GRIP Invest is a fintech platform and offers alternative investment products to the retail investors.

The bank fixed deposits have been yielding low returns for almost 2 years now. YTMs (Yield-to-maturity) of good credit quality debt funds have also come down. Interest rates on small savings schemes are also much lower than they used to be a couple of years. Interest income on various debt products has gone down across the board.

Difficult times indeed for retail fixed income investors.

During such times, it is natural for investors to explore products that offer higher returns, especially such products that resemble bank fixed deposits. I wrote about covered bonds in an earlier post. Every product has merits and demerits, and covered bonds are no different. It is easy to focus on high returns, but risks must also be appreciated. As an investor, it is important that you weigh the potential risk and reward and then decide.

In this post, I will review another such product that promises to offer higher returns. Lease and Inventory Finance from Grip (an investment platform). The pre-tax returns as mentioned on the website are in 20-22% p.a. Quite high for a fixed income product, isn’t it?

Let’s find out more about the products from GRIP investment platform and their risk and return profile. I will use Grip, Grip Invest and Grip Investment platform interchangeably in this post.

Grip Invest: Lease and Inventory Finance: How it works?

- Your money is invested in a limited liability partnership (LLP). You become a partner in the firm. For each transaction/deal, a new LLP is formed.

- The LLP (the lessor) buys the asset (say a truck) and leases the asset to the lessee (say a transportation company). The lessee makes lease payments (rental payments) on a regular basis.

- Grip Invest takes a 1-2% cut on all the lease payments. The LLP pays the taxes at 30% on income and the profits are distributed to the investors (partners).

- Profits distributed by an LLP to its partners are exempt from tax in the hands of the partners (investors) under Section 10(2A) of the Income Tax Act.

- Benefit due to depreciation on purchased asset: Depreciation is a non-cash expense item, helps reduce taxes and increase cash profits.

- Return kicker due to GST input credit: The LLP must have paid GST while purchasing the assets. And will collect GST on lease payments. In absence of input credit, the GST collected would have to be passed to the Government. However, the GST input credit can set off the GST collected on lease payments and hence the LLP can keep the GST collected with itself (until GST input credit is wiped off).

Grip Invest: How much returns you get?

The advertised returns are in the range of 20-22% p.a. pre-tax.

Here are a couple of such deals shown on the website in December 2021. And we will try to calculate the post-tax returns for you for these deals.

Note that these are pre-tax returns. Pre-tax to whom? To LLP? Before or after Grip Invest commission?

Or pre-tax to you?

Well, this pre-tax return is based on the lease income received by the LLP. And this is before Grip Invest commission and of course the taxes paid by the LLP.

Therefore, you won’t earn such high advertised return.

Then, how much would you get?

The good part is that the Grip Invest has provided tentative cashflows to investors in an illustration for each of these deals. Since these pay-outs are exempt in the hands of the investors, you get a good idea of the post-tax returns.

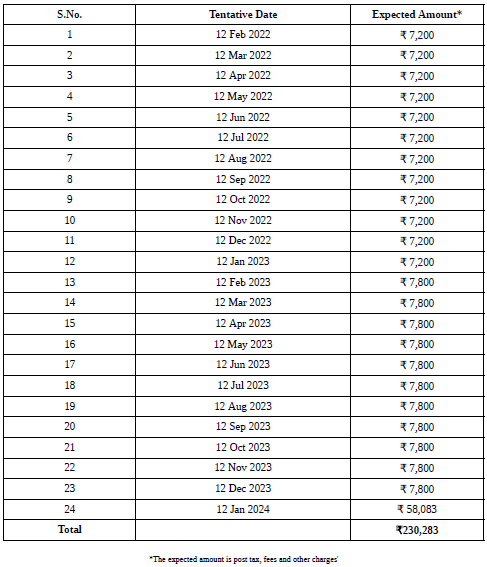

Let’s look at the illustration for Lightning Logistics.

Assume you invest Rs 2 lacs.

If you use IRR function on above cashflows, you get a monthly IRR of 0.95% per month. Or about 11.4% per annum post-tax. Still very high, but far cry from 21.4% highlighted on the deal page.

Let’s look at another deal (Azure).

Again, the IRR is only about 11.43% p.a.

This does not look nice. Grip Invest knows that the investor returns won’t be 20-22% p.a. They also know that the investors would focus on this number of 20-22% p.a. To their credit, they have provided explanation in FAQs. They have shared illustrations that can be used to calculate actual post-tax returns to investors. However, how many investors would do that? Therefore, while they are technically correct, they are not completely honest. While it is unfair for me to question the company’s intent, this seems like an attempt to mislead investors.

11-12% p.a. from a fixed income product on a post-tax is still an awesome return (albeit with a lot of risk). This is almost equity like return. They should have simply highlighted this return to the investors.

Grip Invest: Leasing and Inventory Finance: What are the risks?

This is no free lunch, right?

All the above return calculations assume that things go according to the plan. There is no guarantee of that happening. Your risk exposure is concentrated. If there is any fraud/problem with the lessor/lessee, you may not get the expected payments or even lose the principal.

Yes, there are safeguards such as repossession of leased assets in case of default on lease/rental payments. The repossessed asset can be sold or leased out to another vendor. Fine but I know little about enforceability of contracts. Keep such risks in mind.

Not sure who is the regulator for such products. If things go south, you wouldn’t know who to reach out to.

How do you play this?

You need to go back to basics of portfolio construction. Since we are considering a fixed income product in this post, I will comment only on construction of fixed income portfolios.

You can view your fixed income portfolio as consisting of core and satellite portfolio.

In the core (fixed income) portfolio, you control for both interest rate and credit risk. A core fixed income portfolio would have.

- Bank Fixed Deposits

- PPF/EPF

- Post-office schemes

- RBI Floating rate Bonds (yes, this should fall here)

- Treasury bills

- Government Bonds (if you are buying for interest income)

- Select variants of debt fund schemes (liquid funds, money market funds)

- Ultra-Short or short duration debt funds (with good credit quality portfolio)

- Any investment where you are not bothered about interest rate movements or defaults in the underlying portfolio.

The core portfolio should comprise at least 60-70% of the fixed income portfolio. It can even be 100%.

In the satellite (fixed income) portfolio, you relax on either interest rate or credit risk. OR relax on both types of risks.

- Short duration but low credit quality bonds (or mutual funds)

- Good credit quality but long duration bonds (or mutual funds)

- Low credit quality and long duration bonds (or mutual funds)

Grip Invest products don’t have much of interest rate risk. But these products do carry heavy credit risk. It is a single party risk too. Even credit risk debt funds carry a lot of credit risk, but such funds invest in bonds from multiple companies.

In fixed income investments, there is no free lunch. The extra return comes at the cost of higher risk, whether you appreciate it or not. Nobody wants to borrow at 16-18% p.a. This itself means the transaction is risky. From what I could understand from a podcast on Grip Invest products, the lease rental is in the range of 16-18% p.a. The advertised interest is higher due to GST input credit and depreciation benefit.

Should you stay away from Grip Invest or other similar products?

I am not fond of taking too much risk in my fixed income portfolio. Hence, I won’t be very keen on such products.

However, it would be unfair for me to come down heavily on products whose structure I do not completely understand. Moreover, it is good to have investment options and for that companies like Grip Invest and Wint Wealth deserve credit. And yes, the returns are very attractive (despite the obvious risks).

Therefore, if you must consider such products, you must keep the following things in mind.

- Consider such products as part of your satellite fixed income portfolio. You must limit the exposure.

- I would not be comfortable with more than 5-10% of fixed income portfolio in such products.

- Spread the money across 5-10 such products. This (along in point 2) would ensure that you don’t invest more than 1% in a single transaction.

- Appreciate the credit risk involved. You may not get your money back.

- Appreciate the concentration risk/fraud risk involved.

- Don’t just bank on legal protection that such products seem to give in case of defaults by counterparties. Legal system in our country is slow and you will lose patience.

- Don’t go by fancy 20-22% returns posted on the deal page. Calculate the IRR to get the true sense of returns. And decide if the return is worth the risk.

Do not consider such products replacement for low-return bank fixed deposits. Bank FDs don’t have any credit risk. Grip Invest products do.

3 thoughts on “GRIP Invest: Lease and Inventory Finance: Should you invest?”

Good Detailed Explanation.

Thanks for Sharing !

Good article! The core fixed-income portfolio list is very useful for me!

Regards,

V. Sitaram

Thank you!