Under time pressure to save taxes, you bought a traditional life insurance plan in the last week of March with an annual premium of Rs 1 lac. After a couple of months, when you got time to review the product, you did not like it any bit.

You wanted to get rid of the plan, but the free-look period was already over.

And when you checked with the insurance company about the surrender costs, you were politely told that you wouldn’t get anything back since you have paid just one premium. Your woes didn’t end there. Even if you had the patience and money to pay a few more premium installments, you don’t get much relief. In the initial years, if you surrender, you won’t get more than 30-40% of the total premiums paid back.

Don’t know whether to call this good or bad. Many investors stick with such plans (despite not liking them) simply because of the surrender costs. The good part is that such heavy surrender charges help investors stick with the investment discipline and grow their savings.

The bad part is that such exorbitant exit penalties take the liberty away from the investors.

What if you later realize that the product is not good for achieving your goals? Or that the product offers extremely low returns?

What if you later realize that you signed up for too high a premium?

You are just stuck. Can’t do anything. And that is never good from customers’ perspective.

But why are the surrender costs so high?

The primary reason is the front-loaded nature of commissions in the sale of traditional insurance products. “Front-loaded” means the bulk of the compensation for the sale is paid in the initial years. For instance, in the sale of traditional life insurance products, the first-year commission can be as high as 40% of the annual premium.

Now, if you were to surrender the plan within a couple of years and the commissions can’t be clawed back, who will bear the cost of refunding you the premiums? Hence, you are penalized heavily if you surrender the plan.

The front-loaded nature of commissions also encourages mis-selling on the part of insurance agents and intermediaries. I have considered so many cases of blatant mis-selling by insurance intermediaries, especially the banks, on this blog.

I am NOT saying that all insurance agents and intermediaries are bad. Am sure there are many who are doing a wonderful job. But I must say that the sales incentives and the investors’ interests are misaligned.

What is the IRDA saying about surrender costs?

IRDA realizes that everything is not right with traditional life insurance sales. Surrender costs being one of them. The exit costs are just too high and cannot be justified.

Why does the investor have to lose all or say 3/4th of the money if he/she does not like the product?

Hence, IRDA has proposed a change. Just a proposal. Has invited comments. Nothing is final.

- There will be threshold premium on which surrender charges will apply.

- Any excess premium above that threshold will not be subject to surrender charges.

Let us understand with the help of an illustration. And I take the example from the IRDA proposal itself.

Let us say the annual premium is Rs 1 lac.

And the threshold is Rs 25,000.

You have paid premiums for 3 years. Rs 1 lac X 3 = Rs 3 lacs total premium paid.

Hence, surrender charges will apply only on 25,000 X 3 = Rs 75,000.

Let’s say you can get only 35% of such premium back if you surrender after 3 years.

So, of this Rs 75,000, only 35% will be returned. You get back Rs 26,250.

The remaining (1 lac – Rs 25,000) X 3 = Rs 2.25 lacs won’t be subject to surrender charges.

Hence, the net amount returned to you = Rs 2.25 lacs + 26,250 = Rs 2,51,250. This value is called Adjusted Guaranteed Surrender Value and shall be the minimum surrender value.

The Surrender Value shall be higher of (Adjusted Guaranteed Surrender Value, Special Surrender Value).

Not sure how the Special Surrender value is calculated. So, let’s just focus on the Adjusted Guaranteed Surrender Value.

This is a vast improvement over what you would get if you were to surrender an existing policy now.

While I have been quite critical of IRDA in the past, I must say this is an extremely customer friendly proposal from IRDA.

What will be the Threshold Premium?

It is not yet clear how this “Threshold” would be calculated or arrived at.

It could be an absolute amount or a percentage of annual premium. Or a mixed approach.

The lower the threshold, the better for investors.

As I understand, the insurers will have the discretion to decide the threshold amount.

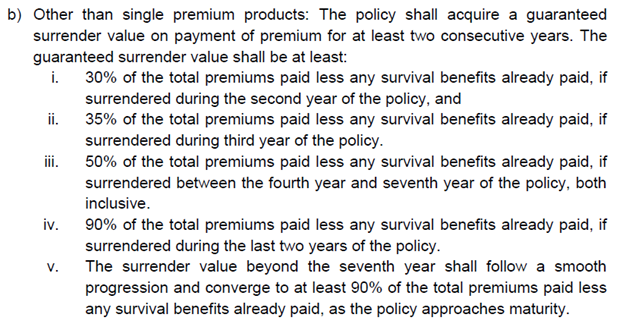

The IRDAI has set broad rules for minimum surrender value. Copying an excerpt from the proposal.

Frankly, tells nothing about how the threshold would be arrived at.

I am also not sure whether IRDA is referring to “Total Premiums paid” or the “Total Applicable Threshold Premium” when it mentions “Total Premiums”. If it is “Total premiums paid”, then this proposal may not account for much. Insurers can simply keep the “Threshold Premium” quite high.

We will have to wait and see.

Not everyone will like this

As mentioned, IRDA has just floated a proposal and invited comments.

The insurance companies will not like this. The insurance agents/intermediaries will not like this either.

Hence, expect a pushback from the insurance industry.

But why?

If the surrender charges are indeed reduced (as proposed), it may be difficult to sustain the front-loaded nature of commissions in traditional plans. Or the insurance company will have to introduce claw back provisions in the traditional plans. Either way, their distribution partners (insurance agents) won’t like this. And incentives change everything. Will the insurance agents be as inclined to sell traditional plans if the initial commissions are not so high?

We will have to see if this proposal sees the light of the day. There will be pushback from the industry. We will have to see if IRDA can hold against all the pressure without diluting the provisions of the proposal. As I mentioned in the previous section, a small play on definition/interpretation of “Threshold premium” can render the change ineffective.

Remember LIC is also affected, and it sells a lot of traditional life insurance plans.

We will soon find out.

By the way, would this change (if accepted) make traditional plans more attractive to invest?

No, it doesn’t.

This specific change only pertains to surrender of policies. Nothing changes if you plan to hold until maturity. Hence, if you must invest in such product, invest on merit.

Additional Read/Links

Exposure Draft-Product Regulations 2023 dated December 12, 2023

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

This post is for education purpose alone and is NOT investment advice. This is not a recommendation to invest or NOT invest in any product. The securities, instruments, or indices quoted are for illustration only and are not recommendatory. My views may be biased, and I may choose not to focus on aspects that you consider important. Your financial goals may be different. You may have a different risk profile. You may be in a different life stage than I am in. Hence, you must NOT base your investment decisions based on my writings. There is no one-size-fits-all solution in investments. What may be a good investment for certain investors may NOT be good for others. And vice versa. Therefore, read and understand the product terms and conditions and consider your risk profile, requirements, and suitability before investing in any investment product or following an investment approach.