Term life insurance is the best way to purchase life insurance. However, many stay away from term life insurance plans because they (or their family) do not get anything if they survive the policy term.

What if there was a term plan where you will never be able to survive the policy term?

Don’t worry the insurance company won’t hunt you down. They are insurers, not assassins. It is another matter altogether that the insurance companies have let many down at the worst possible moment by wrongfully rejecting claims.

Back to the topic.

I am talking about a whole life term insurance plan. There are many life insurance plans now that you provide you cover for the entire or till the age of 100 (almost as good as whole life plan). Now, almost all the insurers let you purchase the coverage till the age of 100. In this post, we pick up a product from Aegon Life.

Aegon Life has come out with a plan that provides you term life cover for life (and not for a fixed tenure). Typically, term life plans have a fixed tenure. If the policyholder passes away during the policy tenure, the nominee gets the Sum Assured. If the policyholder survives the policy term, there is no payment from the insurance company.

There are whole life traditional plans (LIC Jeevan Umang) but this is the first time I am looking at a whole life term plan.

Since this term plan is for life, the insurance company has to pay the Sum Assured under the policy (unless the policyholder chooses not to renew the policy during his life)at some point. Therefore, your family will certainly get the Sum Assured from the company.

Should you opt for such a plan?

What Aegon Life-iTerm Forever is not?

It is not a return of premium term plan. The nominee will get the Sum Assured (not just premium paid) at the time of the death of the policyholder.

Technically, it is not an investment and insurance combo product either. You do not get anything from the insurance company during your life. Only your nominee gets when you pass away.

What is the premium like?

Since the insurer has to pay the Sum Assured, you can expect the premium to be quite high as compared to a plain vanilla term life insurance plan.

Minimum and maximum entry ages are 18 and 65 years respectively. Minimum life cover is Rs 25 lacs. There is no upper limit.

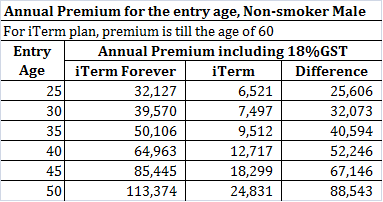

For premium comparison, I picked up annual premiums for iTermForever plan and iTerm plan. The premiums are for a non-smoker male residing in Mumbai. For iTerm plan, the annual premium is for a plan with tenure ending at the age of 60 years. The premium is for a life cover of Rs 1 crore.

You can see that the difference in premium is quite big.

Which one to choose?

Let’s look at the premium difference for a person aged 30 years (at the time of first purchase). The difference is Rs 32,703 per year.

Now, the payout from the insurance company in the event of death till the age of 60 is the same for both the plans i.e. the nominee gets Rs 1 crore. Under iTerm, you have paid much less premium.

After 60, the iTerm plan ceases to exist while coverage for iTerm-Forever continues for your life (if you continue to pay an annual premium). When the policyholder dies after 60, iTermForever plan will pay Rs 1 crore. You might be tempted to say iTermForever is better.

If that’s how you think, you are ignoring a critical aspect.

What if you invested the difference amount?

Rs 32,703 per annum for 30 years (till the age of 60) will grow to Rs 58.03 lacs at 10% p.a. At 12% p.a., the money grows to Rs 86.69 lacs in 30 years.

Do note, beyond the age of 60, you will continue paying the premium under iTermForever plan (i.e. Rs 39,570 per annum). If you invest this amount too, then the corpus gets even bigger.

If the demise happens at the age of 70, the corpus would have grown to Rs 1.57 crores at 10% per annum. At 12%, the corpus would grow to Rs 2.77 crores. The amount is way bigger than Rs 1 crore that your nominee will get under iTerm-Forever plan.

At the same time, you retain the flexibility (if you chose iTerm plan) to use the funds the way you want to. It is your money (investment). Use it the way you want.

Your family does not need to wait till your demise to get the money.

In my opinion, pure vanilla iTerm plan is clearly a much better option.

What I think of the plan?

I believe you should purchase life cover until your planned retirement. And you should save enough by the time you retire. Once you have sufficient wealth, the need for a life insurance plan is no longer there.

Therefore, a plain vanilla term life insurance plan will do. You can go for a slightly higher tenure if you are a bit unsure. There shouldn’t be any need for whole life term insurance plans.

Moreover, as we have seen above, a pure vanilla term plan is a better choice than a whole life term plan.

However, if the non-return of premium has been stopping you from purchasing a term life insurance plan, a whole life plan might be a better choice than your traditional life insurance plans.

Points to Note/Disclosure

You can expect under-writing under iTermForever plan to be extremely strict. After all, the risk of payout is 100%.

Incidentally, there was no premium calculator for this plan on Aegon Life website. The annual premium data mentioned above is from a pdf file uploaded on the Aegon website.

I called up Aegon Life customer to find out more about the plan. I was told that Aegon Life does not sell this plan directly and it can be purchased only through a leading web aggregator. I verified the premiums on the aggregator website.

I can’t understand the reason behind this (it has to be commercial). Frankly, this is a good enough reason for me to stay away from this plan. I have had prior bad experience with this aggregator. Therefore, I don’t trust the aggregator anymore.

By the way, I found out Aegon is not the only insurer that sells whole life term insurance plan. HDFC Life also provides lifelong protection option under its HDFC Click 2 Protect 3D plan.

Additional Links

Claims Settlement Data of Life Insurance companies may be misleading.

3 thoughts on “Will you a purchase a Term Plan that provides you Life Cover for your entire life?”

Hello sir,

I am a 25 yr old female.recently I have inquired about the iterm forever plan from aegon life insurance.and they told me the premium amount is around Rs.11000 yearly for me if I pay till death which will cover upto 100 yrs of age. If I count the premium it will cost me around Rs.8,25000/ for 75 yrs and for 1cr coverage.i find this plan lucrative.should I invest in this plan or still there would be some hidden clause like increase of premium in later years.or I should go with some normal term plan which cover upto age 60 or 65 yrs ? Plz reply

Hi Ankita,

The premium will remain constant.

What is the annual premium for a regular cover till the age of 60?

Hi Ankita,

What is the premium for up to 60-65 years?

You assume a return of 10% for the excess premium and see where you end up in the next 35 years.

Consider the flexibility too.