LIC SIIP (LIC Systematic Investment Insurance Plan) is a Regular premium ULIP. As with ULIPs, the returns are market-linked. But the plan has much expensive cost structure compared to new ULIPs we see these days. Better to stay away.

LIC SIIP plan is a regular premium ULIP from LIC. As I see, the nomenclature has been chosen to ride the popularity of SIPs (systematic investment plans) in mutual funds. Though there is nothing wrong with the name, the choice seems deliberately misleading. We must see this in the context of levels of financial awareness in the country. Given how much investors trust LIC, the plan would have sold well under any name. LIC could have done with better name selection.

Let’s go past the nomenclature and find about the LIC SIIP in detail.

LIC SIIP (Plan 852): Salient Features and Review

- It is a unit-linked insurance plan (ULIP). This means there is no guarantee of returns.

- This is a Type I ULIP. At the time of demise, the nominee gets Higher of (Sum Assured, Fund Value). Under a Type II ULIP, the nominee gets Sum Assured + Fund Value. Everything else being the same, Type I ULIP provides better returns while the Type II ULIP provides better life cover.

- Policy Term: 10 to 25 years

- Regular Premium plan (Premium payment term same as policy term)

- Premium Payment Frequency: Monthly, Quarterly, Half-yearly, Yearly

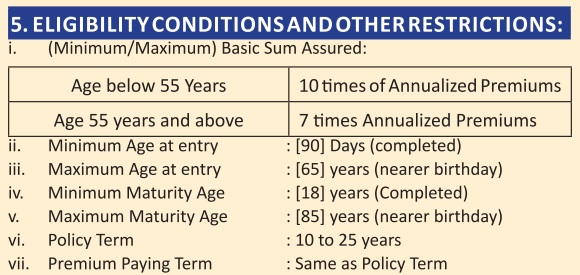

- Sum Assured: Depends on your entry age

- Entry age up to 55 years: 10 times the annualized premium

- Entry age 55 years and above: 7 times the annualized premium

- Eligibility: I reproduce an image from the product brochure

- Charges in the plan: Premium allocation charges, the Mortality charges, fund management charges, switching charges, partial withdrawal charge, etc. Will discuss these later in the post.

- You CAN NOT get a loan under LIC SIIP plan. Loans are not permitted for ULIPs.

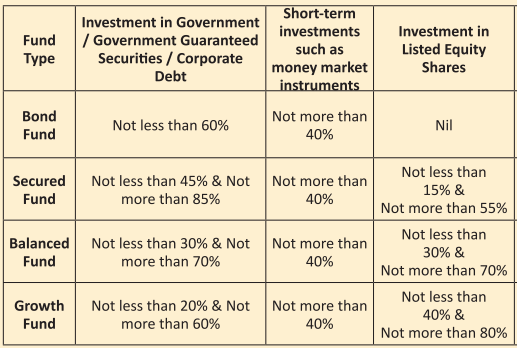

- You have 4 fund choices (Bond Fund, Secured Fund, Balanced Fund, Growth Fund)

LIC SIIP Plan (Plan 852): Various Charges and their impact

For a deeper understanding about various types of charges in ULIPs, how they are adjusted and their impact on returns, refer to this post.

The ULIPs have the same nomenclature for the charges. I will point out areas where LIC SIIP is better or worse than other popular ULIPs.

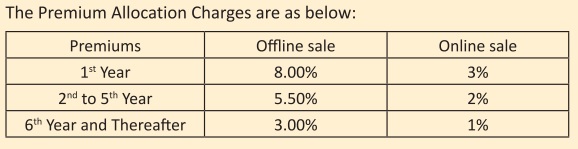

Premium allocation charge: This charge is deducted from the premium before your money gets invested. It is expressed as a percentage of premium. GST is also applicable on these charges.

In LIC SIIP plan, Premium allocation charge is

Therefore, if you invest Rs 1 lacs per annum in the plan, Rs 9,400 (incl. 18% GST) will be charged in case of offline purchase and Rs 3,540 (incl. 18% GST) in case of online purchase. The remaining money will get invested but will be subject to other charges.

From the second till the 5th year, Rs 6,490 will be charged in case of offline and Rs 2,360 will be charged in case of online plan.

From the 6th year onwards, Rs 3,540 and Rs 1,180 will be charged for offline and online plans respectively.

At a time when private insurers are moving towards zero premium allocation charge at least for online sales, these charges are exorbitant.

Mortality charges: These charges go towards providing you the life cover. The mortality charges depend on your age and are recovered every month through the cancellation of fund units every month. I reproduce the mortality charge table from sample policy document on LIC website.

Mortality charges increase with age. If you are old, mortality charges will affect your returns more. At the same time, since this is a Type I ULIP (sum-at-risk = Sum Assured – Fund Value), the impact of mortality charges will be lower. Sum-at-risk is the amount that the insurance company must pay in the event of policyholder demise. In Type-I ULIPs, as the fund value increases, the Sum-at-risk goes down. Therefore, the impact of mortality charges also goes down.

I found the charges slightly higher than some of the ULIPs from private companies that I looked at.

LIC SIIP Plan: Return of Mortality charges

There is a provision that the mortality charges will be returned to the investor at the time of maturity. Only the base charges will be returned to the investor. Any taxes or excess due to your health condition won’t be reimbursed. This will be paid in addition to the fund value.

In isolation, this is an investor-friendly gesture. However, this won’t make much difference to your returns.

Why?

Because you get only the absolute mortality charges. No return is given on these charges. As mentioned earlier, taxes and excess won’t be returned either.

Moreover, since this is a Type-I ULIP, the quantum of mortality charge will go down every year and eventually go to zero once the Fund Value exceeds the Sum Assured.

No matter how we spin it, everything comes from the charges.

Mortality charges won’t be returned for surrendered or discontinued policies or in the event of demise during the policy term. These charges are returned only if the policyholder survives the policy term.

LIC SIIP: Guaranteed Additions

The plan provides guaranteed additions too (kind of loyalty benefits).

I talked about guaranteed additions in my post on LIC Nivesh Plus (a single premium ULIP from LIC. These are just marketing gimmicks. Everything eventually comes from your money.

LIC SIIP plan: How will the maturity proceeds be taxed?

The death benefit is always exempt from tax.

The same is not true for the maturity benefit.

For maturity proceeds to be exempt from tax, the Sum Assured should be at least 10 times the annual premium. If this condition is not met, the maturity proceeds are taxable. There is TDS of 5% too.

If your age at the time of entry in the plan is less than 55 years, your life cover (Sum Assured) will be 10 times Annual Premium. No tax problem in this case. The maturity proceeds will be exempt from tax.

However, if your entry age is 55 or above, the Sum Assured is 7 times the annual premium. While this helps you save a bit on mortality charges, the flipside is that the maturity proceeds will be taxable.

LIC SIIP plan: What are the returns like?

I reproduce the illustration given in the sales brochure.

The illustration shows returns for gross investment returns of 4% and 8% p.a. (as mandated by IRDA). Being a ULIP, you would expect the investments to earn a higher return but that’s not important right now. The returns will also depend on your age and the funds chosen.

Let’s consider the example with a policy term of 25 years and gross returns of 8% p.a. The investor pays a quarterly premium of Rs 30,000 for 25 years and gets Rs 69.17 lacs at the time of maturity. Note this is including Return of Mortality charges and Guaranteed Additions. Total investment was Rs 30 lacs.

This is a net return of 6.07% p.a. 1.94% p.a. of your return gone due to various charges.

Not attractive.

If your investment earned 8% p.a. you would have Rs ~92.07 lacs at the end of 25 years. LIC SIIP charges eat away 37% of the gross returns. Not done.

Points to Note

- The returns will be higher (lower) if the gross returns are higher (lower).

- The returns will be lower (higher) if the entry age is higher (lower).

- This illustration is for an offline plan (through an agent). Offline plans have higher costs. Online plans are cheaper. Everything else being the same, the online plan will give better returns.

- This illustration is for a 30-year-old. For this investor, the Sum Assured is 10 times the annual premium. Hence, the maturity proceeds will be exempt from tax.

- For the entry age 55 years or above, the Sum Assured is only 7 times Annual Premium. Hence, the maturity proceeds will be taxable. The death benefit will still be exempt from tax. There is no illustration for this case in the sales brochure.

LIC SIIP: Should you invest?

I suggest you don’t. Please keep your insurance and investment needs separate.

For your insurance needs, purchase a plain vanilla term life insurance plan.

For your investment needs, purchase pure investment products (and low-cost products) such as PPF, mutual funds etc.

Still, if you must invest in this plan, purchase the plan online. Additionally, note that, if your entry age is 55 or above, the maturity proceeds will be taxable.

The post was first published in March 2020.

Additional Read/Source

- LIC SIIP Plan (Plan 852): Product Brochure

- LIC SIIP Plan (Plan 852): Policy wordings

- LIC Nivesh Plus page on LIC website

- How to select the Best ULIP?

- Why I prefer Mutual Funds over ULIPs?

- ICICI Prudential Life Signature ULIP

- How various charges in ULIPs destroy your returns?

- In a ULIP, you pay more for the life cover as compared to Term Life Insurance Plans

- In traditional plans and ULIPs, your age affects your returns

- The problem with Single Premium Life Insurance Plans

- The Entire Life Insurance Premium is not tax–deductible

- If you are old, don’t buy ULIPs

2 thoughts on “LIC SIIP Plan (852): Review: Not an SIP: Should you invest?”

Very much informative & useful. Thanks lot.

Can you provide best investment. I am at 51. Per year 1 lakh. I like bro get after 20 year monthly or lumsump. Which one is best.

Regards

A s Vivek

How can I cheak Nav of lic Table 852.