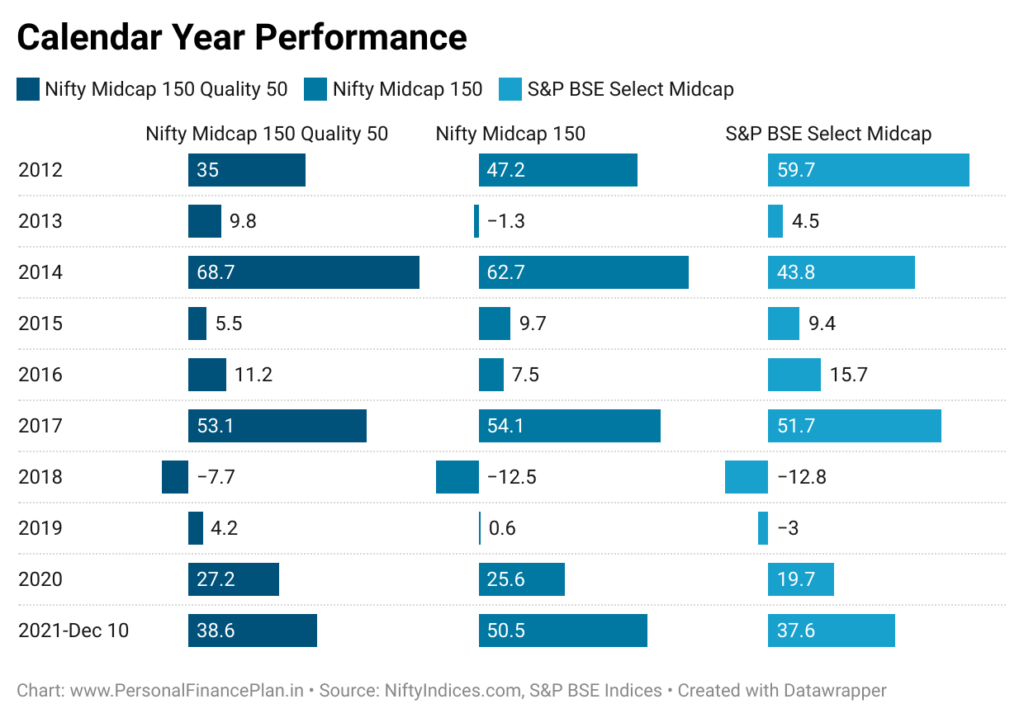

Nifty Midcap 150 Quality 50 index beats the Nifty Midcap 150 index in 6 out of 10 years. And beats S&P BSE Select Midcap in 7 out of 10 years.

S&P BSE Select Midcap beats Nifty Midcap 150 in only 3 out of 10 years.

Easy to see that the performance of S&P BSE Select Midcap index has been underwhelming.

You can see much of the underperformance of the Select Midcap index has come in the past 5 years. In the first five years (2012-2016), it was the best performer. But you must note that the index was launched in June 2015.

Moreover, you can notice that the outperformance of the Nifty Midcap 150 Quality 50 over Nifty Midcap 150 has shrunk over the last 5 years. You can also attribute this narrowing of gap to sharp outperformance by Nifty Midcap 150 in the calendar year 2021.

Data such as this makes things so complicated. How do you know how the next 3, 5 or 10 years are going to pan out? Which index will do better? No way you can be certain about the winner.

That’s why it is important to have conviction in an investment approach so that you can stick through periods of underperformance.

Rolling Returns comparison

The picture is not quite clear in 3-year rolling returns. The best performer keeps changing. However, the 5-year rolling returns present a clear winner in Nifty Midcap 150 Quality 50 index.

As I mentioned earlier, don’t forget that Midcap Quality index was launched only in October 2019.

Maximum drawdown refers to the maximum loss if you had invested on a particular day. Lower the loss, better the strategy. Nifty Midcap 150 Quality index is the clear winner here.

Should you invest in DSP Nifty Midcap 150 Quality 50 ETF?

Nifty Midcap 150 Quality 50 index looks like a winner overall. I like the idea of investing in quality midcap stocks (though there could be a better definition of quality).

If you are considering investing in this index for your long term portfolio, do note that much of the performance data is back-fitted. And as always, past performance may not repeat. In any case, no investment strategy works all the time. There will be periods of underperformance and outperformance. Therefore, to be able to stick with an investment strategy during periods of underperformance, you must have conviction in the investment strategy. By the way, you can expect other AMCs to also launch passive products tracking this Nifty Midcap 150 Quality 50 index soon. UTI has already filed with SEBI. Thus, DSP Midcap Quality ETF is not your only option.

Or if you wish to keep it simple and not worry about underperformance, you can simply stick with a Nifty Midcap 150 index fund or ETF.

About S&P BSE Midcap Select index, the performance seems underwhelming. I wouldn’t be keen.

Additional Read/Links

How to build the “Best Portfolio” using ETFs and index funds?

2 thoughts on “DSP Nifty Midcap 150 Quality 50 ETF vs. ICICI Midcap Select ETF”

Hi,

Thanks a lot for your blog, very informative and helping DIY investors.

Can you please compare Nifty midcap 150 Quality 50 with factor indices: Momentum 30 & Alpha 50 please ?

Hi Dany,

Thanks for the suggestion. Will consider this idea.

I have written about these indices in many of my posts before (but not all 3 together). Do check these out.

Midcap quality and momentum compared in this post.

https://www.personalfinanceplan.in/best-mutual-fund-portfolio-index-funds-etfs-passive-factor-value-momentum-quality-low-volatility/

Momentum and Alpha compared in this post.

https://www.personalfinanceplan.in/nifty-alpha-50-vs-momentum-30-vs-alpha-low-volatility-30/