While a home loan helps you purchase your dream house, an EMI is an unwanted by-product. If I were to tell you that there is a home loan product where you don’t have to pay EMI, what would you think?

Don’t get too excited. You still have to make loan payments. Just that your monthly loan payments won’t be the same every month.

EMI stands for Equated Monthly Installment. This means you have to pay the same amount every month. However, this is not the case with Axis QuikPay Home Loan product, a home loan product launched recently by Axis Bank.

Under an EMI based loan repayment method (reducing balance loans), a portion of your monthly EMI goes towards payment of monthly interest. Anything left after payment of interest is used towards reducing the principal amount. This cycle continues till such time your loan is repaid. As the loan outstanding goes down with the payment of each EMI, interest portion of the EMI goes down and the principal component goes up every month. For more on how EMI based reducing balance loans work, please refer to this post.

How does Axis QuikPay Home Loan work?

Under Axis QuikPay Home Loan, there is no concept of EMIs.

Every month, you pay the same amount of principal. The interest component changes every month. This is because the interest is calculated based on the outstanding principal (just like the EMI based repayment).

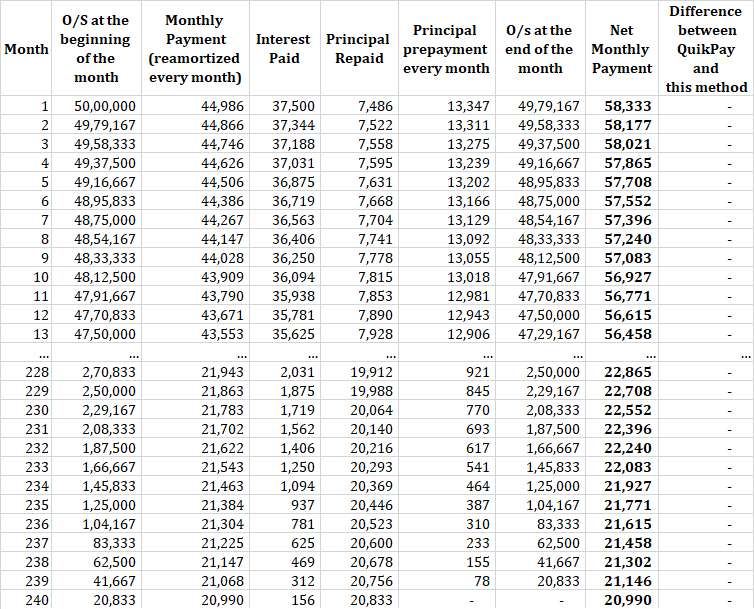

Let’s consider an example. You take Axis QuikPay home loan of Rs 50 lacs at 9% for a tenure of 20 years.

Every month, you will repay principal of Rs 50 lacs/ 240 months = Rs 20,833. You calculate the interest payment by multiplying the monthly interest rate by the Principal Outstanding at the beginning of the month.

Add the principal and the interest component to get your monthly payment.

Since the principal outstanding will go down every month, the interest component will also go down every month.

What is the benefit?

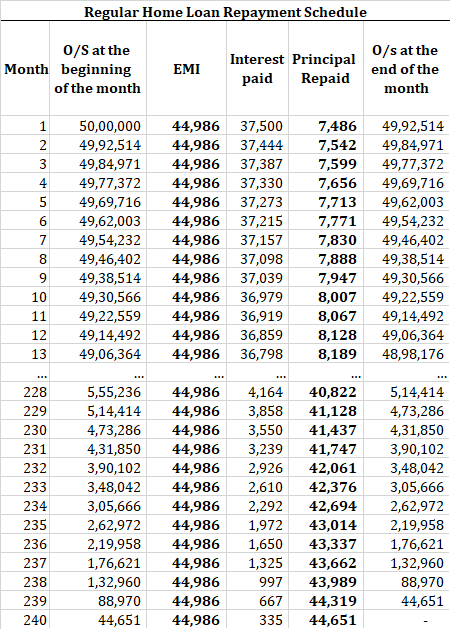

Under a regular home loan, a significant portion of your initial loan EMIs goes towards interest payment. Only a very small portion goes towards principal repayment. Therefore, the principal outstanding goes down very slowly in the initial years. Here is how repayment schedule of a regular home loan looks like.

Under Axis QuikPay Home Loan, principal outstanding will go down much more quickly.

For instance, in the regular home loan, you would have repaid only 1.83% of total loan amount. In the first 5 years, you would have repaid only 11.29% of the loan amount. Under Axis QuikPay Home loan, you will repay 5% in the first year and 25% in the first five years.

Since the principal goes down faster under Axis QuikPay, the total interest that you pay over the loan tenure will be lower than the regular home loan.

Under the regular home loan, you will have to pay Rs 44,986X 240 = Rs 1.08 crores. Of this, Rs 50 lacs is the principal repayment. Therefore, total interest payment is Rs 57.96 lacs.

Under Axis QuikPay, you pay a total of Rs 95.18 lacs. Total interest payment of Rs 45.18 lacs.

So, you save about Rs 12.8 lacs by opting for Axis QuikPay.

Do note the cost of the loan remains the same at 9% p.a. The difference in total interest payment is due to the swifter repayment of principal in the Axis Bank QuikPay loan.

At the same time, you have to see that you have to pay a much higher amount initially in the Axis Loan. You have to look at the affordability of payments too. However, if you have taken a construction linked loan, this won’t be much of a problem since the entire principal will not be released straightway.

What is the catch?

Axis QuikPay Home loan is a fine product. Therefore, it could be a good choice over regular home loan products provided you can keep up with initial high payments.

The problem, however, is that Axis Bank is charging a higher rate of interest for this loan product. The interest rate is higher by 15 to 20 bps (as compared to regular home loans).

To be honest, you shouldn’t pay a higher rate of interest for the following reasons.

- Axis Bank is not taking any additional risk (as compared to a regular home loan) in offering this loan. Therefore, any interest rate premium is not justified.

- Most borrowers close out their home loans much before the contracted tenure. Therefore, in any case, you would want to reduce your principal faster. You already have much flexibility in prepayments in home loans. There is no point in paying a premium.

- Prepayment of home loan does not invite any penalty. Therefore, you can replicate the benefit of Axis QuikPay Home Loan under the regular home loan product too. You simply to make the prepayment of (Monthly payment under Axis QuikPay – EMI under regular home loan) and re-amortize your loan amount every month. And for this, you don’t have to pay an additional 15 to 20 bps every month.

If you still don’t trust that Axis Bank QuikPay home loan can be replicated with a regular home loan, check this out.

You might argue the bank will limit the number of prepayments in the year and you may not be allowed to re-amortize the loan every month either. However, that’s not the point. The point is that you must not pay a higher rate of interest for this product. After all, you don’t have to make prepayments every month. You can make those once every quarter or once every six months. That should suffice.

When I checked the press release for Axis Bank Quik Pay home loan, the focus was on interest savings even with marginal higher pricing. If you know your maths, there is no reason to pay a higher rate of interest under Axis QuikPay home loan.

In the future, if Axis Bank chooses to reduce the interest rate on this product and brings it in line with a regular home loan, you can consider this product.

6 thoughts on “Axis Bank QuikPay Home Loan: A home loan without EMI: What’s the catch?”

The additional 20 or 30 basis points interest is for the thinktank who came up with this load and the sales team that will need to sell it. Of course there are customers who will take it only to realise later that they might be paying a heavy price.

Ho Pradeep,

Haha…Btw, we have to give it to the bankers. They keep coming with such smart things at such high frequency.

Thanks for nicely articulating and explaining in details.

You are welcome, Kalyan.

Dear Deepesh,

Thanks for the detailed post. I am going to take 90L home loan (tenure: 20 years) from Axis in a couple of days, and I can pay 1 to 1.5 L per month as a prepayment (over and above the EMI). In this case, Axis quick pay or normal Home loan which one will be useful for me? Will it reduce the additional interest amount if I choose Quick pay and do the prepayment on a monthly basis? It will be very helpful for me if you give your advice on it.

Thanks,

Baskar j

Dear Baskar,

Everything else being the same, you will pay lower amount of interest in Axis Quickpay loan.

Monthly/quarterly/semi-annual prepayments won’t change that.

Please note that the percentage cost of loan remains the same in both cases. Only the absolute/nominal interest amount changes.

Hope this helps.