You recently welcomed a baby girl to the family. Happy times for the family!

This is also a good time to start investments for her education. The sooner you start, the less it will burden your pocket.

Now the question. Where to invest for daughter’s education?

There are many ways you can do this. You can invest in bank fixed deposits, recurring deposits, blue chip stocks, mutual funds, ULIPs, traditional insurance plans or small savings schemes such as PPF and SSY.

Each product has merits and demerits on the risk-return spectrum and on liquidity/flexibility aspects. I will not cover all these products in this post.

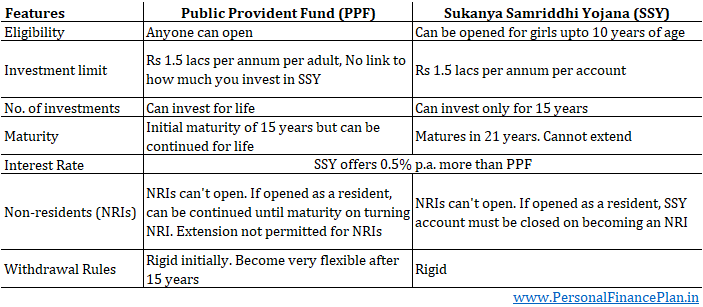

In this post, let’s focus on Public Provident Fund (PPF) and Sukanya Samriddhi Scheme (SSY). Both PPF and SSY are risk-free products. Backed by the Government of India. Both fall under EEE (Exempt-Exempt-Exempt) tax regime. Excellent fixed income products.

If you had to choose one of PPF or SSY as an investment vehicle for your daughter, what would you choose? As always, there is no crisp answer. There are aspects where SSY scores over PPF and there are areas where PPF does better.

Now, how to decide? Let’s compare the two products and find out.

PPF vs SSY: Aspects where SSY is better than PPF

#1 Interest Rate

Sukanya Samriddhi Scheme (SSY) offers a higher rate of interest than PPF. And this has always been the case. SSY offers 0.5% more than PPF. Currently (January 2022), SSY offers 7.6% p.a. while PPF offers only 7.1% p.a.

This alone is good enough to win the battle for SSY.

#2 Contribution

You cannot put more than Rs 1.5 lacs per annum in a PPF account. Fine but there is an additional restriction.

Assuming a family of 4 (father, mother, son, and daughter), you cannot invest more Rs 3 lacs per annum in PPF. I assume the children are minor. Or Rs 1.5 lacs per annum per adult.

Every minor PPF account must have a guardian. And the PPF rule is that you cannot put more than Rs 1.5 lacs per annum cumulatively in your PPF account and the PPF account where you are the guardian. So, if you are a guardian in your daughter’s PPF account and you have put Rs 80,000 in your PPF account, you cannot put more than Rs 70,000 in your daughter’s PPF account. While there are ways to circumvent this restriction, such ways are against the spirit of the law.

Therefore, if you limit yourself to PPF, you cannot put more than Rs 3 lacs (between you and spouse) in a risk-free, tax-free, high return product.

Enter SSY.

Continuing with the same example, you can put Rs 1.5 lacs in your daughter’s SSY account. Or if you have 2 daughters, you can put Rs 3 lacs (Rs 1.5 lacs each).

So, your total contribution to tax-free, risk-free and high return product can go up to Rs 6 lacs.

1.5 lacs in PPF (self or where you are guardian) + Rs 1.5 lacs in PPF (spouse or as guardian) + 1.5 lacs in SSY (of first daughter) + 1.5 lacs in SSY (of second daughter).

PPF vs SSY: Where PPF scores over SSY

#1 Eligibility

Anyone can open a PPF account, irrespective of your age and gender.

No such simplicity with SSY.

SSY can only be opened for girls under 10 years of age. Additionally, you can open SSY only for 2 daughters. There is an exception to this rule. You can open SSY account for 3 daughters if you have twin girls at the time of second birth or triplets at the time of first birth.

#2 Number of contributions

You can only invest in a SSY account for 15 years. And that limits the kind of corpus you can accumulate under SSY.

No such restriction in case of PPF.

You can contribute until you are alive (assume you keep extending the account). Hence, you can accumulate much bigger amounts in PPF.

#3 Product maturity

SSY is a limited duration product. The account matures after 21 years. Even if you do not close the account on completion of 21 years, you won’t earn interest on the balance anymore. Premature closure is permitted at the time of marriage of the account holder.

No such limitations with PPF. A PPF account can be continued for life. The PPF has initial maturity of 15 years. However, you don’t have to close the account on completion of 15 years. You can extend the account in blocks of 5 years any number of times. So, if your PPF account is about to complete 15 years, you can make an application to extend it by another 5 years (20 years). When it is about to finish 20 years, you can extend the account by another 5 years and so on. You can continue the account with or without contributions (default).

You can also use PPF smartly as a pension tool.

#4 Mess for NRIs

Non-residents cannot open PPF or SSY accounts. However, there is a possibility that you were a resident when opened SSY or PPF account and subsequently became an NRI.

If the SSY account holder becomes an NRI, the SSY account must be closed. You must intimate such change to the bank/post-office within 1 month of moving abroad. As per the rules, the SSY account is deemed closed from the date of change of residential status (whether you inform the bank/post-office or not). And such an account does not earn any further interest. If any interest has been credited to SSY account post change of residential status, such interest will be clawed back.

Therefore, if you are planning to move abroad with your family soon, opening a SSY account for your daughter may not be a good idea.

With PPF, you can continue the account until maturity even if you become an NRI (NRIs are not allowed to extend PPF accounts though).

#5 Withdrawal rules

SSY withdrawal rules are very rigid.

You can withdraw up to 50% of the account balance at the end of the previous financial year for the purpose of higher education of the beneficiary (girl). This is allowed only when the girl child turns 18 or has passed 10th standard, whichever is earlier. Even for this, you need documentary evidence of admission, fee etc.

The beneficiary can withdraw the entire amount on completion of 21 years. There is an option to withdraw the complete amount at the time of marriage if it happens before completion of 21 years.

By the way, all these restrictions are there for a reason.

In our country, the interests of daughters are often neglected. Such rules have been put in place to ensure the funds get used only for the intended purpose i.e., education and welfare of the girl child.

PPF withdrawal rules are very flexible after the completion of initial maturity of 15 years.

If you continue the account with contribution, you can withdraw up to 60% of the balance at the end of the previous cycle during this cycle (5 years of extension). If you continue the account without extension, you can withdraw even the entire amount.

#6 The minors will eventually become majors

We saw in the previous section that you can invest only Rs 1.5 lacs per annum per adult. Therefore, for a family of 4 (parents and 2 minor kids), the maximum family contribution to PPF can be Rs 3 lacs per annum.

However, the kids will eventually turn 18. Become an adult.

Then, you (the family) can invest much more. So, if your kids are above 18, you can put 4X 1.5 lacs = 6 lacs in the PPF account.

PPF vs SSY: What should you do?

It does not have to be an either-or answer. Why not both?

Both PPF and SSY are excellent fixed income products. No credit risk. Backed by the Government of India. Both get you tax benefits under Section 80C. You earn tax-free interest in both.

SSY offers a higher rate of interest but cannot be continued for life.

PPF offers a slightly lower rate of interest but is super flexible and can be continued for life.

We know that the PPF account becomes very flexible after completion of initial maturity of 15 years. Therefore, by opening the PPF account for your kids, you at least start the countdown to 15 years. You may only make a minimum contribution.

My suggestion: Open both SSY and PPF accounts for your daughter. Based on your preference, you can decide how much to contribute to each of these accounts.

Additional Links

Latest PPF and SSY interest rates

1 thought on “PPF vs SSY: Where to invest for daughter’s education?”

Dear Deepesh – Thanks for such a wonderful post and this post alone qualifies as the BEST information you have provided and easily qualify as ‘Woman of the Match for 2021’:-) – 7.6% per annum returns – Risk-Free – Govt of India Backed – Taxation is ‘0’ (EEE Basis) – Long-Term Compulsory Investment GUARANTEED for Daughter’s Education as well as Partly for Marriage – Same Scheme available for BOYS too (https://parenting.firstcry.com/articles/post-office-saving-schemes-for-boy-child-in-india) – SURPRISED that not even 1 person commented on such great schemes by GOI – Long-Live FD Schemes which as Simple/Easy to Maintain/Enjoys full-tax benefits and Finally incorporates SAVINGS Habit for future generations!! THANK YOU VERY MUCH for an excellent post!!