HDFC has launched 3 smart-beta (factor) ETFs.

- HDFC Nifty 100 Quality 30 ETF: While I have not written a dedicated post on this index, I have compared the performance of a Quality index (albeit a different one. Nifty 200 Quality 30 index) in many posts. I do not expect the performance to be too different.

- HDFC Nifty 50 Value 20 ETF (NV20): Have reviewed the performance of this index (Nifty 50 Value 20) before and the findings were favourable. You can read about this index and how it is a mix of quality and value factors here.

- HDFC Nifty Growth Sectors 15 ETF: We have never discussed this index before.

A Quality ETF. A Value ETF. And a Growth ETF.

I have discussed both Nifty Quality index and Nifty 50 Value 20 index in the following posts too.

How to construct the “Best Portfolio” using index funds and ETFs?

Performance comparison of all factor indices (Quality, Low Volatility, Momentum, Value, Alpha)

I also reproduce a table from the above posts. And you can see the performance of the Quality and NV20 indices is impressive, at least in back tests.

By the way, many NV20 ETFs (ICICI, Nippon, Kotak) have been around for a over 5 years and the performance has been impressive. So, we are not just talking about back tests. These funds have delivered in the live data too.

Therefore, in this post, let us focus on HDFC Growth Sectors 15 ETF. This is a completely new offering, and we have no other index funds/ETF tracking this index.

Let us see if you should invest in this ETF.

HDFC Growth Sectors 15 ETF: How stocks are selected?

- Replicates the performance of Nifty Growth Sectors 15 index.

- As the name suggests, the index picks 15 “Growth” stocks. However, methodology is quite complicated.

- First, the “Growth” sectors are selected. Then, “Growth” stocks within those sectors are selected.

- To select the “Growth” Sectors, average yearly P/E and P/B of Nifty sectoral indices is compared against average yearly P/E and P/B of Nifty 50. You can find the full list of Nifty Sectoral indices here.

- Those sectors with better P/E and P/B are shortlisted. This Sector selection exercise is repeated every two years. Am unclear when this is due next.

- From the selected sectors, top 50% stocks (as per free float market cap) are shortlisted.

- The stocks are then ranked by EPS growth frequency (EPS stands for Earnings per share) and top 15 stocks are selected. Not sure what EPS growth frequency means. Weightage of any single stock is capped at 15%.

- The stocks’ ranking is revisited, and index is rebalanced every 6 months.

- You can read the full methodology here.

As the name suggests, the index tries to identify the best “Growth” stocks in the “Growth” sectors. Also, note the Sector rebalancing happens every 2 years and stocks rebalancing happens every 6 months.

I copy the sectoral breakup and top constituents for Nifty Growth Sectors 15 index as on August 31, 2022. Source: Factsheet

As on August 31,2022, the index comprises only 3 sectors. P/E and P/B are quite high. Along expected lines.

Which funds/indices to compare HDFC Nifty Growth Sectors 15 ETF with?

Given the way sectors and stocks are picked for this index, this looks yet another definition of momentum. Instead of relying on price data, it relies on fundamental data.

First, pick sectors with high P/E and P/B. Once the sectors are picked, pick stocks with the high EPF growth frequency.

Therefore, while assessing the performance of this index (Nifty Growth Sectors 15), it makes sense to compare the performance against Nifty 200 Momentum 30 index too.

In this post, we will compare the performance of the following 3 indices.

- Nifty 50 TRI (No comparison is complete with Nifty 50)

- Nifty Growth Sectors 15 TRI

- Nifty 200 Momentum 30 TRI (since Nifty Growth Sectors 15 seems to be yet another definition of momentum)

Nifty Growth Sectors 15 index was launched in 2014. Base Date: January 1, 2009

Nifty 200 Momentum 30 index was launched in 2020. Base date: April 1, 2005

HDFC Nifty Growth Sectors 15 ETF: Performance Comparison

We compare the performance of the 3 indices since January 1, 2009, until August 31, 2022.

Nifty 50 CAGR: 15.21% p.a.

Nifty Growth Sectors 15: 18.95% p.a.

Nifty 200 Momentum 30: 21.58% p.a.

The performance of all the indices is impressive. Momentum index is the best performer.

Nifty Growth Sectors 15 beats Nifty 50 comfortably.

But this is just a snapshot in time. We need to analyze the consistency of returns too. Thus, we will look at calendar year and rolling returns too.

As you can see, Nifty Growth Sectors 15 was the best performer in 4 out of first 5 years. From 2009 until 2013, the index was the best in all the years expect 2012.

And when was the index launched? 2014

Therefore, you cannot deny an element of curve-fitting to get the best results.

From 2014 until 2021, the Nifty Growth Sectors 15 finishes last in 6 out of 8 completed years. Beats Nifty 50 in only 1 out of 8 completed years.

Here is the CAGR comparison for the 3 indices since the launch of Nifty Growth Sectors 15. While the launch date was May 22, 2014. I consider the performance since May 31, 2014.

Nifty 50: 13.0% p.a.

Nifty Growth Sectors 15: 11.9% p.a.

Nifty 200 Momentum 30 index: 21.1% p.a.

Nifty Growth Sectors 15 index has underperformed Nifty 50 in more than 8 years since its launch. The index has only outperformed Nifty in back tests.

This is good enough reason to STAY AWAY from HDFC Nifty Growth Sectors 15 ETF.

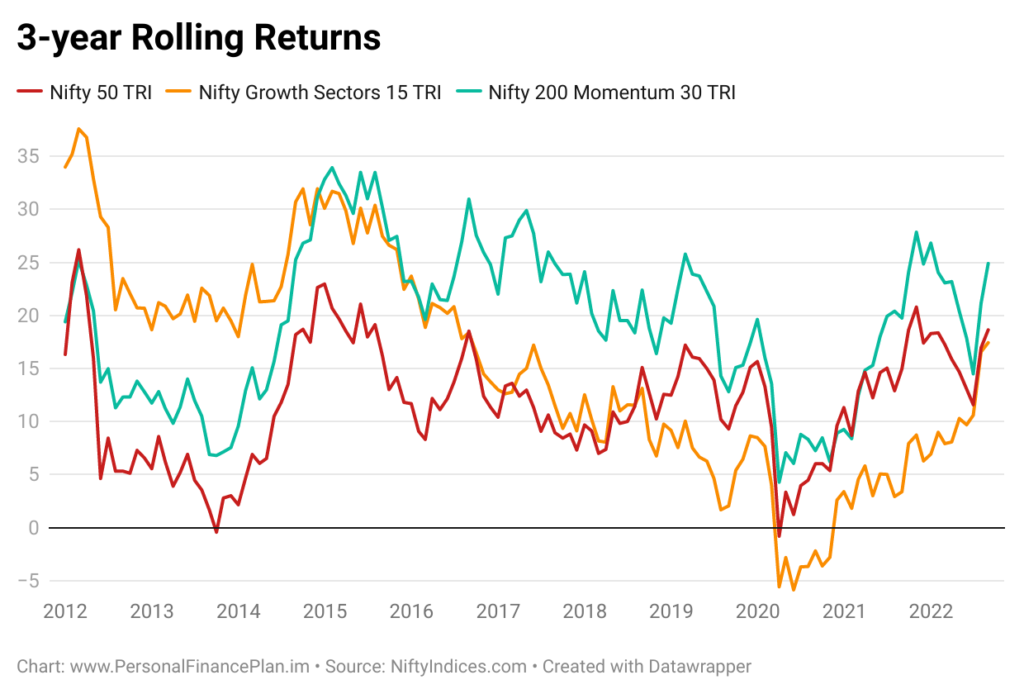

HDFC Nifty Growth Sectors 15 ETF: Rolling Returns

As mentioned earlier, the relative performance of Nifty Growth 15 ETF is not impressive since 2014.

HDFC Nifty Growth Sectors 15: Maximum Drawdown and Rolling risk

The good performance is only before the launch date (May 2014).

On the rolling risk front, the Nifty Growth Sectors 15 does well initially (even after May 2014) but then unravels.

Nifty Growth Sectors 15 Index: Performance Summary

While the performance of Nifty Growth Sectors 15 index looks impressive since inception (base date), the performance is not good since its launch.

There is no reason to invest in this ETF.

HDFC Nifty Growth Sectors 15 ETF Vs Nifty Momentum index funds and ETFs

Nifty Growth Sectors seems yet another definition of momentum. And relies on fundamental data instead of technical (price) data. However, it fares badly compared to the conventional definition of momentum that only considers only price data and volatility. Nifty 200 Momentum 30 picks momentum stocks based on price data.

Nifty 200 Momentum 30 index easily beats Nifty Growth Sectors 15 index. You may argue that the Momentum index is even newer with launch date in 2020 and hence its performance is not dependable either. That is right but the definition of momentum is more conventional in Nifty 200 Momentum 30 index. And that gives more confidence.

Of course, only time will tell whether momentum investing (Momentum 30 index) will beat Nifty 50 over the long term.

However, we do know that the momentum as defined by Nifty Growth Sectors 15 does not seem to work. Frankly, it is bizarre to see HDFC AMC launching such a product.

You must also look at diversification in the two portfolios. In Nifty Growth Sectors 15 index (August 31, 2022), the money is split across just 3 sectors. Contrast this with the breakup for Nifty 200 Momentum 30 index (as on August 31, 2022. As per factsheet).

So, Nifty 200 Momentum 30 index is more diversified and has delivered a superior performance with a conventional definition of momentum.

Nifty Growth Sectors 15 index is concentrated and performs poorly compared to Nifty 200 Momentum 30 index.

Why would you pick up Nifty Growth Sectors 15 then?

I am not suggesting that you must invest in Nifty 200 Momentum 30 index funds or ETFs. You must invest only if you have conviction in momentum investing. And even with that conviction, be prepared for extended periods of underperformance.

All I am suggesting is: Do not invest in HDFC Nifty Growth Sectors 15 ETF.

Featured Image Credit: Unsplash