Regular readers of this blog would already know that I have no love lost for traditional life insurance plans. I have written many posts advising readers to stay away from traditional life insurance plans.

In an earlier post, I had reviewed LIC New Jeevan Anand, a participating non-linked endowment plan.

In this post, I will review LIC New Money Back Plan-25 years, a participating non-linked money back plan from LIC.

As the name suggests, under Money back plans, the insurance company gives you some money back at regular intervals even during the premium payment term.

Let’s find out more about LIC New Money Back plan-25 years and see if such a plan can be a fit in your portfolio.

Must Read: Say No to Traditional Life Insurance Plans

How LIC New Money Back Plan-25 years works?

The policy term is 25 years. You pay premium every year for 25 years. You get 15% of Sum Assured at the end of 5th, 10th, 15th and 20th years. Balanced Sum Assured, along with bonuses is paid at the time of maturity.

Survival Benefit (if the policy holder survives the policy term)

You get 15% of the Sum Assured at the end of 5th, 10th, 15th and 20th year.

At the time of maturity of the plan, you get 40% of the Sum Assured along with accrued simple reversionary bonuses and Final Additional Bonus.

Simple reversionary bonus is announced every year by LIC. It is typically expressed in per thousand of Sum Assured. So, if the bonus announced is Rs 30 per thousand of Sum Assured and Sum Assured under your plan is Rs 10 lacs, your bonus is equal to Rs 30,000 (Rs 30 * 10 lacs /1,000).

Do note this is bonus is not paid right away. It merely accrues and does not even earn any interest. The total accrued bonus is paid at the time of maturity of the policy.

Final Additional Bonus (FAB) is announced every year and paid at the time of death or at the time of maturity of the policy. FAB is tricky. If LIC does not announce good FAB in the year your policy is maturing, you simply lose out.

Do note the two bonuses are not fixed and may vary across years.

Death Benefit (if the policy holder dies during the policy term)

The nominee gets 125% of Sum Assured + Vested Simple Reversionary Bonus + Final Additional Bonus.

No deduction is made for the survival benefits already paid. For instance, if the policy holder dies in 12th year, he would have already received 30% of the Sum Assured (15% at the end of 5th year and 15% at the end of 10th year). Death benefit is over and above survival benefits already paid.

You can read policy wordings here.

Benefit Illustration (LIC New Money Back Plan)

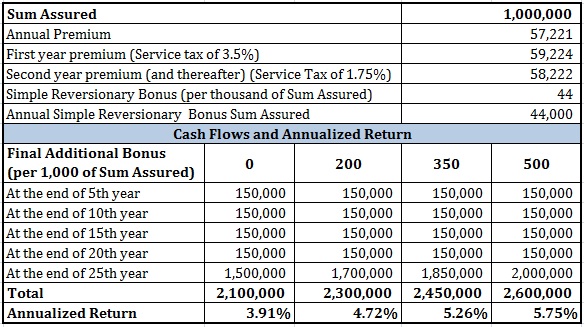

I have considered premium for a 30 year old for Sum Assured of Rs 10 lacs. You can find out the premium for the plan here.

Let’s consider various scenarios if the policy holder survives the term.

As for the values of Simple Reversionary Bonus, LIC has announced bonus of Rs 44 per Rs. 1,000 of Sum Assured for the last six years. So, Rs 44 is a fair assumption. Final Additional Bonus is applicable in the year of maturity (or death) only. Hence, a lot depends on your luck.

I have taken various values of FAB and tried to assess the impact.

For Sum Assured of Rs 10 lacs, you get Rs 1.5 lacs each (Rs 10 lacs * 15%) at the end of 5th, 10th, 15th and 20th year.

The payment at maturity depends on Simple Reversionary Bonuses announced during the policy term and Final Additional Bonus in the year of maturity.

At FAB of Rs 500 (per Rs 1,000 of Sum Assured), you get Rs 4 lacs (40% of Sum Assured) + Rs 11 lacs (Accrued reversionary bonuses Rs 44,000 *25) + Rs 5 lacs (FAB 500 * Rs 10 lacs/ 1000) = Rs 20 lacs

You can see the returns are extremely poor. The safest PPF gives 8.1% at present.

It is one of the reasons I ask investors to stay away from traditional life insurance plans including money back plans. These products provide guaranteed poor returns.

How poor are the returns of LIC New Money Back plan?

For this, let’s try to compare the performance against a combination of term plan and Public Provident Fund.

I consider a term insurance plan of Rs 50 lacs for a 30 year old for a term of 25 years. I have picked up e-Term plan from LIC. Hence, claim settlement ratio of private insurers is no longer a point of concern.

The annual premium is Rs 9,462. That means the remaining amount can go to PPF investment. I assume a return of 8% p.a. on PPF.

If survive the entire 25 years, you will end up with Rs 38.6 lacs in PPF account at the end of 25 years. Annualized return of 6.85% p.a. (premium for term plan reduced the return from 8% to 6.85% p.a.). Still much better than LIC Money Back plan.

You can see return from combination of term plan and PPF easily beats even the most optimistic estimate from LIC Money Back plan.

What about Death Benefit?

You purchase life insurance so that your family is taken care of in case you were not around. In the previous section, we found out that LIC New Money Back Plan – 25 years fared badly if you survive the policy term. What about demise during the policy term? Does the LIC Money Back Plan fare any better in that case?

Let’s find out.

I will compare the scenarios if the policy holder were to die during the policy term. I consider FAB of Rs 500 per Rs 1,000 of Sum Assured in the year of demise.

2,120,000 = 125% of Rs 10 lacs + 44,000 *5 (Reversionary bonus) + 500* 1000 (FAB) + 1.5 lacs (Survival benefit at the end of 5th year)

You can see a simple combination of term plan from LIC and PPF easily outperforms money back plan in every scenario.

Then, why will anyone purchase LIC Money Back plan?

As with any traditional life insurance product, LIC Money Back Plan – 25 years is neither a good insurance product nor a good investment product. Must be strictly avoided.

Then, why will anyone purchase this product?

In my opinion, they fall for the sales pitch. Let’s see how a typical sales pitch for a money back plan goes.

Let’s say you are in 20% tax bracket.

“Sir, you need to pay Rs 59,000 per annum for 25 years. You get tax benefit of 20% on the annual premium under Section 80C. You are paying only Rs 47,000 per annum. And you get Rs 44,000 at the end of the year. So, effectively, you are paying only Rs 3,000 per annum.

And you get an additional Rs 1.5 lacs at the end of 5th, 10th, 15th and 20th year. At the end of 25th year, you will get Rs 9.5 lacs.”

If the product were like that, the return is a cool 16.8% p.a. (even without considering tax benefit).

Wow!!! Could there be a better plan?

We know there is a catch. And what’s that?

You are given the impression that you will get Rs 44,000 every year. In reality, you will get this Rs 44,000 only at the end of 25 years. Is Rs 44,000 today same as Rs 44,000 after 25 years? Of course not.

Moreover, Rs 44,000 merely accrues and does not even earn you any interest.

And therein lies the problem, which most investors tend to overlook.

I do concede it is not right on my part to paint everyone with the same brush. A salesperson cannot turn a bad product into a good product. He/she can only make a bad product appear good. And that’s what insurance agents do.

PersonalFinancePlan Take

This is not a commentary on LIC New Money Back plan alone. I have nothing against LIC. All money back plans (from LIC or private insurers) are equally bad and must be strictly avoided.

In general, traditional life insurance plans provide low life cover and guaranteed poor returns.

The decision is yours.

Still planning to purchase a money back plan?

Let me know your inputs in the comments section.

17 thoughts on “LIC New Money Back Plan provides guaranteed poor returns”

Thanks for your detailed explanation. I see a lot of elderly people around me having been goaded into taking these plans, years back and now they are stuck with it. Even my father was a victim and has 2-3 such policies. Should all of them just close the policies and go for a fresh plain term plan? I guess it may not be as cheap, given they have advanced in their ages..

You are welcome, Mukesh.

Coming to your case, you need to assess if your father needs life insurance.

Typically, elderly or those who have retired do not need to purchase any life insurance. And term insurance is no exception.

They do not need life insurance unless there is some goal, for which they have not been able to accumulate greater wealth.

About money back plans, it depends on how long you have been paying the premium. If you have been paying for a long time, it may actually make sense to continue with those plans.

Please go through the following post.

http://www.personalfinanceplan.in/insurance/life-insurance-continue-or-surrender-or-paid-up/

Thank you Deepesh for your lucid explanation.

Thanks Prabhakara!!!

Hi Deepesh,

Good analysis. I have never ever been a fan of anything but a pure term insurance plan. Insurance should be just that – does anyone ever expect a return on one’s motor insurance or health insurance? Then why look at life insurance with a different yardstick? On my advise, my son just took out a single premium, term plan for 40 years with a 1 cr payout and disability insurance from HDFC Life. While one may question the “loss” due to a single premium payment, one doesn’t need to worry about future payments and the premium upto 1.5 lacs is tax deductible this year. A great product in my view. Any contrary views?

Thanks Vinodh!!!

That is an acceptable decision. Nothing wrong.

We can’t see everything from tax perspective.

Hi Deepesh,

Just read your analysis about LIC New Money Back Plan-25 years, though I liked it I am unfortunate to stuck with this plan, I enrolled for it in the year 2011. this year when I wanted to surrender the policy I got to know that I will only get half of the total premium I paid for last 4 years, though I have not paid the premium for last 2 years. what should I do should I revive it or should I surrender it. Please suggest.

Hi Navneeta,

In your case, I would rather let it go (and not revive the plan). To be honest, I have not worked out the numbers and various scenarios.

However, please do not limit this decision to pure mathematics.

You must see how much cover you have. Purchase a term life insurance plan if you do not sufficient life cover.

If you do want to purchase term life cover either and still want to surrender this plan, it does not make any sense. With this plan, you have atleast some cover.

Also consider hoe you have been investing. If this is your only investment, it is better to continue.

If the annual premium is only a small portion of your overall annual investments, you can even continue it.

I am doomed ..I am 27 and I did this policy of money back for 25 years … Per month 7500 and at the end of 25 years 35lacs

Relax Gaurav. You are not doomed.

It’s ok. Just ensure that you invest more in the other products.

Sir,

My name is Dinesh & I have brought two LIC policy in 1996 & 2003 & surrendered in Jan 2014 as under :-

.

1) Money Back Policy.

Date of Commencement : 15.10.1996

Premium Paid : Rs.66,729/- (Paid @ Rs.5,133/- P.A. in continuation for 13yrs till 14.10.2009)

Loan Take : Rs.28,000/- ( In Year 2008).

Recd Survival Benefit : Total Amt Rs.30000/- ( @Rs.15,000/- each in 2001, 2006 )

Surrendered amt – Recd – Rs. 7,000/- in Jan 2014.

2) Jeevan Anand Policy

Date of Commencement : 08.03.2013.

Premium Paid : Rs.45,360/- (Paid @ Rs.6,480/- P.A. in continuation for 07yrs till 27.05.2009)

Loan Take : Rs.25,000/- ( In Year 2008).

Surrendered amt – Recd – Rs. 5,000/- in Jan 2014.

In Oct 2008, my elder son was born & he was born as mentally & physicaly challenged.

Hence, subsequently i was not in a position to pay premium due to financial crisis.

As I was just busy in hospitals.

Just require your suggestion as I feel that I have recd less amount as for 1st policy, my bonus amount was approx. Rs.80,000/-

For this I have enquire with LIC people also to share the working of how Rs.5,000/- surrender value has come & where the bonus amount has gone.

Request for your feedback, whether there is any chance for receiving any amount.

Dinesh

Hello sir,

I am bhimi , My brother has bought lic new money back policy for 20 years on june 2014 ..and has paid premium 4 times till now of around rs 38000 each time (assured sum is 500000) . I would like to ask you that will it be good time to surrender the policy( how much money we r going to lose) or is there any other way to switch over to term policy or paid up policy as we are now facing some financial crisis are are not in position to continue such policy with so high premium rate .pls help.

Thanku .

Hi Bhimi,

If you can’t pay the premium, make the policy paid-up or surrender the policy.

Hi Deepesh,

I have been lured into buying two LIC policies. Jeevan Anand (sum assured 10 lakhs, half yearly payments of 15719 for 30 years) and New money back plan-25 years (sum assured 10 lakhs, qtrly payments of 15237). At that time, I was not much aware of Term insurance or mutual funds. Now I intend to buy a term insurance (Quote for me is Rs.23000/- per annum for 1 cr) and invest some amount in mutual funds in the form of SIP. But the savings from my salary are being used up by these policies, so that there is no scope for further investment. Kindly offer your feedback, whether it will be wise to surrender/make it paid up the lic policies and invest in mutual funds/buy term insurance.

Hi Jith,

If the policies are new, you can surrender one of the policies (the newer one).

Hi Depesh,

I have bought lic money back policy 7 years before, it is for 20 year. Can i break it without loss my paid premium and 7 years bonus. If yes how can i do it.

Hi Sumit,

Please check with your agent. He will be able to tell the accurate surrender value.