Long-Term Capital Gains on sale on equity mutual funds and listed shares was proposed in Budget 2018. I have discussed the proposal in an earlier post.

In this post, let’s look at the actual impact (in numbers) because of the introduction of tax on long-term capital gains.

LTCG on sale of equity shares/equity mutual funds

From FY2019, the long-term capital gains (holding period > 1 year) on the sale of listed shares and equity mutual fund units will be taxed at 10%.

Initial Rs 1 lac of LTCG shall be exempt from tax.

You can read more about the tax proposal in this post.

How will tax on LTCG on the sale of equity shares/equity mutual funds affect your returns?

This is best understood with the help of an example.

Let’s assume you invest Rs 1 lac today.

I don’t know how much return you will earn over the next 5, 10 or 20 years.

Therefore, I will assume varying levels of returns and consider multiple investment horizons.

Since there is a tax exemption on LTCG (on sale of equity) of Rs 1 lac per financial year, I have reduced the LTCG in the year of sale by Rs 1 lac to calculate tax liability.

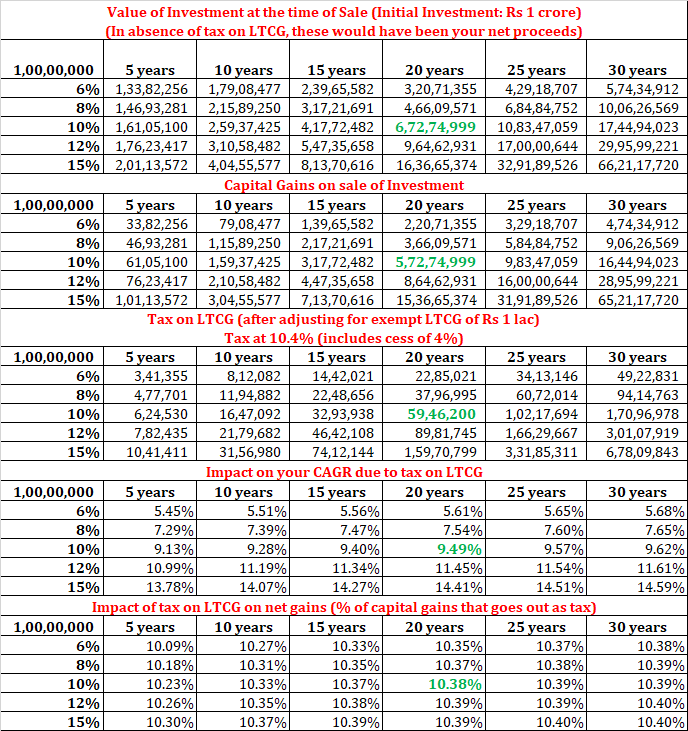

I have calculated the returns for different levels of return and different investment horizon. Of course, you don’t know the return will earn when you invest. However, you should still be able to assess the impact of taxation on your net returns.

If you invest Rs 1 lacs and redeem the investment after 20 years and happen to earn a pre-tax return of 10% p.a., your sale proceeds will be equal to Rs 6.72 lacs.

Your total capital gain is Rs 5.72 lacs. Out of this, Rs 1 lac is exempt. Therefore, you have to pay LTCG tax of 10.4% (including cess) on the taxable gain of Rs 4.72 lacs.

Your LTCG tax liability will be Rs 49,166.

After accounting for tax, your net proceeds is Rs 6.23 lacs.

In 20 years, your money has grown from Rs 1 lacs to Rs 6.23 lacs.

That is post-tax return of 9.58% p.a.

Due to LTCG tax, your pre-tax return of 10% p.a. has gone down to 9.58% p.a.

Moreover, you can see in the above table that the impact in terms of the difference between pre-tax and post-tax return depends on the investment horizon and the rate of return.

Additionally, the impact of LTCG exemption of Rs 1 lac will go down as the investment amount gets bigger.

Let’s do the same calculation with an initial investment of Rs 1 crore.

As you can see, the post-tax return in the same example (20 years, 10% p.a.) goes down to 9.49% p.a. (post-tax return for an initial investment of Rs 1 lac was 9.58% p.a.).

This demonstrates that the net impact of LTCG exemption of Rs 1 lac per financial year goes down as your portfolio gets bigger.

In terms of absolute amount, the tax hit is Rs 59.46 lacs (on the total capital gain before taxes on Rs 6.72 crores). Clearly, not a small amount.

Fall from 10% p.a. to 9.49% p.a. may not look like much. However, when we talk about many years of compounding, the impact is going to be sizeable.

I have read accounts where many experts have mentioned that the impact is going to be minimal. That’s clearly not the case. Most of us shifted from regular to direct to save this extra 0.5-1% p.a. of the expense ratio. Didn’t we?

Therefore, let’s not fool ourselves. There is going to be an impact of LTCG taxation. Let’s accept it and pay the taxes happily.

I always believed that equity investors were getting extremely preferential tax treatment by the Government. Such long-term gains had to start getting tax sooner or later. In my opinion, it is a step in the right direction. However, there is a hit to the investors.

What about the impact of utilizing Rs 1 lacs exemption on LTCG every year?

In my above example, I have taken the benefit of LTCG taxation of Rs 1 lac per year only in the final year. However, I could have taken this every year.

Essentially, you sell MF units one day and buy those back at the same price (assumption) booking long-term gains to the extent of Rs 1 lac per year.

Suppose you invest Rs 10 lacs (10,000 units at NAV of Rs 100). After1 year, the amount becomes 11.5 lacs (NAV is 115). So, you sell 6666 units worth Rs 7.66 lacs resulting in a net gain of Rs 1 lac.

Then, you use the amount to purchase the units in the fund again. Therefore, the number of units remains the same.

After churning once, you have 6666.67 units at cost price of Rs 115 and 3333.33 units at cost price of Rs 100. The average cost price is Rs 110. Had you not sold and booked profits, your average cost price would have still been Rs 100.

Therefore, by booking gain of Rs 1 lac, you have been able to increase your average cost price. This will effectively reduce your tax liability whenever you finally sell the units.

As I see, by doing this, you can increase your corpus by a maximum of Rs 10,000 per annum. Of course, this amount gets invested and earns your return.

Well, even though such analysis can be done, it requires another set of assumptions to be made.

For instance, I need to assume asset price (Fund NAV) at periodic intervals. Why?

Because I need to sell to book profits. And for that, I need the price of the asset (NAV). For all you know, during bad times, you may not even have gains to book. If there is no gain, you can’t take benefit of Rs 1 lac exemption for that year. By the way, in that case, you can book losses and carry forward the losses to be set off in the future years. However, since your average cost price will also be reset downwards by booking loss, there may not be any impact.

In any case, you can see it can get quite complicated.

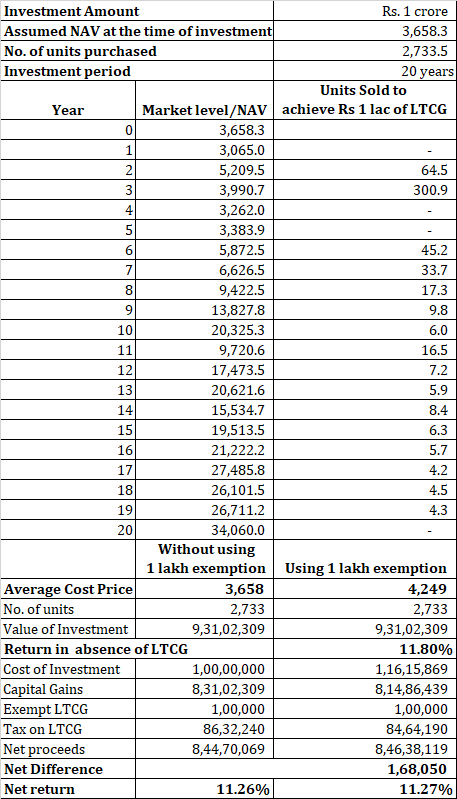

For the analysis, I have considered calendar year Sensex data from 1998 till 2018 (Jan 1) and try to assess the impact on return.

I have considered an initial investment of Rs 1 crore to have a very high number of units. This ensures that, for the all 20 years, I have units (acquired at the base price) to sell and repurchase at the prevailing price.

Please understand unit redemption works on FIFO basis and the oldest units get sold first. A lesser number of units would have complicated the analysis. Not really needed to present my point.

As you can see, for a big portfolio, churning the portfolio may not really make much of a difference. Net tax saving (for the data used) is about 1.68 lacs (when the ending corpus is 9.31 crores).

If you had simply stayed put for 20 years, you would have earned a return of 11.26% p.a.

By continuously churning for 20 years to get the benefit of Rs 1 lacs LTCG exemption, you would have earned 11.27% p.a.

A difference of 0.01% p.a.

Having said that, with good technology, implementing this portfolio tweak wouldn’t take more than 5 minutes. Therefore, it may not really be a bad idea to utilize this benefit. I assume these regular tweaks won’t play around with your investment discipline.

Do note, for a smaller portfolio, the difference in returns could have been a bit bigger.

What about the impact on SIP?

A similar analysis can be extended to impact on Systematic Investment plans too.

However, since the amount involved is small, the units will get churned on a regular basis making the analysis slightly complicated (for my excel skills).

I will consider the impact on SIPs in another post.

18 thoughts on “Impact of Tax on Long Term Capital Gains on Returns: Explained with Examples”

Hi Deepesh,

Thanks for the post, can you add a section for the grandfathered benefits untill March 2018.Eg. if any one has made an investment well before 2017, and does the sale postarch 2018 how will the CG be calculated.

Hi Bala,

Thanks for the inputs.

I didn’t add Grandfathering because it would have unnecessarily complicated the topic.

The intent was to assess the impact of tax of 10%.

Moreover, would have had to make a lot of additional assumptions.

I have discussed the impact of grandfathering on LTCG calculations in another post.

https://www.personalfinanceplan.in/taxes/budget-2018-long-term-capital-gains-equity-equity-mutual-funds-introduced/

Hope this helps.

Let me know if you still have doubts.

Hi Deepesh,

Good illustration. But I have a couple of optimistic points in favour of CG reset every year.

1) First off course is the tax savings itself to the tune of 1 Lac per year

2) CG reset every year could very well help us indirectly time the markets which will enhance our end results. Think about markets running up and we decide to realise 1 Lac gains and then reenter the market not at one shot but in a slightly staggered way (like weekly STP for 2-3 months) when we could catch some potential market falls.

3) If you think long term, there is a chance that this LTCG exemption limit could be raised upwards every 4-5 years and we could have an opportunity to realise higher gains then like say 10 years from now this exemption could be 5 Lacs.

4) On the other hand if in future the FM decides to tax LTCG higher like 15% or 20% then the difference between final returns of reset vs non-reset strategy will be higher and we will regret not resetting LTCG..

So why dont we utilize this 1 Lac limit starting from 2018-19 every year and just save whatever we could hoping for the best.

We wont lose anything by doing it, we have all to gain for.

Hi Pradeep,

Thanks!!

Completely agree with you. If there are savings to be had, why not go for it. More so because it is hardly a 5-minute job if you have a good software to crunch the numbers for you.

However, I do have a few concerns.

1. Timing the market does not help most people.

2. In fact, this is what I am the most worried about. Investor will sell (to book gains up to Rs 1 lac) and wait for the market to come down. It does not come down. And you keep sitting with a reasonable amount. Happens all the time. In fact, this approach can compromise results for investors. More a behavioral trait than anything else.

3. Yes, I believe 1 lakh LTCG shouldn’t around for too long. I also feel, at some point of time, equity taxation will be same as for other capital assets. Makes a lot of sense too.

Hi Deepesh,

Yes you are right, the investors might try to time the market after realising gains. I think it again comes down to disciplined investing and we should show the same discipline that we show for our SIPs. Try to get back into market reasonably quickly especially if it seems market is going well, not at all time highs and a correction doesn’t seem to be imminent.

The other point is if we are practising asset allocation then we are already realising some gains in equity every year or so. Hence this resetting LTCG is not exactly a new exercise, just that we should try to limit our asset allocation changes to LTCG of 1 Lac per fin year. In fact for people already with bigger corpus asset allocation changes will now attract LTCG tax.

So thats a negative with LTCG tax.

Completely agree, Pradeep.

Just that I will always have issues with timing the markets. Investors behave in strange ways about market levels.

Booking the gains to avoid tax is a good choice but it needs to be done with ruthless discipline (rather than based on emotions).

Hi Dheeps Sir, How to calculate “Tax Saving Reinvestment Deposit”,

For Example, If “TSRD” for Rs.1..5 Lac (u/s.80cc) for 5 Years, how to

calculate “Interest” and “Tax” every year? If it is below Taxable Income

The Income tax may be waived? Please explain since I am

a Senior Citizen Man. Thank u & expecting ur kind reply Sir,

Dear Sir,

You can ask the bank for details. you can check the interest for the year online too.

if your total income including interest is less than Rs 3 lacs, you don’t have to pay any income tax.

Suggest you go through the following post.

https://www.personalfinanceplan.in/taxes/how-to-save-tds-on-bank-fixed-deposits/

Waiting for your post on SIPs in the same context….

Sure Makarand.

Hope you liked the post.

Hello Deepesh,

Did not understand how yearly rejig (utilizing Rs 1 lacs exemption on LTCG every year)will end up in more savings & less tax over the long term. Could you please put up an excel illustrating the same?

Thanks

Divya

Hi Divya,

When you book profit (essentially sell the units and repurchase) and keep LTCG within the limit of Rs 1 lac, you avoid tax (for that year) and at the same time, you are jacking up your cost price.

As your cost price goes up, your final profit will go down.

And that’s what saves you tax.

Hope this answers your query.

Ok. But like you mentioned, the difference is only about 0.01% p.a. Right? So we can as well leave it as it is without the churn and pay just marginally more tax. Correct?

Right, if the portfolio is big, the impact won’t be high in percentage terms.

Hi Deepesh,

Is the same LTCG applicable if the mutual fund is in the name of a minor?

Yes, the income will most likely be clubbed with parent’s/guardian’s income.

Hi Deepesh

Liked your post with multiple illustration which is also explained in simple language for understanding to majority I guess.

What strategy would you recommend if someone gets lunpsum and want to reinvest with 3- 5 years & 10 years strategy in mind.

Hi Deepak,

Thanks.

Difficult to answer this. No right or wrong approach

So many variables here including your risk appetite.

I will share what I will do(and I think I am a conservative investor).

I will decide the asset allocation for this money, say 50:50.

Initially, will put all the money in debt. Then, will gradually move to target allocation over the next few years.

If the markets fall sharply, I might expedite the movement.

You could have moved to 50:50 right away. Only time will tell which is a better approach.